Biotech feels like it’s got some wind in its sails here at the start of 2024, with positive sentiments from the JPM conference. Indeed, the public equity markets feeling somewhat buoyant for the first time in ages.

With the close out of 2023, it’s time to take stock of the health of the private venture ecosystem. Analyzing Pitchbook data for venture funding into US-based biopharma companies, at least four themes are worth highlighting related to overall funding, startup creation, mega-rounds, and valuations.

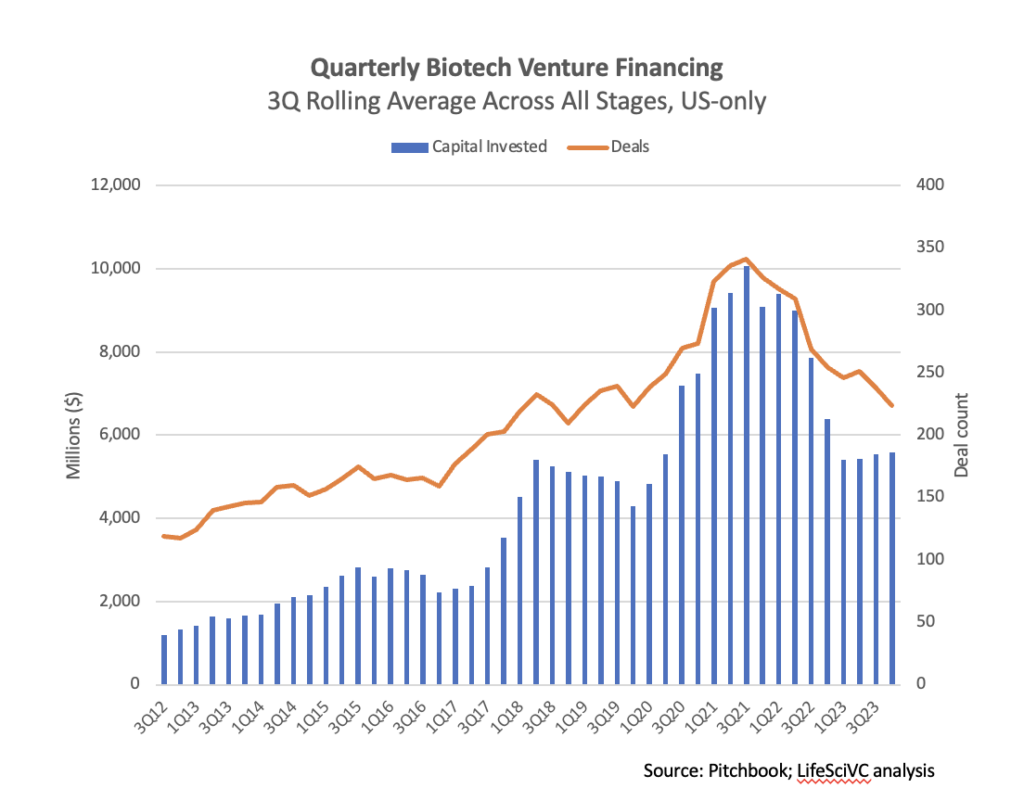

1. VC funding overall has stabilized at around $5B per quarter, which is a historically very healthy amount of capital.

Overall venture funding for US-based biopharma companies was just shy of $5B in 4Q2023, softer than the prior quarter. To smooth out some of the quarterly variability, taking a three-period rolling average of the quarterly funding data reveals what appears to be real stabilization in terms of overall funding. While off the peak quarterly funding level by ~50%, by all historic measures this is a robust level of financing, and supports 800+ private biotech companies each year in the US alone.  2. Pace of new startup creation has slowed considerably, and the proportion of private rounds going into new startups is the lowest its ever been.

