As one of big drivers behind the recent IPO window, cross-over investing into private biotech companies by both mutual fund and hedge fund investors has become increasingly commonplace over the past couple years. As described at the BIO Investor meeting last month in San Francisco, “Cross-over investing all the rage” (here).

This elevated and active role by cross-over investors in the private markets has been an accelerating trend since early in 2012 (here). In fact, in January 2013, BioCentury’s Michael Flanagan wrote in the Financial Markets Preview that an important “factor that could fuel the IPO market is the larger role crossover public investors have played in late-stage private financings, providing an additional source of capital to help shepherd companies to reach a stage where other public investors will take notice”. This has certainly played out as described.

Everyone in venture-backed emerging companies acknowledges that going into the public markets with a solid list of blue chip cross-over investors in the capital structure is a good idea conceptually. It makes sense to line up big future owners of the stock early to help support the book-building process in the offering. But just how much of an impact these investors have is less well explored.

Leveraging a dataset from one of the more active investment banks, I’ve explored the quantitative impact of cross-over led private rounds on pricing and performance and it’s even more compelling than I would have guessed.

Out of 94 therapeutically-focused IPOs in the bank’s dataset since January 2013, 26% of them had cross-over led financing rounds (24 companies). Some of the most active cross-over investors include Adage, Brookside, Deerfield, Fidelity, Foresite, RA Capital, OrbiMed, and Wellington, just to name a few. Many of these cross-over rounds include syndicates of three or more buyside investors.

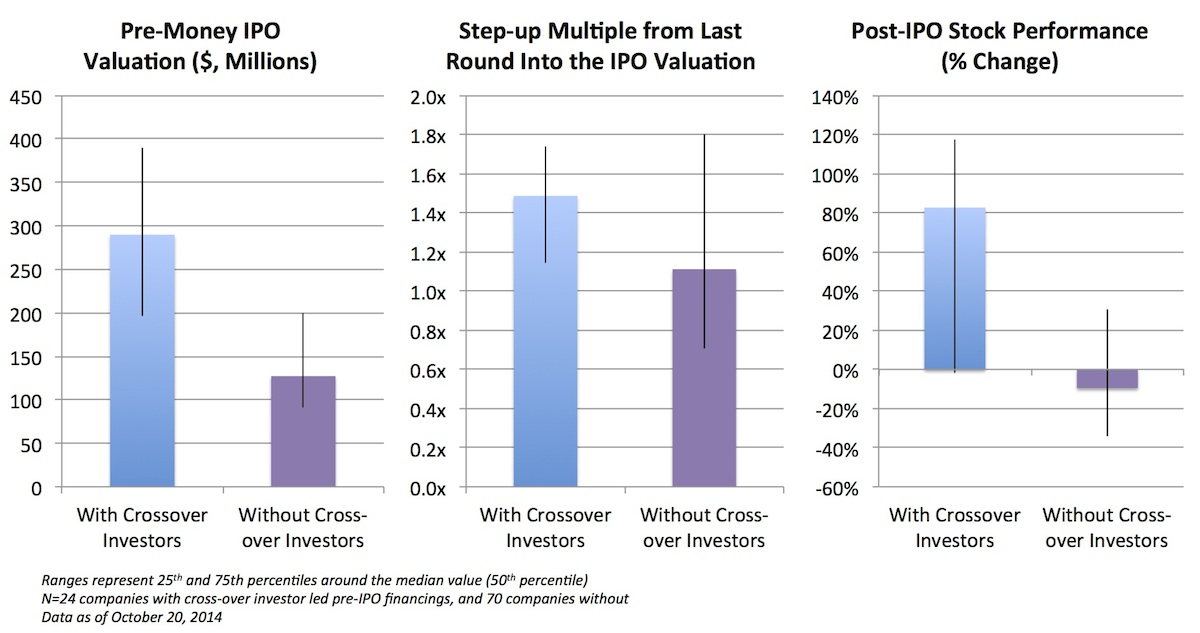

The three-panel chart below tracks a few comparative metrics:

As shown in this chart, companies with cross-over led pre-IPO financing rounds have:

- Significantly higher pre-money valuations at IPO. At the median, these data show a 128% higher valuation – $290M vs $127M. Even the bottom quartile valuation of the cross-over led companies is higher than the top quartile valuation of those without cross-overs involved. Even adjusting for the likely additional capital of ~$50M or so from the cross-over fundraising, this is meaningful and significant.

- Cross-overs support IPOs at bigger step-ups in price at IPO. The multiple over the last private round valuation is 34% higher; at the median, the valuation is 1.5x the post-money of the last private round with cross-overs, and only 1.1x for l. 50% uptick in valuation vs 10%

- Post-IPO stock appreciation vastly outperforms for companies with cross-overs in their pre-IPO round. Despite pricing at higher market cap’s, and at bigger step-ups in valuation, these companies continue to outperform with 83% stock appreciation, at the median, versus trading down by 10% without cross-overs. That’s staggering. Two other related statistics: 33% of cross-over led companies have doubled since their IPOs, only 9% of those without. Further, 56% of companies without cross-over support have traded down since their IPOs versus only 29% of cross-over backed companies.

These quantitative differences are striking, and strongly suggest that cross-over participation in a pre-IPO financing round is a either a significant indicator of actual quality in biotech today, or a catalyst for others to perceive a company as quality. Both of those reasons could explain the material and significant change in company valuation and post-market stock performance.

There are clearly exceptions to this observation: Epizyme, Receptos, and Ophthotech didn’t have cross-overs lead a pre-IPO round, and have clearly outperformed.

But across the full cohort of companies with recently-minted IPOs, the trend is very clear and confirms widely held intuitive belief: the participation of cross-over investors in private rounds appears to be a very good thing for companies aspiring to go public.