Biotech Wisdom Of The Crowds: Competition And Capitalism

Over 200 GLP1 obesity programs are in development today. More than 300 PD1/PDL1 cancer programs exist. Greater than 150 programs target each of CD19 and KRAS. Therapeutic crowding has ratcheted up the competitive intensity in biotech to new levels.

While a perennial concern for decades in the biopharma industry around “hot” mechanisms of action (e.g., statins and SSRIs in the 1990s, TNFs in the 2000s, PD1’s in the 2010s, GLPs today), this herding into well-established mechanisms has accelerated in recent years – both in the volume of activity and in the pace of competition.

Here on this blog we’ve covered these topics a number of times in the past, with the “March of the Lemmings” in cancer in 2012 and “I/O: The Strategic Supernova In Cancer Today” in 2016.

But with the rise of China’s innovative sector, the proliferation of biologic drugs coded by DNA, and more than dozen years of abundant capital, to name just a few things – the challenge has only gotten worse.

As illustrated in LEK’s May 2025 report “Is Biopharma Doing Enough to Advance Novel Targets?” the scale of the current crowding challenge is staggering. All of these targets have at least 50 programs against them in preclinical or clinical development.

Further, the pace of “fast follower” drugs is striking relative the past: according to PhRMA’s recent report on innovation, the average time for a drug class to have three FDA approvals in it went from ~15 years in 1990-2003 to ~2 years in 2013-2021.

Many others have discussed this “therapeutic crowding” topic, so I won’t belabor the points here. They have already explored and indicted it for a myriad of negative impacts on the sector: poor biotech success rates, failures of IPOs and Smid-cap biotechs, lack of generalist investors in the space, rise of short sellers, and the demise of the XBI biotech index, amongst other bad karma for the sector.

But who is to blame? VC’s, obviously.

Indeed, VCs are commonly cited as the culprit: we apparently start and fund too many companies doing the same things. Too much capital chasing too few novel ideas. Too many “me-too” programs.

