We’re half way through one of the craziest years in recent memory, with a raging viral pandemic, civil unrest and protests, staggering unemployment and economic woes, and invasive murder hornets. And yet, like the indefatigable Energizer bunny, the biotech market just keeps marching onwards and upwards.

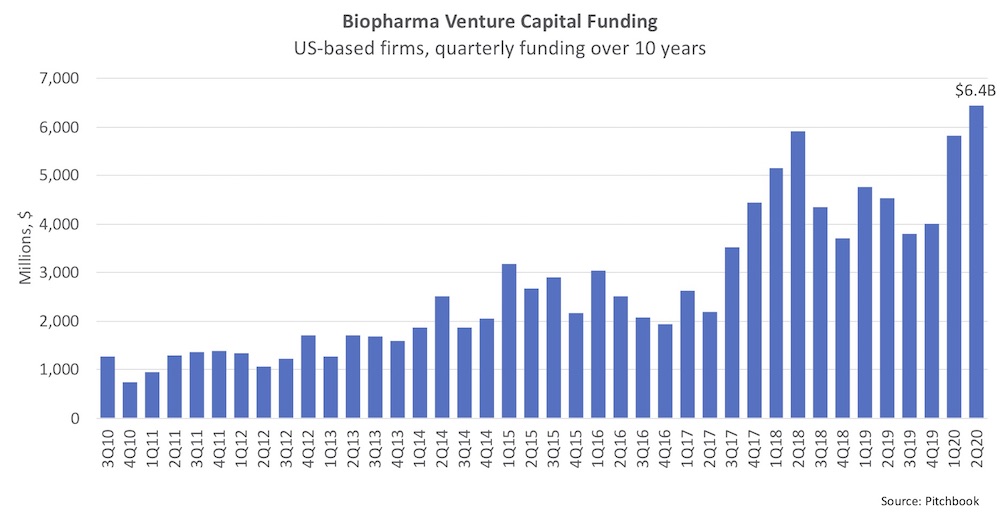

Recent 2Q 2020 data from Pitchbook shows that venture capital funding into US-based biopharma companies was the largest quarter in the history of the industry – topping over $6.4B. In the midst of the crazy macro backdrop, private biotechs raised more in the last three months than the annual totals in every year prior to 2014.

This strength has surprised many market participants, including me: in April, I had forecast that 2Q 2020 would soften a bit from the “record-setting” 1Q performance due to social distancing… but that’s obviously not what happened. It was another record-setting quarter.

This strength has surprised many market participants, including me: in April, I had forecast that 2Q 2020 would soften a bit from the “record-setting” 1Q performance due to social distancing… but that’s obviously not what happened. It was another record-setting quarter.

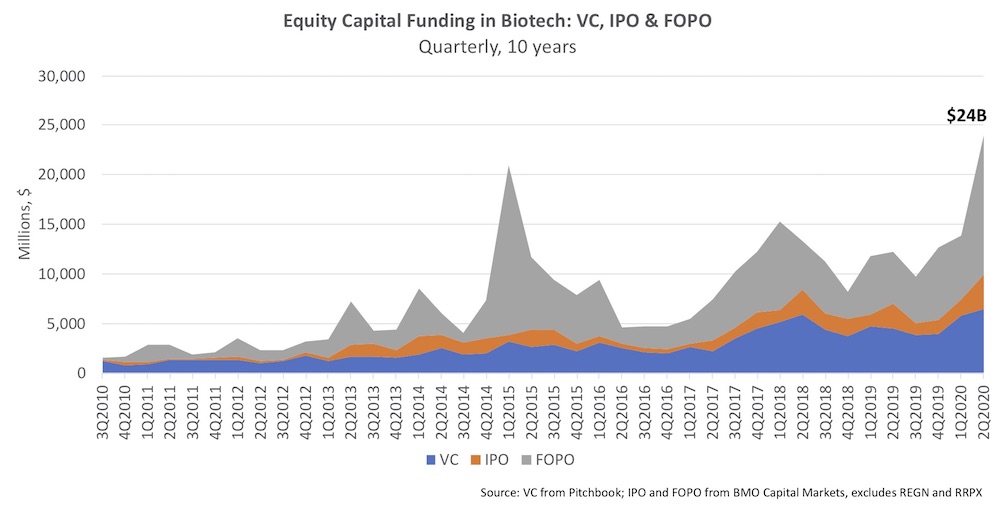

Beyond private venture capital funding, the public markets for biotech are also swimming in capital. With stellar 2020 returns in the biotech equity markets relative to other sectors, investor interest and inflows have been strong. And with biotech IPOs performing incredibly well in 2020, investors have been eager to participate in these offerings – oversubscription, upsizing, and going above the range seem strangely commonplace in this market.

According to data from BMO Capital Markets, in aggregate, we’ve seen over $17.6B in equity funding in 2Q2020 into biopharma across both IPOs and follow-on’s (excluding offerings from Regeneron and Royalty Pharma). The biotech IPO fundraising level, in terms of capital raised, is the largest ever witnessed in a quarter, and the follow-on number is only beaten by 1Q 2015.

This tidal wave of funding is well illustrated by this combined public and private funding chart, highlighting the record-breaking $24B in total equity funding:

I’ve opined previously on the reasons why biotech is an unusual sector relative to broader economy during a pandemic or recession (here). The current financing market has been further buoyed by the strong sentiment that science will lead us out of this pandemic crisis, and the muted political rhetoric about drug pricing this election cycle.

In light of these funding levels, it’s fair to say the cost of capital for biotech companies has probably never been this low – allowing many companies to scale their platforms and programs faster.

But the multi-billion-dollar question is will more capital translate into more drugs and thus more value for patients and shareholders? I think (and hope) so. It’s likely there will be more drugs in the long run, reflecting the simple math that more programs are getting funded – and that’s a good thing.

But more capital also means the average “health of the herd” will go down: without a meaningful constraint on the supply of capital, less robust ideas and weaker therapeutic concepts will also get funded alongside the smarter bets. Companies will advance larger portfolios of R&D projects, where the incremental programs might not be as strong or validated as the lead ones. In short, the diligence “bar” goes down for both investors and management teams in a world awash in capital. In addition, a largely unconstrained supply of capital chasing a relatively stable number of deals means that valuations will go up – and could be at risk of over-heating in certain cases. These concerns are especially true in over-hyped areas, like I/O a few years ago, or like the number of COVID-related programs now being funded.

Only in hindsight will we know whether this tidal wave of capital hitting the sector was put to good use or not; financial market bubbles themselves are only widely recognized after the fact. Whether biotech is rationally allocating capital, or is in an irrational funding bubble, largely depends on what the sector does with the capital – and if it can be productively deployed to drive innovative R&D.

Hopefully, history will look favorably on this period – where this plethora of funding delivers a huge spike in the number of compelling new medicines reaching the market in the next 5-10 years. Only time will tell.