Everyone has heard of the monster returns to some venture funds from high-flyng social media and technology companies: Facebook’s potential 800x for Accel, Google’s 350x for KPCB and Sequoia, Zynga’s 100x+ for Union Square, Foundry, and Avalon. These single big tech wins returned (or will return) multiples of their entire funds.

The sad reality is that these types of “halo deal” wins just don’t happen in Life Science venture capital investing. We have great success stories in the 5x-15x range, like Amira, Avila, Enobia, Plexxikon – but 100x+ returns aren’t in the genetics of our ecosystem. The venture model in LS is about higher consistency and lower rates of failure, as discussed previously in this blog.

But this lack of massive outliers has important implications for what the optimal fund size should be in Life Science venture capital, and how to deliver returns to LPs. This subject has been explored by others: Bijan Salehizadeh’s blog on the historic returns by fund size, and Kevin Lalande of Sante Ventures has a well written whitepaper on why venture doesn’t scale, especially in LS.

Fundamentally, returns at the fund level all come down to a relatively simple math problem: cash in, cash out. VCs hope (aspirationally) to achieve 3x gross returns for their Limited Partners, which after fees and profit sharing ends up near a net return of 2.25x. In a textbook venture fund cash flow J-curve, this equates to about ~25% net IRR over the 10-year life of the fund. Most LPs would be very pleased with those outcomes. In the 2000s, as noted before, the entire asset class under-delivered those expectations, but it’s still the goal of most early stage venture firms.

So what’s the math for what it takes to achieve a 3x gross return for a fund? “Cash in” is obviously a function of fund size. “Cash out” – or distributions paid out upon exits – is highly dependent upon two critical variables: exit sizes and ownership at exit.

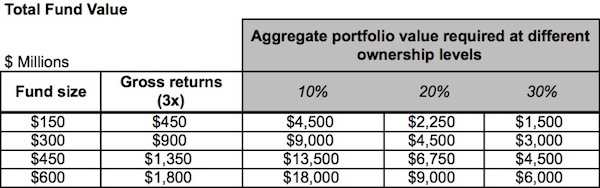

Here’s a table that captures the magnitude of the returns required to achieve a 3x fund as a function of fund size. Assuming a range of possible average ownerships across the entire portfolio of 10-40%, the table highlights the implied total aggregate value of all the portfolio companies of the fund.

For example, for a 3x return with 20% average exit ownership, a $150M fund requires over $2.2B in total value to be created by its portfolio companies, and a $600M fund requires $9B. Those are very big numbers, and the latter one is bigger than all the M&A exits of last year, the best in recent memory. The numbers above are so large as to be amorphous and hard to digest. When we consider what those values imply about the deals specifically, the challenge becomes clear.

