Times remain tough for private biotech venture capital funding. Access to capital is more constrained than it’s been in years, and companies are starting to feel the pinch. Yet, despite the pain after a cycle of excess, perhaps this return towards more discipline should be embraced.

As has already been widely reported, aggregate venture capital funding in the first quarter of 2023 is well off its peaks of 2020-2022. This has led to the spike in shutdowns, restructurings, reductions-in-force, and “strategic alternatives” across the industry.

While the total financing level remains robust by historic standards, with over $4B flowing into private biotech companies in 1Q23, this is a significant drop from the tsunami of funding that washed over the sector in recent years (described in detail in 2020, 2021, and 2022).

While the contraction in funding levels is to be expected in rising interest rates, as risky long term capital is disproportionately impacted by higher discount rates, there are a few nuances in the data worth sharing.

Venture capital funding of private biotech startups is a process: companies are created and then serially financed as they advance their pipelines (Series A, B, C, and beyond), and if they are successful they either get bought or they matriculate into the public equity markets where they continue to access the funds required for R&D. To aid in their maturation, public investors often help by pulling companies into the public markets via “crossover” financings. During the heady days of the recent bubble, companies raced through this process and got public quickly.

Today we’re seeing the impact of the market’s indigestion on the process, and it has real implications for patients and innovation.

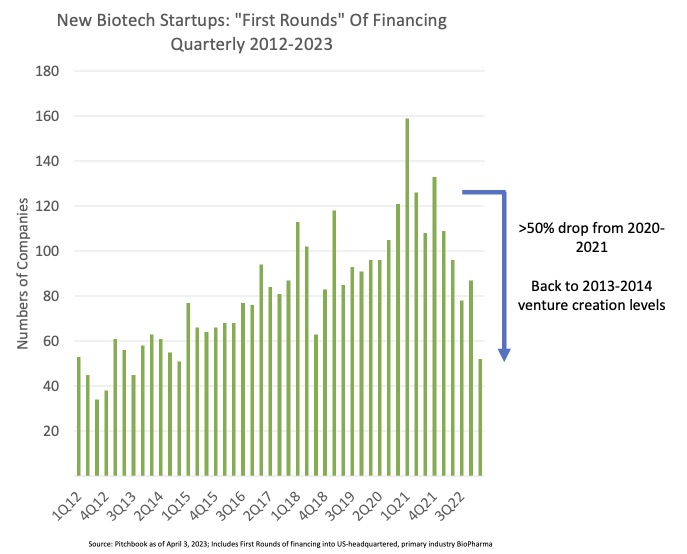

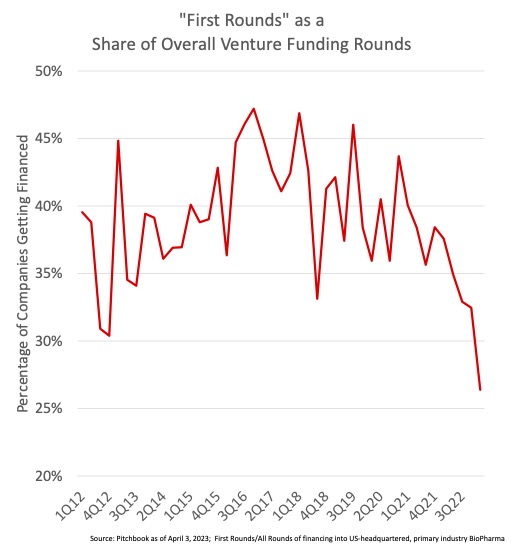

First, after two years of challenging times in the public markets, the pace of venture creation has stalled. According to Pitchbook, less than 60 new startups raised their first round of financing in 1Q23, which is essentially back to 2013-2014 levels, when the decade-long bull run started. Only a few quarters ago, everyone seemingly wanted to be in the “venture creation” business – not so much the case today, especially with dislocated value opportunities in the micro-cap public markets. First rounds as a share of the overall number of companies getting venture funding has hit a historic low in 1Q23 at just 26%.

