Biotech is in the midst of an incredible era of innovation: new modalities and novel medicines delivering real value to patients, leading to a decade-long bull cycle. It’s been exhilarating to watch and participate in this market, and venture capital activity in biopharma remains near all-time highs.

As evidence of this ebullient era, venture capital funding into US-based biotech firms has been above a record-setting $3.5B for each of the last 8 quarters, according to the latest Pitchbook data. In short, overall fund flows into emerging biotech stories are very good. While the end of 2019 was off the mid-2018 quarterly peak in funding levels, these numbers are still huge by historic standards. It wasn’t that long ago that an entire year’s worth of venture funding was in the $4-5B range.

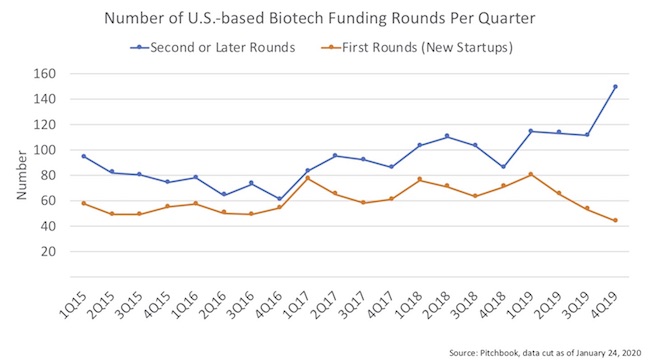

Beyond the aggregate funding levels, tracking the number of new entrants is an important metric for the health of an ecosystem – and one that readers here will know that I’ve covered in the past (here, here, here). Both the absolute number of new companies announcing their first funding rounds, as well as changes in the pace of venture formation, are important biomarkers for the health of the ecosystem.

In contrast to the rosy top-line, the data are potentially showing a troubling trendline.

The number of new biotech startups announcing their first rounds of funding has dropped each quarter since beginning of 2019, down nearly 50% from a year ago, to what may be the lowest number in five years. The percentage of new startups getting their first rounds of funding, relative to second or later rounds, has dropped from the long-running average of ~40% to nearly 20%. And these metrics are juxtaposed with a backdrop of solid overall venture funding numbers – suggesting a shift from new startup formation to backing existing players. The divergent trendlines in the chart below illustrate this dynamic.

It’s not just about the number of startups either. The funding levels into new first rounds for startups has dropped – as both a percentage and in absolute terms.

Several possible interpretations of these challenging startup formation trendlines.

One, it could meaningfully reflect a changing sentiment in the long-range prospects of biotech in light of the drug pricing debate and general anti-biopharma political punditry. As I detailed previously, early stage investors have to be confident they’ll be rewarded years, if not more than a decade, into the future. These trendlines could suggest an increasing lack of confidence in the future, as venture formation is a lagging indicator of changing sentiment. Creating a startup takes time. By the time a funding round is announced, whether it’s just an angel, seed or a Series A round, the concept has typically been incubating for months if not quarters. So the number of new startups receiving their first funding often lags actual venture formation activity. For example, 1Q 2016 and 1Q 2019 were relatively strong quarters for new startups, in part because many of those startups got “formed” in the excitement of 6-9 months earlier when the public equity markets were peaking (before the 2H 2015 and 4Q 2018 market weakness). Given the choppiness in the biotech markets in mid-2019, the continued political clamor around drug pricing and the increasingly unpredictable future, startup formation could have slowed. Investors may be more hesitant to put the time, energy, and capital into new startups – when they may need those resources to support existing companies through a potentially precarious future 12-24 month period. This could be the case.

Another interpretation could be that the snake is finally getting indigestion from eating the pig. We’ve been in a multi-year bull cycle in biotech startup formation. Both the pace of venture creation and aggregate venture fund flows have been high over past five years. A number of new venture firms have formed with an explicit focus on venture creation, including in geographies outside of Boston and San Francisco. In-house venture creation models are inherently constrained and hard to scale. The startup formation activity from all of these new funds, especially those with in-house models, could start to slow – given the consumption of rate-limiting time and energy, even if capital remains abundant – and that might be what we’re seeing here. Another take on this possibility would be that we’ve got plenty of corporate substrate in the biotech ecosystem right now, so it’s easy to feed our sector’s capital deployment requirements without creating an increasing number of new startups.

Lastly, a third interpretation could be that all of this is just noise, or a longer-than-normal temporal delay in Pitchbook’s capture of new startup announcements; the numbers do always get updated real-time. In the past week or so, the numbers have shifted up. So it could just be noise.

But my gut tells me there’s something real in the multi-quarter divergent trendline: anxiety about the upcoming election may bias early stage investors to reserve more for existing deals in what may be a challenging time ahead, rather than starting lots more companies right now (aka., more mouths to feed in the future). After the 4Q2019’s strong performance, maybe we’ll see a new spike in startups in mid-2020 – only time will tell.

While we remain confident in the future of biotech venture creation here at Atlas, the slowdown in startup formation suggested by these data could be a lagging metric of a broader shift in sentiment towards more cautious and less unbridled optimism.