Most readers won’t believe the title, or at least not if they’ve read much in the past few years about the anemic early stage biotech environment. But hopefully this post will convince them.

It all comes down to what do we mean by “early stage”. To a biotech hedge fund trader, it might be pre-Phase 2. To those of us in the venture world, early stage could simply mean a new company, or a preclinical program, or a new drug discovery initiative. Unfortunately, without common and easily measured definitions, generalizations about early stage biotech venture data are challenging and often misleading.

Most data sources, like VentureSource, CB Insight, or NVCA/Moneytree, track financings by round or sequence (1st, 2nd, etc…), which doesn’t reflect much about the technological stage of the underlying assets or platforms. They also track “by product status” but that’s predominantly a Tech sector nomenclature.

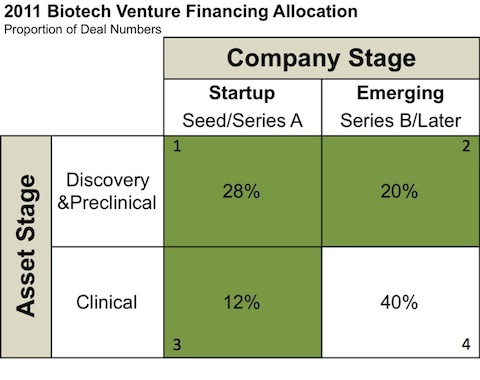

So what is the right definition of an “early stage” biotech company? I don’t know, but a very simple framework around two dimensions – company stage and asset stage – can be useful here (btw, as a former consultant, long live the 2×2):

Most people instinctively think of the Quadrant 1 (upper left) as “early stage” – and it is the quintessential biotech NewCo: a combination of a brand new company and a new discovery stage platform or program.

Most people instinctively think of the Quadrant 1 (upper left) as “early stage” – and it is the quintessential biotech NewCo: a combination of a brand new company and a new discovery stage platform or program.

But Quadrant 2 (upper right) is doing early stage R&D as well: a company raising its 2nd or 3rd or later round of financing to support its emerging discovery and preclinical pipeline. But this latter group is tracked as “later stage” by most data providers (i.e., its not a “First Financing”).

Quadrant 3 – startups formed around clinical stage assets – essentially represents the in-licensing model in biotech, often called the Spec Pharm, No Research Development Only (NRDO), or Search & Develop (S&D) strategy. These are brand new companies raising their first financings, so are considered early stage by most data providers.

Quadrant 4 captures later stage biotechs: companies with their assets maturing that have raised multiple rounds of funding.

The tranching of financing rounds makes the difference between Quadrant 1 vs 2, and 3 vs 4, challenging to parse from the data in a meaningful way. Take Biotech A, which raised a $5M Series A, $5M Series B, and $10M Series C. Its a later stage deal in most of the data. On the other hand, Biotech B, with a $20M 3-tranche Series A, is tracked as an early stage “first financing” deal. Obviously there’s not any meaningful difference between them on the surface, but these are tracked very differently in most datasets.

Unfortunately, no major data provider actually annotates the funding data by these or similar buckets in a systematic manner across the hundreds of rounds and companies that get funded per year. But I’ve taken a crack at estimating the breakdown for 2011.

- VentureSource data reveals that ~40% of the Biotech rounds closed in 2011 were Seed/First Rounds. This is up over 2009-2010, but in line with 2007-2008.

- BioWorld (through their Snapshot) and OnBioVC have tracked what percent of rounds are for preclinical stage companies: in 2011, roughly 70% of Series As, and 33% of later rounds (Series B+) were in pre-clinical stage companies. This rolls up to about 50% of the overall number of companies funded. This is an uptick from 2007-2009.

- Combining these statistics, one can estimate what proportion of biotechs fall into these different buckets:

So these data clearly support the idea that in 2011 the relative proportion of financings done around “early stage” deals is reasonably high. And the data I’ve seen isn’t dramatically different for 2007-2010 as a whole. Early science companies (Quadrants 1,2) represent ~ 50% of the financings (by number of deals), and Spec Pharm like models (Quadrants 3) add on another ~10%. So upwards of ~60% of deals that get funded have some claim to being called “early stage” investments. Note this is by deal numbers, not dollars: Quadrant 4 eats up a much greater share of the capital than 40%, probably closer to 60%+. When the data on 2012 is collected, it will be interesting to see where it comes out given the abysmal top line numbers from the first half.

Frameworks like this are more than just definitional: they can help dissect what it takes to make a successful investment. In particular, when considering new investments into companies in these three “early stage” quadrants, there are clearly very different substrates and skills required.

Quadrant 1 is a classic biotech startup – typically roll-up-your-sleeves venture creation around academic science or a whiteboard concept. Both platforms and asset plays can be found in this Quadrant, as can bricks-and-mortar biotechs along with virtual, distributed R&D models. They require formative company-building skills. At Atlas, we spend much of our time working in deals of this type. Quadrant 1 startups obviously mature into Quadrant 2 or 4 over time as they raise more capital and their pipelines progress.

New investments in Quadrant 2 deals (or “Other People’s Deals”, OPDs, as we call them) are typically “special situations” for venture creation-focused firms like Atlas – occasionally we’ll invest in them if we feel we can add real value, the rounds’ pricing still offers attractive opportunities for large ownership stakes, etc… The capitalization structure can often be an albatross on these deals, and syndicate management typically becomes more challenging as the number of investors across different rounds (and preferred stock terms) increases in these boardrooms.

Creating and investing in Quadrant 3 startups requires significant negotiation skills and deep Pharma connections, as the process of spinning out an asset or portfolio from a larger company isn’t simple. Its also requires lots of patience. These Quadrant 3 plays can be product roll-up strategies, like Clovis and Tesaro, or they can be single asset spin-outs, like Stromedix or Arteaus. Our Atlas Venture Development Concept has been focused on this type of deal: helping a Pharma externalize the development of a program through some form of a strategic out-licensing mechanism.

Importantly, there is no right Quadrant to be in – new investments into any can make attractive returns. The fundamentals of team, product/platform, ownership and deal dynamics, and an efficient use of equity capital determine that outcome.

To finish up – “early stage” biotech means a lot of things to a lot of people. But definitions matter, and lots of rather important nuance gets lost in generalities – like the fact that “early stage” deals still represent a good proportion of the biotechs getting funded today.