Todd Zion, the founder of the adjustable insulin company, SmartCells, has done wonders for the Boston Life Science angel community – and reinvigorated their interest in funding therapeutics companies. It’s a great story and Todd deserves the attention he’s been receiving about SmartCells’ unique success.

As a quick snapshot: founded in 2003, SmartCells spun out of MIT with the mission of developing a glucose-regulated insulin product for diabetes. In the presence of high glucose, the insulin would work. In its absence, the insulin would be masked/protected and not function. Thus mimicking the body’s normal glucose response. Over the course of the next 7 years, the company developed the technology and six months ago Merck bought them for an upfront rumored to be in the $80M range and milestone payments of potentially $500M more if its successful – definitely one of the largest preclinical stage deals in years.

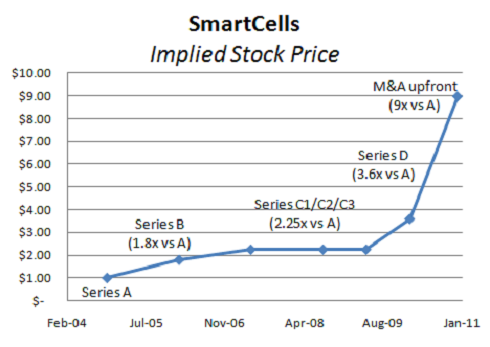

Based on the public disclosures I’ve seen, SmartCells upfront alone generated a 9x return to the Series A shares (since 2004) and a 2.5x return for the Series D (in less than a year). If successful, the contingent payments would make for a huge investment multiple. Here’s the implied pricing over time through the upfront payment (assuming the A-round was $1.00)

Obviously a big chunk of the deal is contingent on success. Merck recently announced in its 2010 10K that it determined that SmartCells had a “fair value at the acquisition date of $138M” including the upfront and risk-adjusting the future biobuck payments. At that fair value price, the implied share price is closer to $15-20 – a very respectable expected return, albeit only partially realized.

A few interesting themes worth highlighting about the deal:

1. Impressive equity capital efficiency. Smartcells only raised $9.6M in equity financing from 2004-2010, across four Series of stock. Over $10M in additional non-dilutive grant funding helped support the company via SBIRs, DoD awards, and JDRF funds. At its peak in 2010, the company had only 17 employees, a very small in-house lab, and leveraged a great network of collaborators at the MGH, Joslin, JDRF, NIH, and elsewhere. And yet they were able to develop their adjustable glucose sensitivity platform, confirm the sugar response and safety profile in five different preclinical large and small animal species, and receive approval for doing Phase 1 clinical studies.

2. Retaining value for founders and team. From what I’ve heard, about 50% of the capitalization of SmartCells when acquired was still owned by founders and other common stockholders. Very unusual in biotech given the traditional capital requirements. Their exquisite capital efficiency obviously enabled them to maintain their ownership, but the mechanics of the titrated financings over time also allowed for price appreciation and less dilution.

3. Angels backed them all the way. Most angels won’t touch therapeutics deals because of the traditional capital intensity, but SmartCells found several supportive groups and has changed some perceptions about biopharma. At the time of its acquisition, they apparently had 150+ individual angel investors as direct shareholders.

4. SmartCells pivoted a licensing deal into an M&A transaction. When faced with the tax inefficiency of generating liquidity from a licensing transaction with Merck, SmartCells worked hard to reconfigure the deal to be an outright acquisition. Since licensing deals have favorable accounting treatment, they had to make the deal “cost” neutral to Merck – but in doing so greatly increased the value to its shareholders. (An LLC from the outset would have also solved the issue).

Many will question whether the SmartCells model is truly repeatable. I’ve heard it discounted as random luck, that Merck was foolish to bet so much on something so early, that it’s a special situation, etc… They didn’t have a single venture investor, nor did they hire a banker for the transaction, nor did they bring on an experienced Pharma exec to the run the company, etc… So its special – especially because there aren’t many potential 10x+ return stories in biotech.

But I think its certainly a model whose basic attributes can be emulated: novel technologies/products applied against huge unmet medical needs can generate outsized returns if they are pursued with disciplined capital efficiency, an openness to external collaboration in lieu of excess infrastructure, and a keen focus on the needs of potential Pharma partners. Sounds as easy as Apple Pie.

In a world still dominated by big media savvy “company-building” stories, its refreshing to learn about scrappy deals like SmartCells.