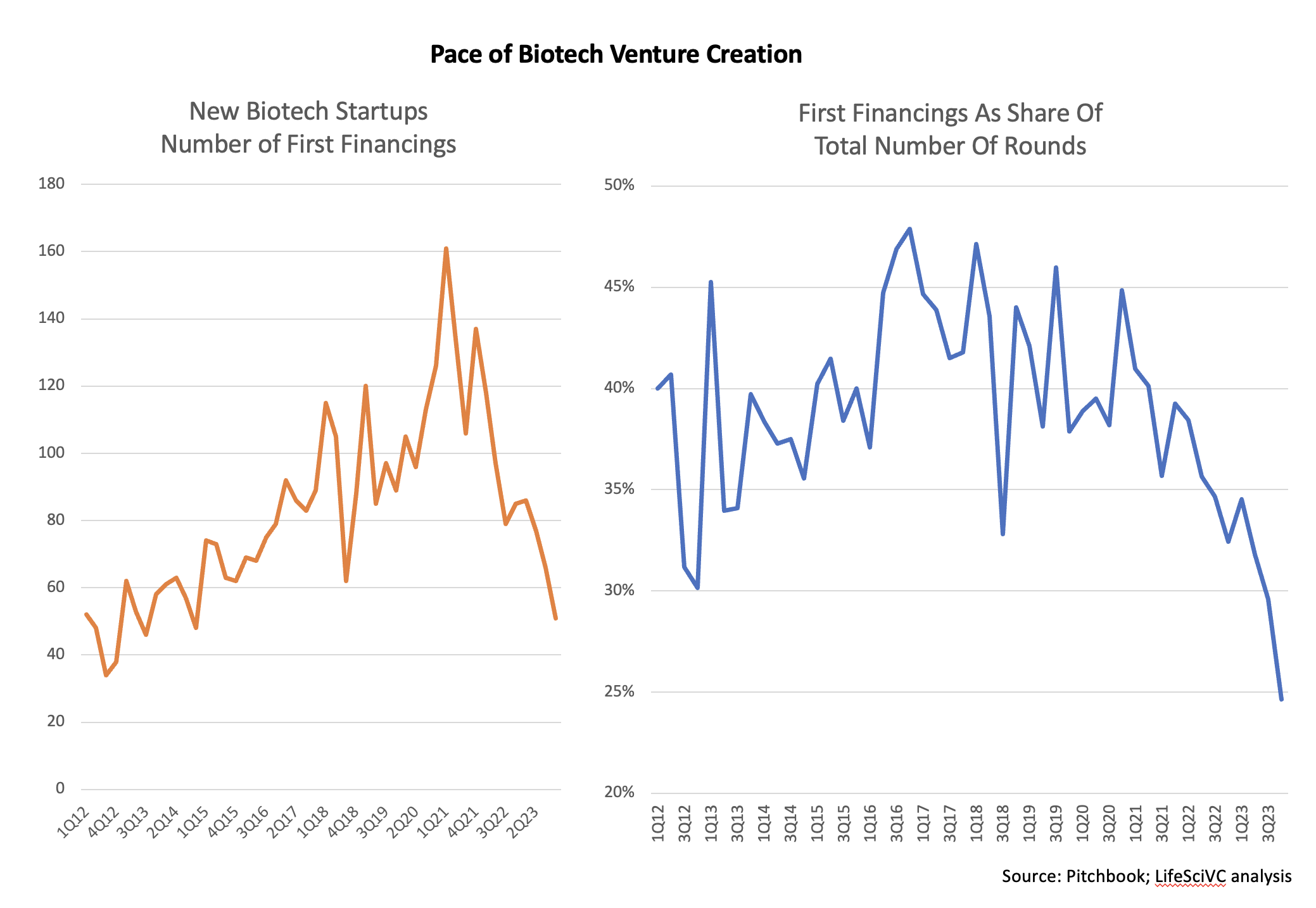

2. Pace of new startup creation has slowed considerably, and the proportion of private rounds going into new startups is the lowest its ever been.

On the venture creation side of things, using the proxy of “first financings” as a good metric for new startup formation, things have clearly tightened up significantly over the past year or so. With a little over 50 new startups raising capital in 4Q23, we’re back to levels not seen for nearly a decade, at the start of the biotech secular bull market in 2013-2014.

Further, the share of rounds going towards startups raising their first financings, versus follow-on rounds, is the lowest ever recorded, according to Pitchbook data, coming in just below 25% in 4Q24. This is clear evidence for the “digestion” process – the venture ecosystem experienced rampant startup formation in 2020-2021, and now has to work through that backlog of existing startups.

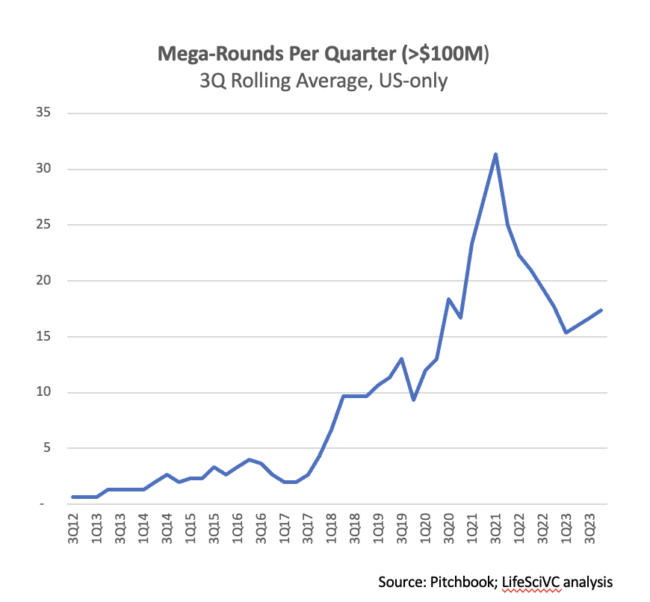

3. Mega-rounds greater than $100M continue to be fairly common.

3. Mega-rounds greater than $100M continue to be fairly common.

Starting in 2018, large rounds became more frequent in biotech venture funding. These peaked in the pandemic bubble, but have not returned to their 2018-2019 levels. We’ve seen at least one mega-round per week, on average, throughout 2023.

