Biotech is back with a vengeance in this IPO window. After a decade drought, we’ve witnessed over 30 new biotech offerings this year and more than $2.5B raised – the best IPO market since 2000. In fact, it’s already the 2nd busiest IPO year in the 30+ year history of biotech – bigger than both the 1991 and 1996 windows in terms of number of new offerings.

No one could have predicted that five years post-Lehman’s collapse we’d be in the midst of such a hot biotech market, much less predicting it just 12 months ago. Frankly, many venture investors of my generation, who joined venture capital shortly after the Genomics bubble burst, have never seen a public offering window like this before – it’s exciting, and great for our sector to have a set of emerging biotechs well fueled to accomplish big things in the clinic.

Furthermore, beyond just “getting public” with fresh capital, healthcare IPOs have been the best performing IPO sector of 2013, up 64% on average year to date following their offerings, besting all other sectors according to Renaissance Capital (see chart here).

The list of offerings and their stories have been covered elsewhere (here, here), and as the window was being opened earlier this year I shared some thoughts on the diverse nature of the companies getting out and their cost of capital (here).

But with this window in full swing, its worth speculating as to why the biotech IPO market has been so strong.

Why now?

There are several reasons underlying the optimism in the public biotech market today.

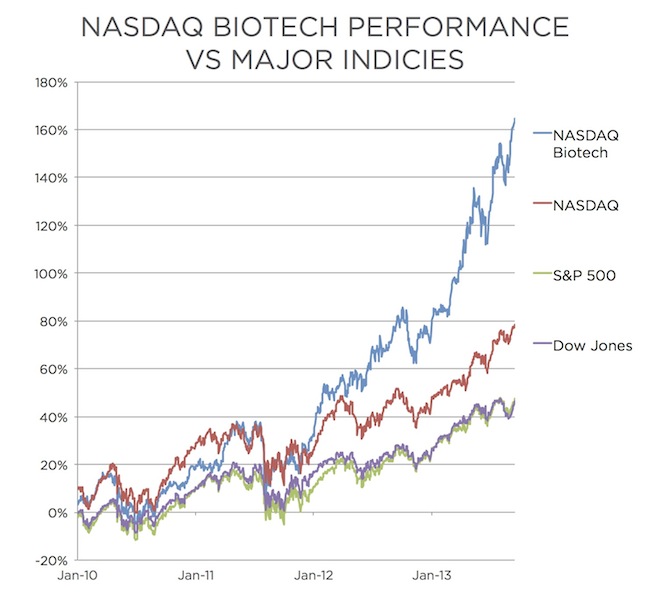

- Generalists are back, chasing the sector’s outperformance. For most of the past decade, few generalist investors (e.g., mutual funds) have given biotech much credence after the carnage of the genomics bubble and certainly weren’t jumping into new offerings. Biotech was deemed too risky for its return potential. But since 2010, biotech and in particular the Nasdaq Biotech Index has massively outperformed other investment sectors – by over 100% or 10,000 basis points (see the chart below). Outperformance of a “mere” 1000 basis points by a sector may sway a generalist fund manager’s allocation models; a differential of 10,000 basis points definitely will. This sector differential means that any generalist fund manager who hasn’t had enough weighting to biotech in their portfolios over the past three years has likely underperformed indices, and those with overweight positions have done remarkably well. This has brought generalists back into the sector. Bankers that I’ve talked with highlighted that the oversubscribed books of many recent offerings are due to demand from generalists looking for biotech exposure, and often following the ‘thought leadership’ of key specialist buyside managers like Fidelity, Brookside, RA Capital, Adage, and others. Generalist interest is a major part of the IPO demand today.