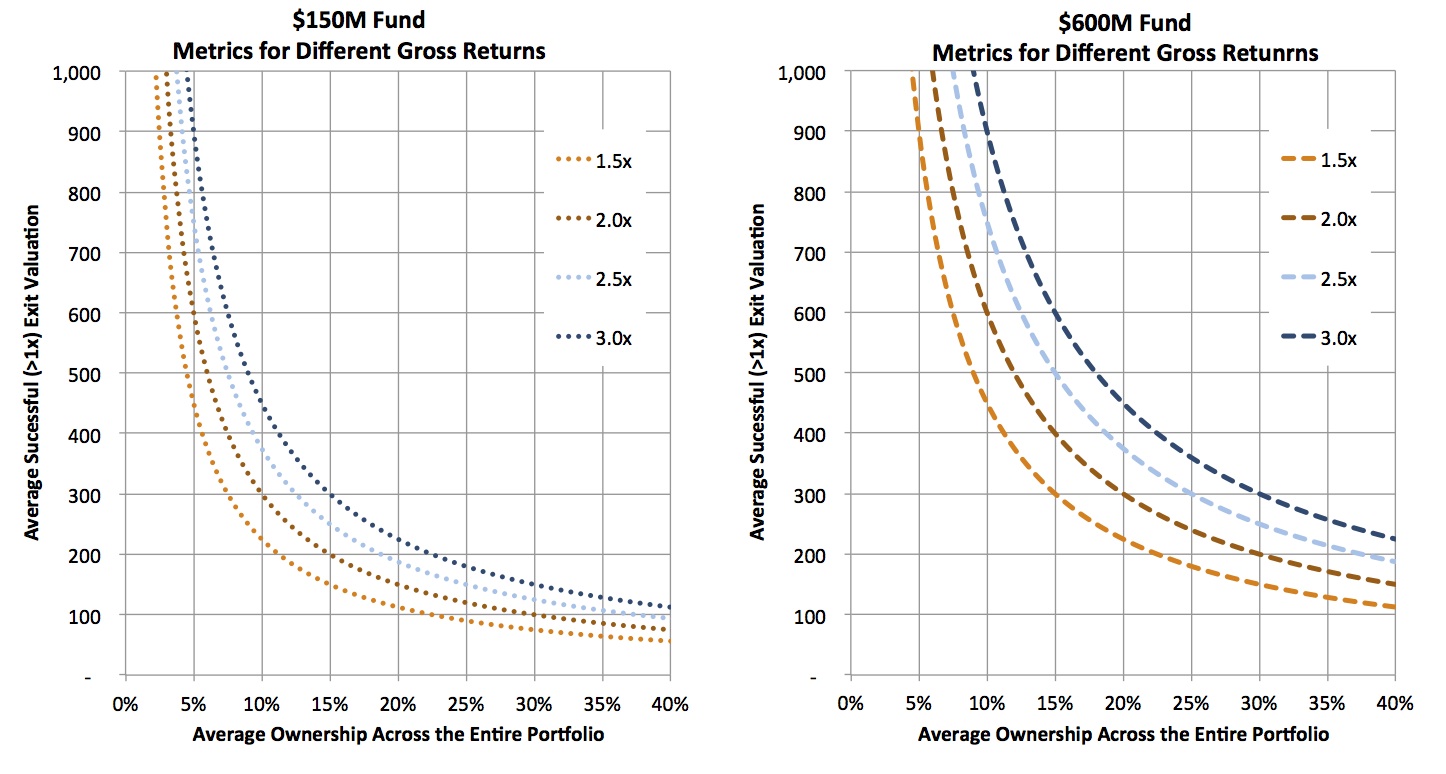

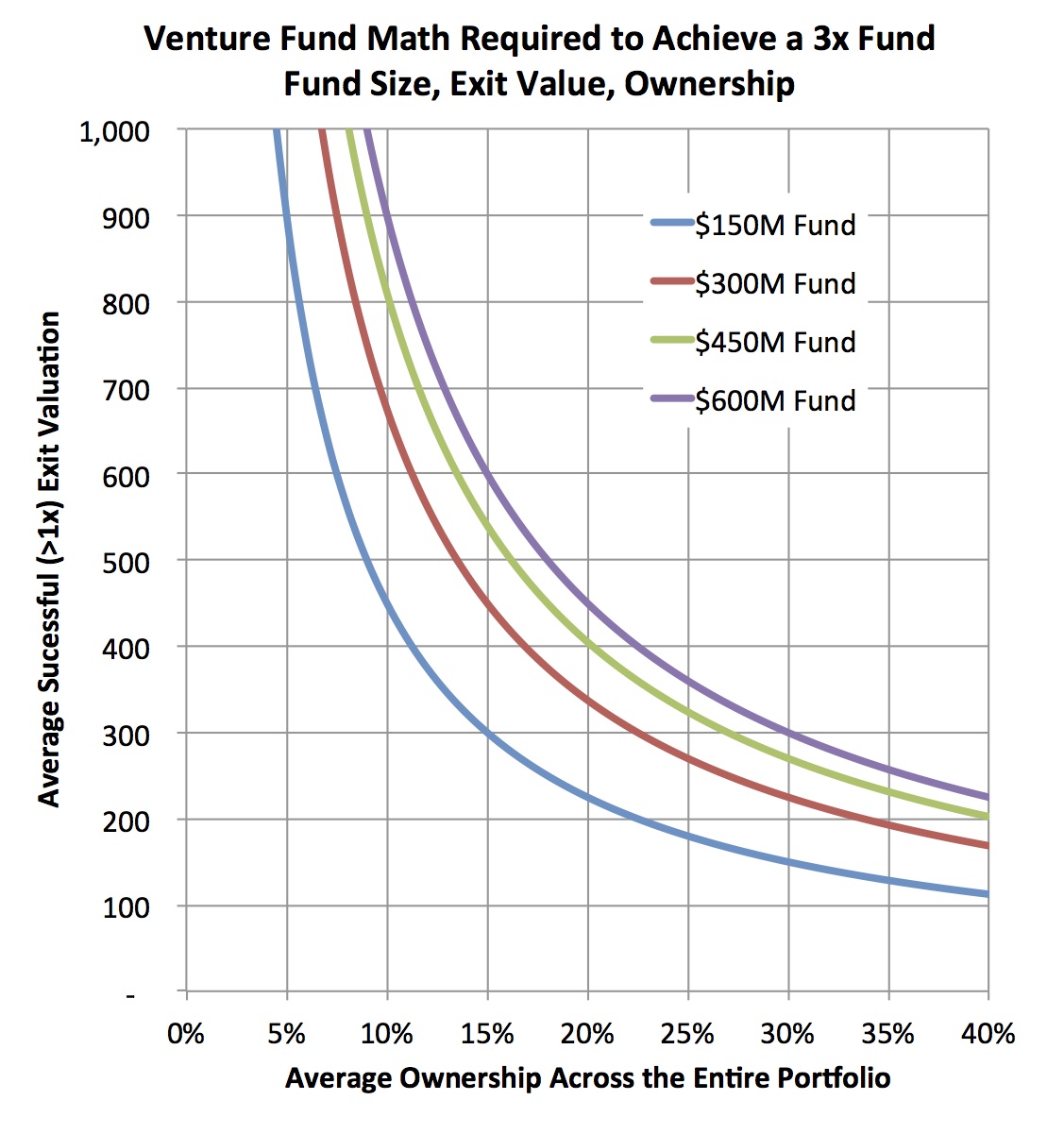

To do that analysis requires a few assumptions: I’ve assumed smaller funds have fewer deals (a $150 fund has 15 deals) and larger funds have more (a $600 fund has 30 deals). Fewer deals than this will increase the numbers below dramatically. I also generously assumed that two-thirds of the deals are positive (>1x), and the remaining third goes to zero (performance well above industry-wide distributions). With these in mind, the figure below captures the relationship between the average exit value across the portfolio of these “positive” deals, and the average ownership. Each of the isoquant lines represent what’s required to reach a 3x gross return for each fund size. The takeaway: the numbers required for the average deal are staggeringly large for the bigger funds.

For example, at an average 20% ownership, a $600M fund needs 20 of its 30 deals (all the ones that are positive) to be valued on average at $450M. This is an average valuation for all the winners. For reference, according to BioCentury data, there have only been 17 venture-backed M&A deals from 2007-2011 with disclosed upfront payments bigger than $400M, and only a small handful of IPOs to break that valuation in their offerings. The top decile of all exits in LS are above $400M. So to hit 3x on a $600M fund essentially means that fund has to own 20% of every great top decile deal over an entire investment cycle, and own only those winning deals, not the mediocre ones. Similar math problems constrain $450M funds, as they need on average 20% ownership of 15+ deals worth over $400M. This doesn’t seem feasible in biotech.

For example, at an average 20% ownership, a $600M fund needs 20 of its 30 deals (all the ones that are positive) to be valued on average at $450M. This is an average valuation for all the winners. For reference, according to BioCentury data, there have only been 17 venture-backed M&A deals from 2007-2011 with disclosed upfront payments bigger than $400M, and only a small handful of IPOs to break that valuation in their offerings. The top decile of all exits in LS are above $400M. So to hit 3x on a $600M fund essentially means that fund has to own 20% of every great top decile deal over an entire investment cycle, and own only those winning deals, not the mediocre ones. Similar math problems constrain $450M funds, as they need on average 20% ownership of 15+ deals worth over $400M. This doesn’t seem feasible in biotech.