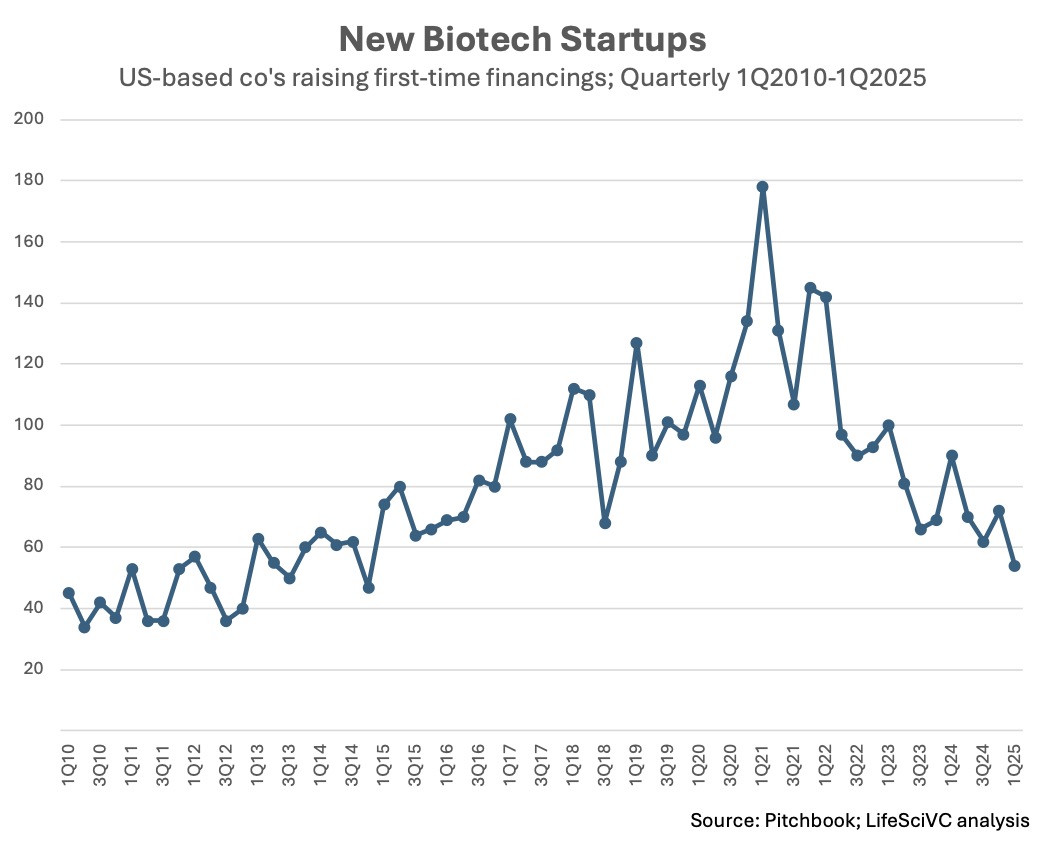

Since 2012 when the JOBS Act primed the IPO pump, we’ve brought over 600 companies public on US exchanges, many of which doing similar things to other biotechs. Think about how many CART CD-19 companies got started… or gene editing and gene therapy plays… literally, dozens and dozens of them emerged, all chasing similar indications. During 2020-2021, the bubble in venture creation started over 180 biotech’s a quarter in the US alone (which thankfully is down to a third of that recently). Private biotech investors, including and frequently led by VCs, were behind most of these companies.

In light of all that, the criticism undoubtedly has some truth to it. VCs are in part responsible for startup biotech’s contribution to the rise in therapeutic crowding (though Pharma and other established players also do their part to contribute to this dynamic as well).

But we can’t throw the baby out with the bath water: yes, VCs helped crowd the space – but they also bankrolled the breakthroughs. No crowd, no drugs. Without early stage investors, biotechs couldn’t really get started, as the sector depends on them for capital at a minimum, and strategic value-add and corporate governance on a good day.

So here’s my contrarian counterpoint: if you believe in markets and capitalism, you have to embrace the competitive tension that crowding manifests. May the best companies with the most successful drugs win. Fail to deliver valuable and differentiated medicines and your shareholders will face losses.

In the long run, this dynamic marketplace of rewards and losses creates a mechanism for bringing great drugs forward – and I’d argue this system is good for patients around the world. There are some real downsides, which I’ll mention below, but it is risk-taking capitalism that delivers innovation.

Crowding around new innovations also isn’t a disease only biotech VCs can succumb to: all VCs suffer from a powerful herding instinct. In fact, (over-)allocating capital to “hot” ideas is wired into the DNA of the venture capital industry and the market cycle of innovation (euphoric peaks, despairing troughs).

The tech VC sector, nearly 10x the scale of biotech, does this all the time.

Take ride-hailing app’s. Uber and Lyft are the big global winners, but at least scores of startups were launched in the US alone, and upwards of 150 companies around the world. Anyone remember Sidecar? Started in 2011, before Lyft, ended up shutting down in 2015. Or Juno? It started 7 years after Uber.

Or grocery delivery services. At least 50-70 startups formed to execute on this business model. Instacart is clearly the dominant player, but it started 13 years after FreshDirect and more than 20 years after Peapod. Tons of others failed along the way. Add in the meal delivery firms and there have been a few hundred startups focused on getting food to people.

The list goes on. Dating apps. Social media startups. Online betting platforms. Electric vehicles. So many “hot” spaces, all of which got crowded quickly, backed by VCs who hoped to pick a winner.

If you were smart or lucky enough to pick one of the dominant winners, you were a VC hero. But the reality is most investors in these spaces likely lost money… like lemmings running off crowded cliffs.

Even with these investment losses, there’s one clear beneficiary of the crowding into these spaces: consumers. And the crowds often consolidate into a few winners that have become ubiquitous in the lives of most Americans.

I’d like to believe that in the long run, therapeutic crowding will deliver something similar. While investors in many deals will lose money, those that deliver value for patients will accrue returns over time. And in each disease or indication, we’ll have a handful of approved medical options to give patients choices around what level of benefit-risk they would like, and to give payors choice around what level of cost they can support.

It’s instructive, though, to dig into some of the profound differences between tech and biotech investing to understand how crowding differentially impacts our respective sectors.

In many areas of tech investing, there are minimal barriers to entry: a good coder can fire out a product offering quickly. Time to market is fast, and getting critical consumer feedback allows a startup to iterate on its product quickly. R&D cycles times are days, weeks, and months. Market competition between startups happens very quickly, and often intensely. Well-known financial metrics assist in tracking the momentum of these plays (e.g., MRR, CAC, users, etc). A deep and broad pool of seed, early stage, and growth investors exist, allocating capital to the winners (and, over time, away from the losers). If a startup can achieve escape velocity, leading to a massive reduction in its cost of capital, it can scale even faster… and scaling creates dominant market positions, leading to consolidation and a “winner take all” dynamic. So crowding in tech dissipates into a few big winners over the course of time, often within five years.

