Big Pharma remains a highly profitable cash cow in spite of its well-known R&D challenges and perennial patent cliffs. One of the biggest questions their Boards must wrestle with is what to do with all the cash.

In recent years, plowing it back into internal R&D hasn’t been the preferred option given pipeline productivity questions. Returning capital to shareholders via dividends has certainly been high on the list. Another, albeit indirect, way of paying shareholders is through share repurchases (stock buybacks), and it has also been quite popular. The expectation (or hope) with these indirect stock buybacks is that the stock will move upwards because the shares oustanding goes down (or at least the buybacks offset the dilution from the exercise of options).

But buybacks have a more mixed assessment in practice (here, here) and are typically only a smart if a company is (a) under-valued and (b) has no better uses of capital. This latter point is where they draw my ire, especially given their scale in our industry and the many strategic alternatives.

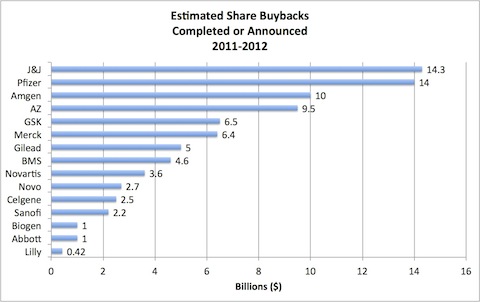

By my estimates (assembled via SEC filings and Reuters, so take it as directionally correct), over $75B in stock repurchases have been or will be completed between January 2011 and December 2012 by 15 of the top Big BioPharma companies. BioCentury’s lead article “Pharma Bull Run” over the weekend suggested $34B over a twelve month period, so in line with my estimates. The figure below captures the range across a set of Big Pharma/Biotech:

To appreciate the magnitude of these buybacks, it’s worth comparing them to other important financial values in the biopharma ecosystem. It’s bigger than the NIH budget for both 2011-2012 by nearly 25%. It’s 4.5x bigger than all of the private venture-backed M&A that occurred in the past 18 months – and that involved over 70 biotech companies. It’s 12x bigger than the sum total of venture dollars invested in biotech in that period. And its nearly 80x bigger than all the capital raised by fifteen biotech IPOs during that period. This is a huge amount of capital washing into stock repurchases.

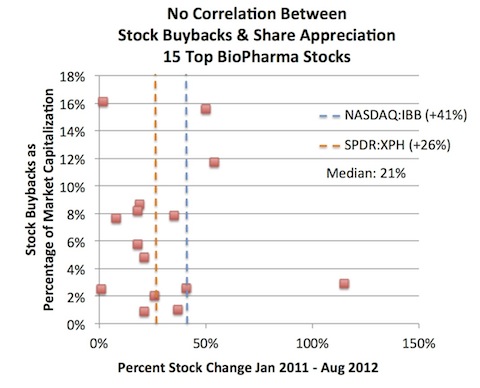

So in light of their relative scale, what have these multi-billion dollar buybacks done for these companies’ stock performance? It’s not clear. While all of their share prices are up since January 2011, but there’s no correlation in this small sample set between stock movements and the size of the buyback (figure below). And they’ve not risen faster than related indices: the median of this group is up 21%, the SPDR S&P Pharmaceuticals XPH ETF is up 26%, and the NASDAQ Biotech Index IBB is up 41%, and the latter two track lots of non-buyback Pharma/Biotech stocks. But who knows what would have happened had they not done these massive repurchases.

Importantly, at a macro level, this huge quantity of buybacks sends a clear signal that Boards and management teams of these big companies believe these repurchases are the best use of capital. So their sentiment must be that there’s few if any attractive investment opportunities in the life sciences at this point that are likely to create returns better than the hard-to-measure and questionable impact of their buybacks. That’s discouraging, and cynically suggests to me that many of these companies must be over-valued if that’s how they are thinking.

Big BioPharma clearly believes the Street rewards them for buybacks, and the Street’s short-term nature probably encourages them to keep doing it. And given how much cash they have on their balance sheets, and generate each year, I certainly believe a healthy amount of share repurchases per company (on top of 1.5x more that gets distributed via cash dividends) is the right thing to do. But $76B seems like an egregiously large amount for the biggest players in the industry to be pouring into an inefficient vehicle for long-term return generation.

I firmly believe that there are better long-term uses of capital for these companies, with better ROI prospects, than these buybacks. In an environment where we have an apparent dearth of early stage innovation and a challenging path to advance it from bench to bedside to pharmacy, I can think of a few ideas.

Lets do a thought experiment. Imagine if only a few percentage points of these buybacks were used for longer-term investments. It would be billions of dollars per year. Here are few uses:

- More creative early stage deal-making: I’m clearly conflicted here, but think that Big BioPharma could do a lot more early stage deal-making through risk-sharing, company-building “open R&D” collaborations. Genentech-Roche type models come to mind – ones that could help build the next great companies. Further, one could envision more partnerships with structured relationships like Agios-Celgene, WARP Drive-Sanofi or Arteaus-Lilly. Taking a couple percent of the annual buyback number and investing it through creative deals would significantly increase the deal pool and greatly reduce the cost-of-capital for startups. The issue will be the P&L exposure these deals may cause, so creativity will be important.

- Supporting new public offerings of emerging biotech firms: Stelios Papadopoulos, John Maraganore & Moncef Slaoui wrote a BioCentury editorial in January about the need for Pharma to step up with IPO funding to build confidence for other investors. It’s an interesting concept. Without access to longer-term growth capital, our sector will struggle to build the next Gilead or Celgene. If these Big BioPharma’s channeled just 1% of the annual buyback value into an IPO funding vehicle, it would double the size the biotech IPO funding environment.

- Helping anchor new or existing early stage venture funds with LP commitments: As has been widely reported, fewer venture funds are focused on truly early stage biotech innovation, so helping launch, support and sustain these funds would help engender a more vibrant biotech ecosystem while providing a better prospect for returns. There’s some of this going on (e.g., Merck and GSK both have a few LP relationships), but it could be more significant. The paucity of syndicate partners is a real concern for those of us active in early stage, so we’d welcome the launch of more funds. Further, like the IPO fund, these investments would be balance sheet items and should essentially treated like a repurchased share (an asset).

- Accelerating the funding around pre-competitive work, like that of SAGE Bionetworks or the Structural Genomics Consortium (SGC). These nascent efforts are being funded piecemeal today, but could have huge longer-term impact if they were resourced to help validate new targets efficiently. Even a fraction of a percentage of the annual buyback would massively increase these funding efforts.

These four ideas could be very well funded with 5% or less of the aggregate share buybacks being done today. And I’m sure others have lots of better ideas.

The critical Board question these Big BioPharma’s need to answer is whether these ideas – doing more creative deals, becoming an equity holder in emerging biotech IPOs or an LP in biotech venture funds, or fostering these precompetitive advances – will lead to more value creation for shareholders of these Big BioPharma’s in the long run than that extra ~5% they tossed into buybacks.

For me, the answer is clearly Yes.