It’s biotech armageddon out there: with massive value destruction across public stocks, it’s clearly the worst market backdrop in over 20 years.

Nothing like this pullback has happened in recent memory. This is way worse than the short “sky is falling” downdrafts in 4Q 2018 and 2H 2015. It is also way worse, for biotech, than the financial meltdown of the Great Recession in 2008-2009. Biotech was anemic before that crisis and was only slightly more anemic after it. A much better comparison is the dot.com and Genomics Bubbles imploding, where the depth and duration of the pullback was similar.

Like twenty years ago, massive risk-off sentiment decimated the high risk and often speculative technology-driven sectors like consumer internet and biotechnology. We all knew it was getting frothy, but I don’t think there was widespread expectation for a complete public market implosion, like we’ve seen. The macro headwinds around inflation fears, rising interest rates, an invasion of the Ukraine, continued waves of COVID variants, deepening supply chain issues… all have combined to create a deeply bearish climate towards higher risk equities.

For those keen on exploring strategic options in a steep downturn, read Peter Kolchinsky’s 10,000 word tome on the subject. While I may not agree with all of recommendations, it covers a lot of ground and is an appropriately provocative piece for Boards and management teams alike.

Without even rehashing the numbers, it’s very clear that the dislocation in the public markets has been profound. Hopefully we hit bottom here in June, but only time will tell.

But what about the private VC-backed biotech markets?

STAT News raised concerns yesterday about fear and desperation in the private biotech world: citing deals falling apart and valuations plummeting, it claims that many are “really scared and frightened.”

There is no doubt the private markets are more challenging than they were during the ebullient markets of 2020-2021, and current sentiment reflects a jittery financing environment.

However, in times like this some historic comparison is useful, in order to rebase where things really are – and in this case offer a rather contrarian view of the state of the financing market today.