This isn’t really how biotech works.

Barriers to entry have historically been very high, as deep scientific expertise and integrated capabilities are required (though this is changing as drug R&D expertise democratizes and commoditizes around the globe). R&D is intensely regulated to prevent harm (and prove efficacy), leading to prolonged cycle times measured in years, and often decades from idea to approved drugs in new technologies.

Direct competition between drug candidates doesn’t happen early in development; instead, competition really only occurs via capital allocation decisions of investors making implied comparisons around target product profiles (TPPs). True head-to-head competition between products is delayed often until approval. Scientific data is the only real currency of competition (clinical or preclinical), not any robust financial metric.

Lastly, scale advantages don’t really accrue until a decade into the company life cycle: either in very late clinical studies (global Phase 3s), and often not until commercialization. Scale may in fact work against nimble innovative research and early development. Further, premature scaling for a startup is quite counterproductive (huge burns for early stage companies), rather than helpful escape velocity.

All of this conspires in biotech to lead to an ecosystem where firms must persist for far longer in order to reveal their actual product profiles. Successful firms are able to credibly communicate the TPP of their programs, and figure out how to raise capital (take equity dilution) and do partnership deals (take asset dilution) in order to maintain adequate balance sheets to transform their candidates into actual drugs. If you can do it faster or cheaper (like what China has been doing recently, or AI/ML promises to do), that obviously helps create R&D advantages during that long innovation process.

Further, unlike tech, there’s a relatively small universe of investors allocating scarce funds to help these new and emerging firms navigate that R&D journey to market. There’s also an absence of late stage, “less valuation sensitive” private growth capital, which essentially forces loss-making development-stage biotechs into the public markets. In tougher times, like today, more startups will starve during this journey than might otherwise; but in frothier times, more will survive than probably should. Because capital allocators are human, their fear and greed drive this market cycle. And those emotions move due to comparative data packages (and TPPs) of R&D stage medicines, not financial metrics, which frequently leads to mispricing/dislocations in the market – all part of what makes biotech investing both an opportunity and a challenge.

This long duration crowding dynamic further means that “me-too” or less differentiated products will survive longer than they might in the tech sector – at times surviving all the way to drug approval. This occurs in large part because one only really knows for sure if a drug is a meh “me-too” product until mid- or late-stage clinical trials have read out, usually 5-10 years after a startup forms.

In a free market that is actively allocating capital to new startups, the creation and persistence of players in crowded areas is bound to happen – in part because no firm plans to make a undifferentiated product. I’ve never heard a pitch from an entrepreneur that declares “we’d like to make a second-in-class product”. Everyone has a dream for why they think they can make either a first-in-class or best-in-class product. It’s always a new angle on affinity, potency, delivery, pharmacology, selectivity, dosing, etc… And entrepreneurs good at selling that dream will find investors to back them. But, in the end, most dreams don’t come true – though it often takes a long time in biotech to realize that.

Fortunately, to at least a modest extent, me-too or incrementally different products do actually have a place in the biopharma marketplace: they offer more choice for patients around convenience, tolerability, or efficacy, as well as potential competition for formulary or payor status, leading to pressure on net drug prices.

In summary, crowding is the expected consequence of an active market for capital allocation (and management teams’ time allocation), and happens in tech and biotech venture investing. While there are profound differences in how this herding instinct impacts the two ecosystems, it’s just part of the innovation cycle – and part of the creative destruction so important in risk capital markets.

There are, however, real downsides to over-crowding for biotech that are important to not gloss over, especially in specific disease areas and modalities: real opportunity costs of not funding out of favor areas with high unmet needs; patient participation and perhaps over-enrollment in trials for drugs unlikely to demonstrate value; dilution of scarce management talent over too many similar startups; and, long term investor losses leading to a shift (outflows) to other sectors, to name a few. These are real, and seeking to mitigate these risks is important, but in a free market for capital allocation they are unlikely to go away.

Startups crowding into hot spaces is axiomatic with markets. In a sector defined by science, R&D, and risk capital, crowding isn’t necessarily a bug – it’s a feature. Winners will emerge from the crowd and bring new and differentiated drugs forward – and patients will benefit.