On the other hand, for smaller funds, the math might begin to work. To hit 3x, a $150M fund needs to have 20% average ownership across 10 exits with an average value of $200M. Since these are averages, even just one deal with 30% ownership exiting at a $400M valuation has a big impact on the average. The distribution of returns to achieve this 3x outcome is certainly still challenging on a $150M fund, but I’d argue it’s at least in the realm of the possible.

As noted above, a fund’s returns or “cash out” is a function of both exit values and ownership stakes. Both of those variables have real constraints on them that make the biotech venture fund math problem very challenging for large funds:

- Exit sizes in LS have a natural ceiling. Historically, the median exit value for venture-backed R&D-based biotech firms over the past five or ten years has been around $150-175M, based on CapIQ data, as well as that from Lalande’s analysis. As noted above, the top decile threshold for deal values is roughly $400M, and has been for a decade. The reasons for this ceiling are intrinsic to the early stage life science business: risky R&D projects face large discount rates, development burns lots of cash, and it takes a long time. Very few R&D-led biotech companies have escaped gravity in the past decade and gotten above $1B valuations. And when they do, they’ve typically consumed so much capital that the returns on those deals are often muted. As noted in prior analysis, the amount of equity capital invested tends to inversely correlate with cash-on-cash returns. This “natural ceiling” on biotech exit values is a constraint that can be managed but needs to be factored into how we raise funds and build companies; if a biotech venture investor chooses to ignore it, they’ll be fighting a natural law like gravity.

- Biotech exits and value creation occur in a discontinuous, unpredictable way. Lalande’s analysis (Figure 7) elegantly shows the lack of correlation between the amount of equity raised and the eventual exit values. The historical odds of getting a top decile $400M+ exit value are roughly the same for a deal that has raised $30M vs one that has raised $150M. While it’s nearly impossible to bootstrap the discovery and development of a clinical stage program on only a few million dollars, it’s clear that above a certain threshold of invested capital the downstream value creation is more stochastic than many would like to believe.

