Twenty years ago the biotech world was in the midst of one of the best IPO windows in its history. Nearly a hundred biotech companies went public from 1991-1994, including a number of the great companies that have become household biotech names: Alkermes, Amylin, Cephalon, Gilead, Human Genome Sciences, Imclone, Isis, MedImmune, PDL, Sepracor, and Vertex. Of course there were also a lot of names lost to the annals of history, or bankruptcy, but this window certainly helped launch a solid set of fully integrated, “built-to-last” biotechs.

Reflecting on today’s very different environment, I think it’s instructive to look back at that window to understand some of the drivers for why the early stage biotech arena is undergoing dynamic change and experimentation today. Two key observations jump out at me.

1. Many of these IPOs brought windfall returns to their venture backers. These are the IPOs that helped reinforce the mythical status of the biotech IPO. The average step-up in valuation over the private invested capital was ~4x, highlighting the very low cost-of-capital provided by public equity investors in that period.

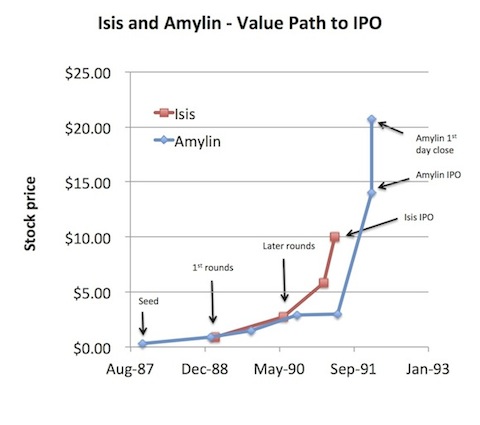

Lets explore two examples, Isis and Amylin, since both are still with us today and the subject of much discussion. Both raised their “1st rounds” in 1989 and went public only a few years later in 1991-1992 after raising roughly $20M in venture capital each. The chart below with implied stock price says it all. Not only the impressive valuation step-ups, but the short time from first institutional funding to IPO. Wish I had been in venture capital back then.

Today’s capital markets are obviously very different: most companies raise capital privately at relatively flat rounds over long timeframes and if they go public at all their IPOs are valued at or near their aggregate invested capital.

Take a couple recent examples: AVEO got public in Feb 2010 at $9.00 per share, yet had an average private investor share price of $8.97 over the past 10 years (see related post). Merrimack just IPO’d in Mar 2012 at $7.00, essentially flat with the last private round in 2011, and only a 1.8x over the average price of the past 11 years. And these are great biotech companies. For most of the past decade, step-ups on total invested capital have typically been only 1.5x or so. Sadly, high capital intensity has been the signature of many of the past decade’s IPO stories.

As everyone knows, the biotech IPO model just isn’t what it used to be, and nor has it for a decade. It’s also not likely to change anytime soon. Why is this? In large part because of the second key observation.

2. Only a subset of the 1991-1994 IPO window have accrued real value over time. There were certainly a few big winners in there – Gilead probably being the biggest, up over 100x since its IPO in 1992. MedImmune also fared quite well with its $16B acquisition (though AZ is not thrilled about it now), and Vertex is up 10x.

But let’s take the prior two examples, Isis and Amylin, which represent “successful” 20-year old mid-cap biotechs. Both have gone from preclinical stage companies around their IPOs to having products launched or filed with the FDA. But they haven’t really created any shareholder value over 20 years. Isis today trades at $8 per share, but it went public at $10 per share. Amylin went out at $14, but closed on the end of its first day of trading in 1992 at $21 per share. It now trades at $25. So for 20 years, these companies (and many, many others in the 1991-1994 cohort) have underperformed not only all major equity indices, but also treasury bills, and consumed billions in equity capital. And recall that many more companies from this window, probably at least half, ended up dying long whimpering deaths like long-forgotten Autoimmune Inc and Alpha-Beta Technology.

Though it may seem surprising, public investors have caught onto the flaw in this biotech investment strategy. Their diagnosis (and mine) of the problem has at least three parts: insatiably high capital intensity funding large portfolios (funded on the back of the serial public equity flows, there’s been little focus on capital efficiency), an endless cycle of “rinse and repeat” anti-shareholder behaviors (in public market there’s always someone else willing to fund the promise, and expand a new option pool, so its ok to wash out the existing shareholders with dilution), and management teams too focused on “built-to-last” company survival vs shareholder value maximization (like going it alone “to build the next Gilead” even when the best outcome for existing shareholders, and often patients, is to sell now and access the balance sheet resources of a bigger company). These may be harsh criticisms, and lots of companies don’t exhibit this behavior, but they are indeed real concerns held by biotech investors today.

Public buysiders know these tactics well, and obviously seek to avoid exposure to them. Activist buyside shareholders have gotten increasingly active in biotech, and on the whole I think it’s a good thing: investors behaving like owners, as they should, in order to push for better value-maximizing strategies. I have a lot of sympathy for many (not all) of these investors because in many ways VCs are the definition of activist owners/investors.

Twenty-years of these observations have led buysiders to become skittish IPO investors, and they are often blamed for the IPO problem today. I can certainly argue that the pendulum has swung too far, but their skittishness is an understandable reaction to the past decade’s IPO roster. If most IPOs trade down after their IPOs, why bother buying at the offering. Seems rational.

But it’s also clear that buysiders will still support innovative biotechs to go public: in fact, I’ve heard them lament that lots of the best companies are being sold “too early” to Pharma. That may indeed be true, but in most cases the dilution of “going long” with a high cost-of-capital makes selling a company “early” a far more attractive outcome to existing shareholders. More IPOs (vs M&A) would certainly happen if the cost-of-capital of public equity was cheaper, and it doesn’t need to drop to the 1991-1994 level to be interesting.

The current reality, shaped by a couple decades of lackluster performance, is that the public markets aren’t open for business in biotech. While they are much less tolerant of the value-destroying tactics of the past (which is a good thing), they have also set the bar so high as to discourage even great, innovative companies from considering it as a viable option. In this new world, the old company building models just don’t work: it’s hard to back a startup today with an investment thesis around “we’re building the next Gilead” – the capital markets are just so different.

And beyond the public capital market changes, there’s been plenty of other forces at work to adjust to in the biotech: Pharma R&D productivity issues and their increasingly active M&A interests, emergence of a robust CRO network, more translationally focused academic medicine initiatives, corporate venturing, etc…

These forces have certainly changed our landscape over the past 20 years, and it would be a mistake to continue pushing the “built-to-last” biotech strategies born in a different era in today’s environment.

This is why many venture investors are pushing experiments today around capital efficiency, globally distributed R&D, asset-centric models, tighter linkages with Pharma at company inception to access lower cost-of-capital, alternative routes to liquidity like structured transactions, etc… And many of these approaches are working – great stories like Avila, Stromedix, Amira, Enobia, etc are being built in this new environment.

Who knows what the future will hold, and the re-emergence of attractive low cost pools of capital in the public markets would certainly change the flavor of companies we’re starting today. However, for the time being, a twenty-year “Back to the Future” isn’t happening, so we’ll just have to look nostalgically at the 1991-1994 window, celebrate its successes, and continue adapting to the brave new world.