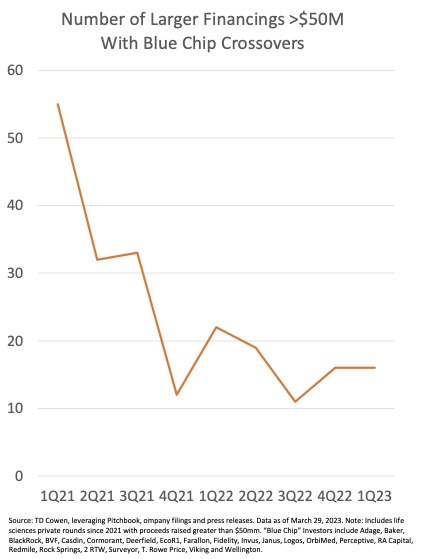

Second, the crossover phenomenon underpinning the prolific IPO window in the recent period continues to sit out of the current market. Extending the period from last year, participation by blue chip public investors in large private rounds has been a fraction of what it was in early 2021; these key investors have largely been sitting on their hands when it comes to private rounds. Based on TD Cowen analysis, their participation is off 60-70% from eight quarters ago. Many of them are, understandably, focused on finding opportunities in the public markets with good risk-return profiles.

Third, as money gets tighter and the investors active in private deals shrinks, pricing comes under pressure. With data from Cooley only through 4Q22, life science venture down-rounds have spiked nearly five-fold. The prior 7 quarters of 2021 and 2022, up-rounds were 90%+ of all venture rounds; then, in 4Q22, that dropped to only 74% of rounds. I’d expect the 1Q23 to be in line with that or lower, frankly.

These charts paint a challenging picture in the private markets: a log-jam of private companies, who expected to go public by now, are now faced with the prospect of down-rounds to access the capital they need. Many of them raised dollops of capital at robust valuations a couple years ago during the “plentiful” times. Now, these companies are seeking alternatives to the potentially punitive private rounds, by aggressively partnering assets (taking asset dilution instead of equity dilution), or by exploring non-traditional paths to the public markets like reverse mergers. There’s been huge appetite in the latter in the recent processes, according to bankers involved.

With fewer new startups getting formed, and the aforementioned shutdowns/RIFs across the industry, the financing pressure for downstream private rounds may abate somewhat in 2024-2025. Plus, there’s also plenty of venture firepower on the sidelines today to help, as many VCs raised significant funds in the past 12 months, including most recently Canaan, SR One, Cure, Patient Square, and Dimension. Hopefully these and others will be deployed with appropriate discipline.

This contraction in the number of startups could be for the better. Certainly, fewer new biotech companies will mean less over-competitive crowding on a finite set of emerging mechanisms and modalities, which is a good thing. And huge mega-rounds for early science projects are also probably a thing of the past, which is a good thing as disciplined equity capital efficiency returns.

Further, it’s tough times like this that that separate the practitioners of hype from those of substance, and we’re certainly seeing that across the ecosystem. The market’s message is clear: focus on making pipelines of real drugs, not hypelines of promotional material. After putting lots of faith in the euphoria of the buoyant markets, we’re now seeing a return of “In God We Trust, All Else Bring Data.”

Two oft-cited axioms are critical to remember here, and explain some of the aftermath we’re dealing with: the average health of the herd goes down with abundance, and more startups have died of indigestion than starvation. While there’s clearly some starvation happening now, and likely some regrettable corporate failures, it’s a broader consequence of over-indulging on a huge surplus of funding for years and the inevitable lowering the bar for quality. This new retrenchment will hopefully help address those excesses.

The biotech industry, like most asset classes and sectors, has always experienced the full throes of the business cycle, and this time is no different. We’ve experienced cycles of under-funding and over-funding, as the market’s correction mechanism is more often a hammer than a scalpel. Veteran investors and management teams have all seen this multiple times in the past few decades. Many of us believe the worst carnage in the public markets is now behind us, so hopefully we can start the healthy process of renewed optimism and an improved financing climate in the coming quarters.

Importantly, thoughtful and resilient venture creation strategies during down markets can often pay off handsomely: by example, we helped start Alnylam in the aftermath of the genomics bubble in 2002, co-founded Nimbus in the spring of 2009 when the markets were bottoming, and began working on concepts underpinning Kymera in the 2015-2016 downturn, to name a few.

Fundamentally, we continue to believe this is great time for skilled venture creation strategies to take cutting-edge science and back seasoned management teams to advance it into innovative new therapies for patients!