With lots of venture investors fleeing early stage biotech over the past few years, many have questioned where the next vintage of great startup companies will come from. This theme was touched on a few weeks ago in my post on our shrinking biotech ecosystem. There’s definitely fewer biotech companies, public and private. And there’s definitely a dearth of venture funding. But I still think there’s plenty to be excited about in early stage biotech. Its a contrarian bet today, but I think less capital chasing fewer companies, with more disciplined investors, offer a mix that bodes well for returns from early stage investing.

To put some data behind those themes, here are a few observations derived from Dow Jones VentureSource. Other data sources, like OnBioVC, show similar trends.

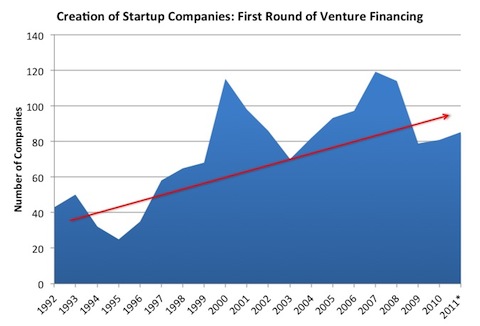

1. Company creation is still happening. The number of first round financings of US-based biotechs is down an alarming 30% from its peak in 2007. That’s a big drop. But it has leveled off for the past couple years at an annualized rate of about 80 new biotech startups per year. One can argue what the right number of new companies should be, but its fair to say that 20 newly funded startups per quarter (vs 30 at the peak) is still a reasonable clip (btw, worth noting these data don’t include angel and seed financings, so the actual startup rate may be higher). Taking a longer term view over the past 20 years, we’ve been on a secular upswing in new startup creation with the expected cyclicality: low points in 1994-95 and 2003, with peaks in 2000 and 2007. I’ve not done a comprehensive analysis, but I’d bet during these slower periods a larger proportion of new deals end up delivering solid retunrs (e.g., high returning deals like Adnexus & Momenta were first funded by Atlas in the nuclear winter of 1H2003; ArQule and Exelixis similarly in the downturn of 1994-1995).

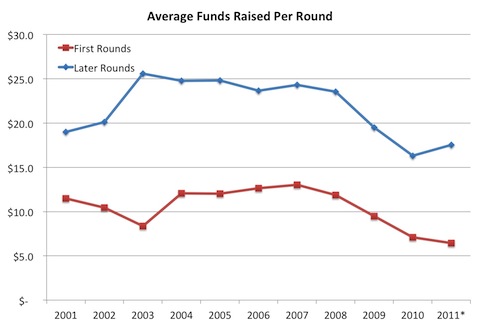

2. Capital is constrained across the board. The average amount of funding raised in first and later rounds in the mid-2000’s held surprisingly steady at $12M and $25M, respectively. But since the 2008, these numbers have come off dramatically – dropping by as much as 50% for first round financings down to ~$6M. Wearing my capital efficiency hat (my favorite hat), this tightening could be viewed as a big positive: we’re building a set of smaller, leaner, less equity-intensive biotechs and that will be a good thing for returns. The theme of “virtualization” has enabled more capital efficient prosecution of both discovery and development programs; not just purely virtual companies, but also more externally-leveraged platform companies as well. That said, the alternative view could be that we’re in a adverse capital starvation environment: biotechs given anorexic venture diets are unlikely to be healthy drivers of innovation. You can’t starve your way to growth. I suspect the truth is somewhere in between.

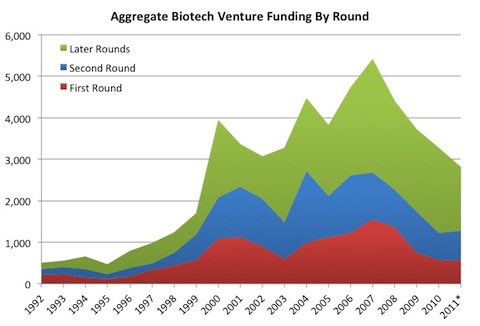

These two trends have had a big impact on the aggregate numbers: fewer companies with smaller capital raises has led to a significant drop of nearly $2 billion in total biotech venture funding since 2007. Seems alarming. However, its not well appreciated in the community that 2007 was the biggest year of biotech venture financing ever – significantly more than during the heady days of the 2000-2001 genomics bubble. So while the aggregate numbers are lower, we can take comfort that we’re in the midst of a positive long term trend of robust financing. The chart below captures this – adding up first, second, and later rounds of biotech financings over the past 20 years. Another observation is that first round financings are receiving a lower allocation of biotech funding in the past few years: they were 25-30% of the market in the mid-2000’s; now just less than 20%. (Note: these figures aren’t comprehensive as they don’t include significant recaps or non-traditional financing rounds). As I and others have noted, corporate venture involvement has been helpful for keeping early stage alive, but can’t make up for a drop in funding this large.

Another takeaway from these observations is that we’ll have far fewer later stage biotechs in a couple years: birth rates define demographic trends and the same holds for biotech startups. The spike in first rounds in 2007 (119 companies) led to the spike in later rounds in 2010 (126 companies): in fact, 2010 tallied the largest number of later rounds of the prior decade. Since first rounds are down by 30% over the past few years, there will be a constrained supply of later stage companies in 2013-2015. The laws of supply & demand would suggest that if there’s fewer later stage companies, capital sources will be competing to fund them, and the scarcity of quality, maturing companies should be a good thing for pricing and funding. I’m looking forward to those days.

I’m often in discussions where folks bring up the “early stage biotech funding gap”. If its about deals and dollars, then these data certainly suggest a big gap in first round funding has formed over the past few years. But I’d challenge the assertion that this is the right way to think about the ‘gap’ – i.e., what’s the right number of deals and dollars? Given the large number of rather lame biotechs out there today, one could easily argue we’ve been overfunding the sector. I’m not sure what the right level of funding is, but 80 venture-backed startups per year doesn’t worry me as too little.

But the important consideration around the ‘gap’ is not necessarily what’s the right overall funding level, but instead what type of companies these first round financings are for. Are they funding early stage innovative drug discovery companies, or are they startups formed around in-licensing clinical stage compounds? Many VCs continue to finance the latter (including Atlas), and I’m sure they’ll be a number of deals with very nice returns. But in the world of venture creation, there’s certainly a ‘gap’ in the number of drug discovery plays being financed. We’re working hard to do our part to fill that gap at Atlas, as are a few other early stage and corporate VCs, but we’re not in crowded company in today’s market.

So to conclude – with my (martini) glass-half-full – I see a bright future for today’s early stage biotech investments in these trends: only the better ideas are getting financing, fewer investors are chasing these deals, capital efficiency is driving lower equity intensity, and in a few years when this crop of new startups mature they’ll be in a “sellers market” given that paucity of other players. Or so the biotech optimist in me would like to believe.