Over the past decade biotech investments made by diversified venture capital firms have outperformed those by healthcare-focused firms. Its unclear why the difference exists, but the historical data suggest it’s a striking differential.

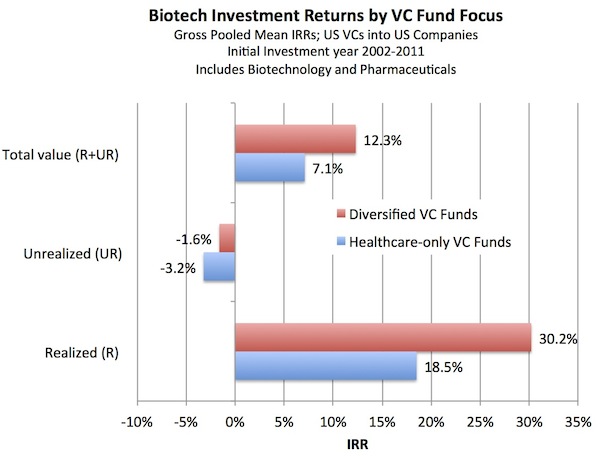

Examining the NVCA Benchmarking Database powered by Cambridge Associates, biotechnology and pharmaceutical (collectively “biotech”) investment returns by Healthcare-only VC funds vs Diversified VC funds were compared. Healthcare-only includes firms that do biotech, pharma, medtech, diagnostics, etc but don’t do Tech deals; Diversified firms do both technology and healthcare deals. This dataset tracks individual investments by fund type, and in this analysis includes over 2100 deals by US VCs into US companies with an initial investment between in the last decade 2002-2011 (data are as of Sept 30, 2011). See chart below:

Surprisingly, realized returns for biotech investments by diversified funds were better by nearly 1200 basis points, a huge outperformance. Looking at unrealized returns (deals still in progress), both were negative, highlighting the lack of markups in valuation over time for biotech in general. But the difference still favors diversified funds. And the combined “total value” measure (realized + unrealized returns) favors diversified funds by a remarkable 520 basis points. These data highlight a very large performance differential.

Is this just a statistical fluke? I guess it could be, but the numbers in each group are large enough to suggest otherwise. There are 1401 investments included in the healthcare-only bucket, and 766 in the diversified fund bucket. These are big numbers. The dataset unfortunately doesn’t allow for detailed statistics on p-values and significance, but the “effect size” here looks pretty large. Further, I have heard a few LPs with broad portfolios of venture investments confirm this outperformance of biotech deals from diversified funds. So it’s probably real.

What are the drivers of this outperformance? I really don’t know. It’s certainly not that the investing teams are different: both healthcare-focused and diversified funds have biotech teams with a preponderance of PhDs/MDs who’ve been in industry or operating roles for long enough to know this isn’t an easy business.

Here are a few potential hypotheses to explain these findings:

- Do biotech VCs from diversified funds walk from failing deals faster? Are there differences in how reserves are allocated? Since the scarce pool of remaining reserves in a fund are allocated across sectors, is there a more “efficient market” in a diversified fund for channeling capital towards winners and starving losers across macro cycles? Maybe. I suspect though that the variability in behavior across individual firms is far greater than that across fund style (meaning both types of funds are equally likely to have good/bad reserves allocation practices).

- Are healthcare-only investors more geared to early stage deals and therefore back winners that just take longer to realize? This could explain the difference in realized returns, but my experience is that this isn’t the case. A large number of healthcare-only players are explicitly later-stage investors, and lots of diversified funds maintain an exclusively early stage focus. So I’m pretty sure this doesn’t explain it either.

- Do VCs from diversified funds do different kinds of biotech deals? Do they avoid big capital intensive plays? This could be the case, but I don’t have the data here. In a diversified fund, where capital efficient tech deals compete for the same fund resources as biotech, there could be a bias towards leaner, more capital efficient biotech bets. Their portfolios could also include fewer big burn regulatory bets (source of discomfort for Tech partners) and fewer “big science project” platforms that lack product-oriented focused. Who knows, but this might be a driver.

Whatever the historical drivers of this difference, the future could be quite different. Although many good diversified funds have been raised in past couple years (Canaan, Flagship, Polaris, etc..), a number of well-regarded diversified funds have sadly split: Soffinova, ATV, Morganthaler, Scale, etc… And Index has raised a dedicated LS-only fund under the brand’s umbrella. Lastly, several smart healthcare-only funds have arrived on the scene, including Third Rock Ventures and Column Group. This new mix will certainly change the landscape over the next decade, and perhaps change the data. Only time will tell.

I’m still puzzled at the large difference in biotech returns by fund type. I’d like to believe it was due to some synergy or advantage inherent to a diversified fund that makes them better at doing biotech deals (especially since Atlas is a diversified fund!). But frankly it’s hard to explain. While there are numerous advantages at the fund level for why diversified funds are compelling to LPs, those aren’t critical to understanding the root causes of why biotech returns are different. Only the last hypothesis above about deal type differences seems credible, but maybe there are others hypotheses. Maybe we can crowdsource a few more.