- Recent IPO vintages have done very well in biotech. It’s not just the big indices in biotech that have done well; many of the new offerings from the 2010-2012 vintages have delivered great returns, including Clovis, Tesaro, Intercept, Pacira, Aegerion – all up 300-500% since their public debuts. I blogged on their “quiet outperformance” relative to other sectors last summer (here). There have been blow-ups like Pacific Biosciences and AVEO Oncology, but by and large these new biotech offerings have done better than many vintages in the mid-2000s (and many other IPO sectors). This provides further support for IPOs as an important element of the ‘biotech has outperformed’ thesis underlying the recent window, reinforcing the buy decision for a number of generalist investors.

- Biotech is benefiting from a ‘recycling-scarcity’ cycle. Strong mid-cap performance and big M&A deals have liberated cash for reinvestment into new biotech names, but there aren’t a lot of good existing stories. This is the essence of the “recycling-scarcity” thesis underlying the window, and I think it has real merit. Acquisitions of bigger drug companies, like Onyx, Elan, Warner Chilcott, and Bausch & Lomb create a lot of happy investors in 2013 (here) wanting to put their $29B+ of proceeds back into the formula that worked: exciting mid-cap drug companies. Further, large-cap biopharma names like Biogen, Vertex, Alexion, BioMarin, Celgene, etc have had great run-ups in their valuations in recent years (see #1 above), and many managers are trying to recycle profits into higher growth potential small/mid-cap names. This demand to recycle capital is paired with a real scarcity of interesting biotech names. After a decade of limited new offerings, and abundant M&A, the shrinking ecosystem of biopharma companies larger than >$50M range (covered in a blog post a couple years ago here) has been a real issue. The universe of investable small/mid-cap biotech names has shrunk by close to a third. This creates both the sentiment and reality of scarcity. The oversubscribed nature of many of the recent offers further reinforces the sense of scarcity – not being able to “get in the deal” or “get enough of the deal”. Putting recycled capital to work in exciting new “scarce” offerings becomes the accelerant needed to fuel a booming IPO window.

- The JOBS Act has certainly greased the skids of the offering process with its test-the-water and confidential S1 approach. According to the NVCA, over 80% of the offerings this spring utilized this new pathway to get public. A number of recently public biotech CEOs have come out in support of (and appreciation of) the JOBS Act as a real catalyst for their offerings (here, here). I recently heard that one of the best offerings of the year took only 62 days from its IPO Organizational Meeting to its Offering – that is lightening fast and reflects the “greased skids” nature of the IPO process today. Kudos to Washington for getting something right.

I’m sure there are other reasons, but the above four are certainly big contributors. In some ways, the first three are responses to a “cyclic trough” for the sector, which lasted most of the last decade. Alex de Winter of GE Ventures articulates this in a recent blog post (here).

I tend to share his optimistic view that the core elements of the four contributors are likely to continue to play out in favor of biotech over the next few years, especially with the long-term ‘bullish’ case for the drug sector (described here).

The real risk to this market is if generalist investors become skittish and move to underweight biotech in their portfolio allocations. Without generalist interest in the new offerings, biotech could quickly return to its more familiar and challenging IPO dynamics. The type of event that could trigger this weakening of enthusiasm could be a broad downdraft in the biotech markets as a whole (e.g., poor launch trajectories, challenging revenue or earnings numbers across the big biotech names, or pricing changes in the US market), or more likely a handful of big clinical stage blow-ups from a few recent IPOs. We just had one with Prosensa/GSK’s failure last week. If other clinical bets blow up in some of the other new high-flying offerings, that could send generalists to the exit signs. One can only hope that the sector remains resilient to these dynamics.

It’s inevitable that some pullback occurs in the markets given their ‘heat’ today, but the degree of the pullback depends on the substance of the products we’re developing as a sector and our ability to retain generalist interest. If investors sense ‘smoke & mirrors’ in stories that become overhyped, along with big clinical failures, then the window will come crashing shut. But if we are successful at articulating the value of the innovative product candidates we’re developing, with a balanced sense of the risk and likely returns, then we as a sector will be able to maintain the long-term participation of the generalist investor community – and build the high growth biotech companies of tomorrow.