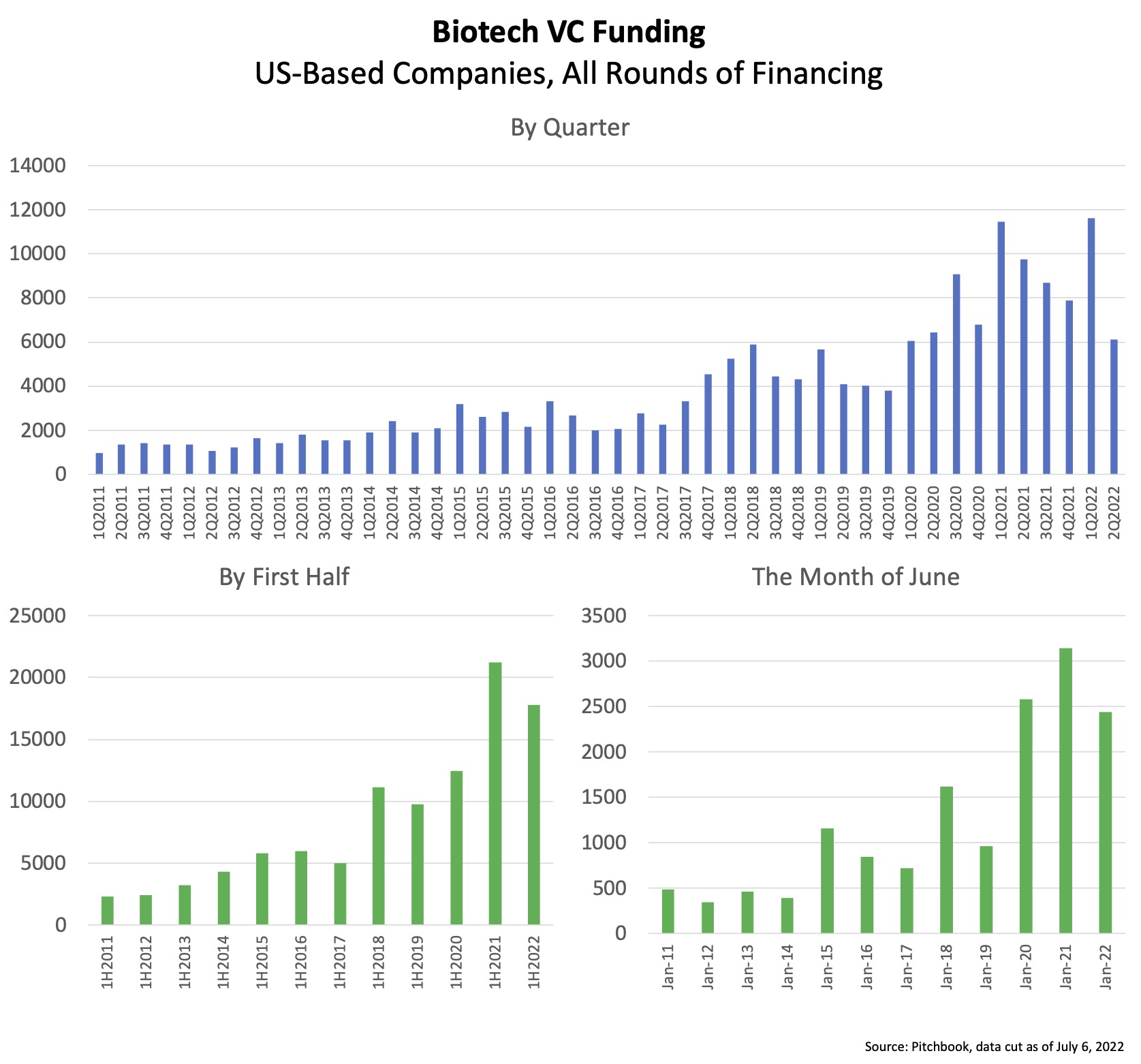

The reality is the private biotech ecosystem is awash in more capital today than all but two years in the 40+ year history of the industry. There’s a huge amount of capital still available to fund innovation going forward. Here’s the data, according to PitchBook, dated as of today:

- 2022 is off to the fastest start for private financings than every year except 2021: nearly $18B has been invested in the US into private biopharma companies in the first six months of the year (1H 2022). For comparison, 2017 was heralded as a year of “investor exuberance” by pundits, and yet 1H 2022 is already 40% higher than all of 2017.

- Over $6B has been invested in 2Q 2022, well short of 2Q 2021 and nearly as much as 2Q 2020, but far more than 2Q in all prior years – that’s way more VC funding than any year during the 2012-2020 bull market run. In 2Q 2022 alone, there was more capital than in all of 2013, often highlighted as a “boom” year for backing biotechs as the IPO window really opened.

- June 2022 was also huge: it was the biggest month of the quarter, at nearly $2.5B, beating all the June’s before 2020 ever. And June was nearly 18 months after the peak in the public markets, mitigating the impact of merely temporal dynamics in these data.

If you didn’t know where the markets were at their peak in 2021, and had been asleep since before COVID hit, you’d wake up today and think the private biotech financing climate was incredibly strong – one of the best ever.

That’s a staggering data disconnect from widely-held sentiment today.

This is in large part because sentiment is always a first derivative function: the direction of change. The VC-backed private market in 2Q 2022 is down considerably (50%) from peaking in 1Q 2022 and 1Q 2021 (both above $11B in a single quarter). But the first derivative misses that it’s still a huge absolute number by historical comparison: $6B+ in a single quarter.

It’s also because the public equity markets often set the tone for the sector: it’s easy to watch the ups and downs (lately downs) every day, and feel that volatility viscerally. And we also know the public equity financing environment has been very unwelcoming, largely closed for IPOs.

For later stage companies, the inability to tap the public equity markets means they will need to do another private round (and clearly many have in the recent quarters), and their valuations will need to reflect the “new” public market comparables to some degree.

Surprisingly, however, this valuation compression isn’t reflected in the latest cut of the data: median pre- and post-money valuations for June 2022, for 2Q 2022, and for 1H 2022 are all higher than their respective period in any prior year, including 2021, according to Pitchbook data. I suspect the gravity pulling valuations towards earth will appear in future data cuts.

Stepping back though, these data are very clear: there’s still plenty of capital out there to fund private biotechs.

Further, this isn’t likely to dramatically change in the near term: I anticipate robust absolute private funding levels over the next few quarters. While the disconnect between private and public markets can’t go on forever, the private world still has copious amounts of capital available that has to be put to work.

This is in part due to a structural aspect of venture capital which allows it to work over longer timeframes and multiple cycles. VC fundraising in the past few years has been very strong, with over $113B being raised by VCs for all sectors in 2021 alone, an all-time high. Many biotech VC firms have raised large funds in the past few quarters. Importantly, these are close-ended investment vehicles with long-term commitments of capital from LP’s. Most of the committed capital gets deployed in the initial investment period, which is usually over 4 years. VCs have to put that money into deals, and can’t sit on it as “cash” like a hedge fund. That means all of those venture fund dollars that got raised in the past two years are likely to get deployed into private biotechs over the next few years. Most funds can deploy up to 20% into public equities, and I suspect many VCs will look at value-shopping there; but the vast majority of VC funds will still get deployed into the private markets. This represents a huge amount of dry powder for the VC-backed biotech ecosystem over the next couple years.

In summary, while sentiment is clearly negative, and every biotech should be belt-tightening and adopting fiscally-disciplined budgets, the private markets have been remarkably resilient and are going to continue to be robustly funding innovation going forward: companies with strong science, led by solid teams, will continue to get financed. For private biotech, the desperation of Chicken Little isn’t yet warranted as the sky isn’t falling. Or at least not entirely.