Multiple reasons for this: larger rounds help hedge future financing risk in choppy markets; bigger VC funds have been raised in recent years which require bigger check sizes, driving rounds larger; and, among other things, costs and burn rates continue to climb, especially for funding complex modalities and later stage assets privately (given lack of an IPO market).

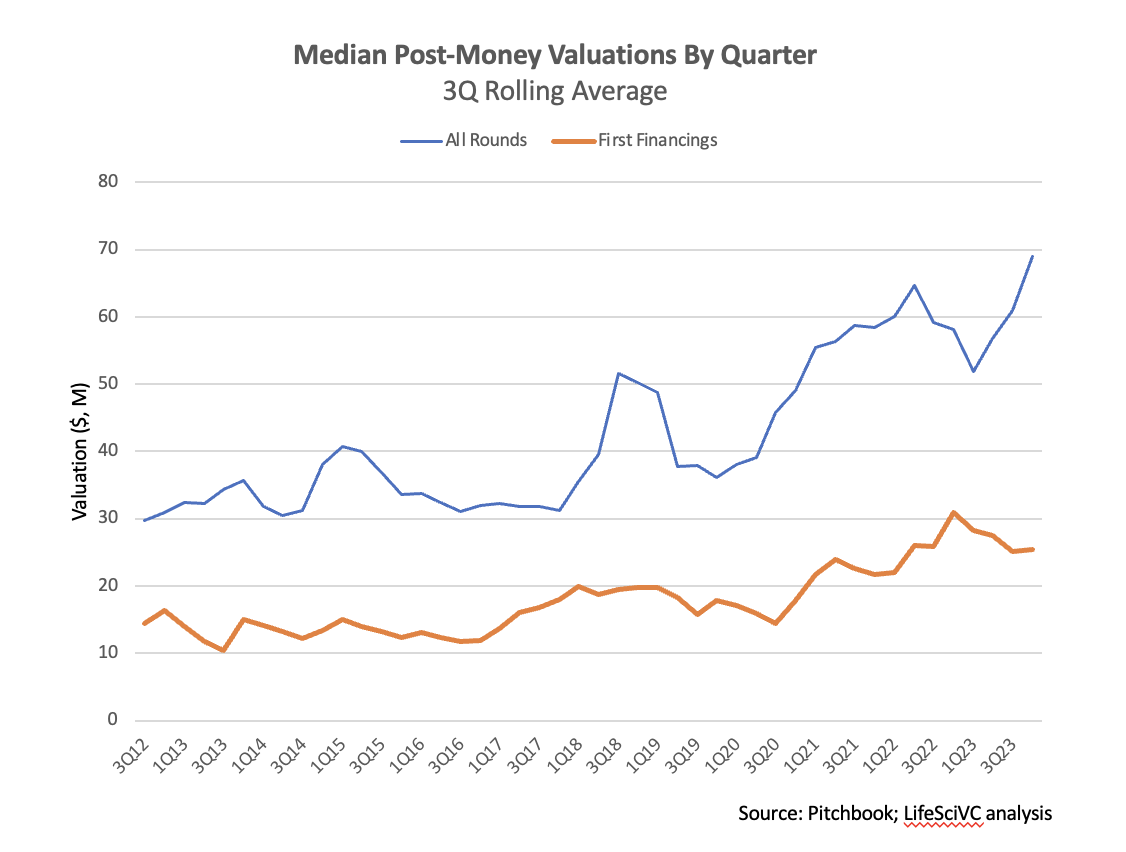

4. Private round valuations have remained surprisingly robust despite 2022-2023’s choppy market turbulence and resetting of public equity valuations.

4. Private round valuations have remained surprisingly robust despite 2022-2023’s choppy market turbulence and resetting of public equity valuations.

Post-money valuations in private deals have held up remarkably well in 2023: the median post-money in the 2H of 2023 was ~$70M+, higher than it’s ever been, and more than 100% greater than a decade ago. A significant driver of this relates to the prior observations: as more venture funding activity was focused on later stage rounds in 2023 relative to prior periods, as well as the persistence of these mega-rounds, it has pulled up the median post-money valuations. That said, even first round valuations remain robust, holding up at roughly twice the valuation of 5-10 years ago.

Stepping back from the specifics of these data, the venture funding market for private biotech companies feels like it’s returned to a healthier place than the bubblicious euphoria of a few years ago. It’s also not feeling like the nuclear winter of 2002-2003 either, where venture-backed biotech was starving.

These days good ideas around solid science and stellar teams are often able to find venture financing, even if timelines for diligence and closing rounds are taking longer than in the heat of the pandemic bubble. It’s clear the private market is still digesting the huge number of new startups created in the 2020-2021 frothiness; some will attract financing and progress, others will shut down or be acquired – all of which is good for the overall health of the herd.

Given the significant dry powder in venture funds raised in the past couple years, 2024 is likely to be a continuation of a number of these themes – supporting the progress of a healthy and hopefully disciplined venture ecosystem.