A few weeks ago I wrote a pair of blogs comparing Tech vs Life Science venture capital backed investments: one was on returns in the 2000’s where LS beat out Tech investing (highlighting a Nature Biotech article Bijan Salehizadeh of Highland Capital and I published) and one was on management compensation differences, where LS entrepreneurs are biased to more cash, less equity than their Tech counterparts.

These comparisons prompted a number of readers to comment that one of the big issues with Life Science investing was that deals just take longer to get to liquidity events vs Tech companies. This belief has been cited so many times its become conventional wisdom. And recent ‘halo’ deals like Groupon and Zynga that possess incredible escape velocity, going from Series A to billion-dollar valuations in just a few years, help to support this perception.

But its wrong, at least for exits via the public market IPO route.

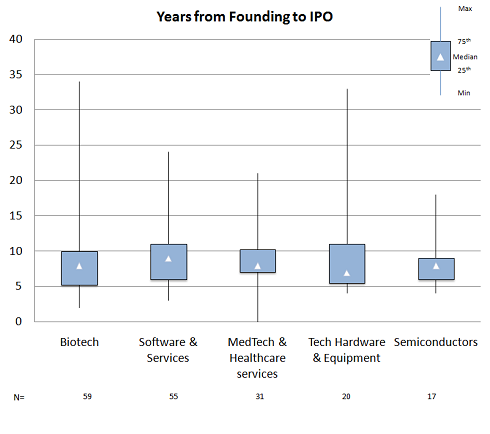

Looking at the same “Venture-backed IPO” dataset from the NVCA as we explored in the Nature Biotech paper, a quick analysis of the time from founding of a company to its IPO suggests that there’s really no difference between different Tech sectors and LS. The chart below captures the time distributions. The median time from founding to IPO for these sectors ranges from 7-10 years, with the shortest quartile at 5-6 years.

A few caveats and observations:

- Founding date and first-funding date are often quite different. It can take founders months to years to get their first real financing done. But I see no reason why this would be different for Tech vs LS deals. And I don’t have the data handy to run the analysis!

- IPOs aren’t liquidity events in Biotech, they’re just financings and insiders typically do at least a third. This insider participation isn’t the case some of the higher flying Tech IPOs, but venture investors still often hold their shares for a long time after the offering. We held shares of Isilon for years after the IPO until its exit last fall via acquisition by EMC. I don’t have the data to be quantitative on this, but the IRRs differences in the past decade would suggest time-to-liquidity can’t be much better for Tech.

- M&A exits aren’t included in this analysis. Lots of LS companies get sold before they’d be ready for the public markets. The same must be true for the Tech sector but I don’t have the data.

- All sectors seem to have a few really old venture-backed IPOs: 20-30 year old companies that go public. These were typically companies that got their first institutional funding by growth equity oriented venture investors in the few years prior to their IPOs. Good examples of why averages are meaningless in this dataset.

So I think its fair to say that despite the incredible pace of some ‘halo’ deals in the social media space, the general ‘conventional wisdom’ that Biotech is slower to IPO exit than Tech just isn’t supported by the data.