Having a highly functional and productive Board of Directors is a key ingredient for success for most companies, but its of particular importance for early stage startups. The web is full of advice around what are the “best practices” for venture-backed boards, what makes for a great board meeting. Some of the best posts out there: Mark Suster’s “Agile Board”, Brad Feld’s “Best Board Meetings”, and Fred Wilson’s “How to Build a Good Board”.

Many of the themes highlighted in those posts hold true across sectors, and I’d certainly advocate a majority of them in the life sciences. Here’s my distilled version of many of these tips:

- Insist on a prepared Board. Send out materials 2 or more days in advance, and assume the Board has read them rather than walking through all the slides in the meeting. Do a pre-Board call with each Director to make sure they are up to speed.

- Start every Board meeting with context. Ground the discussion with an introduction that covers “this is where we were last Board meeting, these things have happened since, this is what I want to discuss today, and these are the key decisions we need to make”.

- Keep a right-sized Board. The smaller, the better. Too many VCs can make for headaches (and are typically a sign of having raised too much money). Larger Boards don’t have to be dysfunctional if managed well, but they are certainly more work for a CEO.

- Get independent voices on the Board. In addition to the major investors, a founder representative, and the CEO, most high functioning boards have a least one strong independent voice with deep domain knowledge. Often it’s also good to have a fellow startup CEO; peer-to-peer board relationships can be very helpful.

- Share the love at the Board meeting. During the main part of the meeting, include the senior team. Its great for the Board, and hopefully good for the team.

- Don’t short-change the Executive Session. Typically this should include just the CEO and the Board to cover the bulk of the topics. And it good hygiene to have a Non-CEO Executive Session, where the Board can discuss items related to the CEO or other sensitive matters.

- Communicate frequently with the Board. Don’t wait until just before the 4-6 Board meetings to communicate with your Board. Set up interim calls, send out CEO updates via email. Faster feedback loops are key (see “Agile Boards” above).

- Make your Board work for you. Assign action items to your Board (especially with regard to networking, access), and make sure they truly ‘own’ their committee work and represent that back to the rest of the Board (e.g., like Compensation Committee recommendations).

-

Don’t have surprises at a Board meeting. If there’s late breaking news, alert Board and consider changing/delaying meeting to deal with circumstances, gather information and present plans.

All of those, and more in the posts above, are great tips to follow for a healthy Board and quality meetings.

But these generalities miss a few things that I think are necessary for a high-performing Biotech Board. And if you search the web, while there’s a ton on internet-based Tech businesses, there’s a real paucity of information out there for how to run a science-driven Biotech Board. The nature of the problems and people involved are very different: Internet-enabled Tech startups launch products on tiny amounts of capital, led by Lean Startup Ninja’s and 22-year old soon-to-be-billionaires, these companies can iterate rapidly around things I don’t understand, minimally viable products, and real-time market feedback (see this great parody here).

Compare that to Biotech. We are trying to manage the challenge of science-based businesses: biology is full of “unknown unknowns”, drug R&D has long and unforgiving timelines, we face very high project attrition rates, we have to work in a highly regulated environment, capital intensity is typically higher, etc… The people involved are also different: the typical senior team has some grey hair and often collectively has 100+ years of experience in (or biases from) drug R&D. So there are some subtle (and not so subtle) differences about what a Biotech Board needs to deal with and the type of team involved in those discussions.

Here are three practical things that I think most early stage biotechs should consider as they engage their Board of Directors.

Don’t forget, it’s all about the science. At the end of the day, if the therapeutic strategy fails to help patients, or the discovery platform doesn’t deliver novel drugs, there’s no company. The science is central to the story. But instead of consuming bulk quantities of time in the Board meeting about the science, create an ad hoc science sub-committee of the Board (for any of the Board interested in it) and make sure to have deep science working sessions with them in between or before every Board meeting. Dig into what’s working, what’s not, what’s the next set of killer experimental or research milestones. Not only should this help provide good scientific input to the team (if you’ve got your Board composition right), it should also create (hopefully) enthusiastic supporters in the Boardroom about the quality of the science. Great science leads to great medicine, and nothing reminds an investor about why they invested then a big dose of high quality, energizing science. I love data, and a great pre-Board science session fires me up.

Present the financials in a meaningful way to enable the Board to really track, monitor, and risk-manage the R&D spend. Traditional financial statements need to be prepared to keep the accounting firms happy, but don’t waste time on them: these financial statements mean little to startup biotechs, e.g., the P&L is really an L&L, balance sheets provide little insight. The key things that matter are (a) Cash, (b) where it’s going, and (c) when will it run out (the infamous OOCD or Out-of-Cash-Date). I have found that three charts go a long way to making this clear for Boards:

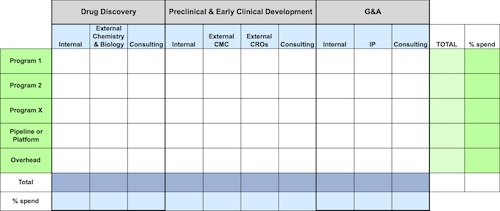

- Programmatic Spending Matrix. This chart helps put a fine lens on where the company is really spending its scarce resources, what percentage is going to each program, how much is being spent internally vs externally, what’s the aggregate overhead cost, etc… This resource matrix is very valuable for managing the capital exposure to specific risk buckets and resource footprint.

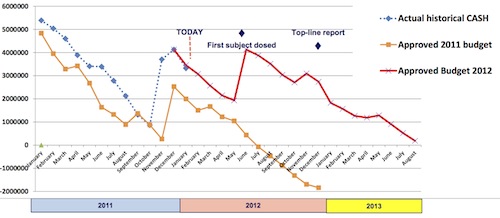

- Cash Trajectory to OOCD Aligned to Key R&D Milestones. Tracking the cash over time lined up against a few key events and decisions helps to focus the mind on what matters.

- The Top 10 Expense Items. Drug R&D spend often doesn’t feel very tangible, so to put a more real-world feel on where the cash is going, I find that it’s nice to see a table of what the Top 10 expenses are in a period. It is often CROs (big studies), external consultants, and lawyers (IP); it helps make the L&L Statement feel more real. And may raise the alarm bells about where the cash is going.

Lastly, Intellectual Property underpins what we do in Biotech. Don’t short-change that part of the Board agenda, not only about your IP, but about your competitors IP. Especially for claims that are pending but might issue: you never want to be caught on the backfoot with regard to IP issues. A great best practice here is to have a new outside law firm do a full patent review once every 12-18 months as a audit or diagnostic for the current patent strategy. Having a third party opinion on your IP on a frequent basis is most certainly worth the cost and most Boards don’t do this audit/diagnostic enough.

These latter themes are certainly not an exhaustive set of tips, nor are they uniquely specific to Biotech, but I think they are a good starting point for engaging a high-performing Board.