This blog was written by Sam Truex, former CBO of Padlock and Synlogics, and current Atlas EIR, as part of the From the Trenches feature of LifeSciVC.

Funding for biotech companies has been abundant this year. As covered the first week in October by Timmerman Report and Meg Tirrell on cnbc, biotech IPOs are pricing at a steady pace. Q3 2017 also saw the largest quarterly injection of VC funding into biopharma ever in the history of our industry, at $3.6B according to LifeSciVC.

It is positive, welcome news that interest in biotech investment is solid, particularly given that the outlook for the 2017 funding environment was quite uncertain a year ago. Yet even with eager investors, companies have important decisions to make about the form and pace of financing to pursue. Financing transactions, particularly those beyond Series A, are built on strategic considerations, including:

- What are the foreseeable value inflection points for the company?

- How much investment is required to reach those milestones and continue building a sustainable company? What contingencies are needed in case there are challenges along the way?

- How solid is the current investor base? What is the climate for future investor interest in the company and how can it be enhanced to maximize value for current shareholders while allowing for a sound long-term financing strategy?

While it may seem that the IPO decision is purely one of timing, there is also a crucial decision on whether to pursue an IPO at all. There are other alternatives, after all. Highly financeable companies have chosen other paths. Intarcia and Moderna have preferred to pursue successive, hefty private rounds that allow them to focus internally rather than on public company activities. Private funding rounds are considerably more straightforward transactions than those that lead to public companies and are far less distracting post-financing, but they retain the captive investor stance with no liquidity on the horizon.

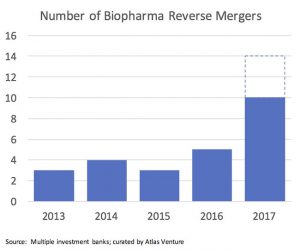

Another alternative is to become public via a reverse merger, which has increasingly gained favor as a tool in the financing toolbox. With the IPO boom in 2014-2015 and the inevitable clinical failures that have followed, reverse merger targets continue to emerge. These are public companies who determine that their own programs are no longer worth pursuing – either not at all, or at least not as independent companies. With public listings and cash on hand, these companies can be attractive merger targets for private companies that desire both. Indeed, the number of reverse mergers in 2017 is already two-fold the number that occurred in 2016 and the year isn’t over.

Ron Renaud’s eloquent review Putting It In Reverse from early 2016 provides an overview of the reverse transaction, a solid list of factors to consider when contemplating a reverse merger and criteria for a good reverse target. Ron references the impressive valuations achieved by Medivation, Synageva and Puma in recent years after reverse mergers earlier in their evolution, yet also highlights the reality that numerous companies that have foundered and failed following reverse mergers. It should be no surprise that success is case specific and critically driven by the fundamentals of the surviving company.

During the last year, Atlas-backed companies miRagen and Synlogic have leveraged the reverse merger path to become public. Both made the decision to do so when the IPO market outlook was highly uncertain and both secured concurrent private financing rounds to lengthen their newly-public runway. These companies are on solid ground currently, with cash on hand and the public markets at their disposal. They share the need to actively tell their evolving story to build momentum for that next financing.

Having contemplated these alternatives deeply with the Synlogic team in Q1 2017 and having recently followed up with CFOs Todd Shegog of Synlogic and Jason Leverone of miRagen, I share here some key considerations in comparing alternative financing paths.

This list of considerations is not exhaustive. The only thing that is eminently clear is that there is no one right path. Candid input from high-quality banking teams who know the company and are living the capital markets daily can be very valuable. The fundamentals of the company combined with its current capital position and time horizon need to be considered carefully in light of not just the next financing, but the one or two after that. As Jason Leverone wisely put it, capital, runway, and near term milestones are key; you need to have the right balance here going into the financing to be successful for the long run. Simply completing the financing transaction at hand is not enough.