- Ownership stakes diminish with capital intensity and syndication. As the above analysis shows, average ownership across a portfolio is a big driver of fund returns. But maintaining ownership in the face of increasing capital intensity in R&D is hard, especially as burn rates increase in clinical development and the company’s financing risk becomes greater. This typically leads to over-syndication. And big syndicates mean less ownership for everyone. It’s very hard for one investor to go above their pro-rata in a good deal to maintain or grow ownership over time. All these factors conspire to make it very hard to maintain high ownerships. Avila had no investor larger than 25%, and Adnexus and Novexel had none larger than 20%. Reviewing the S1s of some recent IPOs highlights this point further: after Clovis and Verastem IPOs, every investor was below 15%, and after AVEO and Ironwood IPOs none of the private investors were greater than 10%. These were widely acclaimed successful recent IPOs, but due to capital intensity their lead venture investors don’t hold ownerships consistent with returning large funds. History may prove me wrong: they could break out of the biotech valuation range and become $5B+ mid-cap biotechs. I hope this comes to pass, but the odds are very long.

So with these constraints, and the simple math on what it takes to deliver returns, what’s the optimal fund size going forward? Only time will tell, but the cards are clearly not stacked in favor of delivering great returns from large funds in the Life Sciences. It’s fair to say that a $250M fund has math on its side – and on the LPs side.

The above analysis comes with a few caveats:

- The 3x gross fund multiple aspiration may be too aggressive, because only 16% of VC funds between 1981-2003 vintages achieved this threshold (SVB). More modest projections will still likely generate IRRs that beat other asset classes over the coming decade: a fund with a 2.25x gross multiple typically leads to a ~1.8x net multiple, and net IRRs in the 15-19% range (following a textbook J-curve). But even 2.25x gross return target only changes the exit value requirements by ~25% or so, still leaving extremely large average exit values/frequencies for the large funds to achieve. The chart below captures the different impacts of lowering the gross multiple on a $150M and $600M fund. While most of the curves are reasonable for the $150M fund, the $600M fund only becomes realistic around the 1.5x gross point, hardly something to celebrate.

- Shorter holding periods could provide attractive IRRs for a fund despite lower target multiples. The late stage thesis is that the time-to-exit for their deals are shorter, and so a 2x gross fund may still have a good IRR if it returns capital over 3-5 years instead of 5-10 like an early stage venture fund. This may very well be the case, but late stage LS investing is not as low risk as perceived, as I’ve written about previously.

- Higher ownerships could offset many of these challenges. A number of venture firms active in the life sciences, including Atlas and Third Rock Ventures, do venture creation around new startups where we’ll often own more than 50% during the early days of the company. If one were able to maintain super-sized ownerships through to an exit, that could have a profound impact on overall fund returns (as the figures above reflect).

- Betting on large Black Swans in biotech may work in the future. The past isn’t predictive of the future, so maybe we’ll have a lot more Pharmasset-like exits. Its worth noting that, at the exit, Pharmasset’s largest venture shareholder, Burrill & Company, owned 5.7% and returned north of $500M from the $10.8B acquisition, estimated to be a 30-40x return. This is clearly a huge outcome in the Life Sciences. I’d like to believe that Pharmasset-like, “100-year flood” biotech valuations are likely to happen more frequently in the future, but betting on the luck of a feeding frenzy is a tough investment strategy to get right with reliable frequency.

A couple final comments on the theme as well:

- Tech VC isn’t insulated entirely from fund size challenges. Gravity affects Tech as well, and while the constraints of exit size and ownership are much less rigid, they remain important variables for technology-focused venture capital. The massive >$1B funds being raised today will require massive exits, and many of them. But with the non-zero probability of “halo deals” delivering outsized returns, some large funds can still work in some frothy investment cycles for the Tech sector. Groupon is likely to return nearly 1x of NEA’s $2B+ fund – a good example of this.

- Fund allocations are a better term than fund size. I’ve used the term “fund size” in the above analysis; the better definition is probably LS “fund allocation” since it applies to LS investing from both LS-only and diversified funds. The “natural ceiling” and ownership considerations outlined above are more specific to LS than other sectors in a broader diversified venture portfolio. The latter portfolio can combine the consistency of a $150M LS allocation (and 3x aspiration) with a similar sized exposure to the potential outlier alpha of Tech in a modestly sized diversified fund.

- GPs benefit financially from large funds. I saved this one for last, but there’s an even simpler math at play here: in many cases, since management fees off of the large funds could make a GP rich on their own, who needs a 3x fund? I’d like to believe this isn’t the driver of the large funds out there, but I’d be remiss if I didn’t mention it. This undoubtedly contributes to why some GPs continue to push for bigger funds, despite the fact that those fund sizes have historically delivered less attractive returns than funds in the sub-$250M range (see SVB report).

At the end of the day, fund returns are all about the math of “Cash-in, Cash-out”. And achieving what could be deemed attractive “Cash-out” metrics has a lot to do with the “Cash-in” part of the equation.