Biotech IPOs have long been viewed with skeptism, especially over the past few years in comparison to the high-flying media darlings in the Tech space. But recently a number of the social media phenoms have fallen from grace: Groupon is off 72%, Zynga is off 68%, and Facebook is off 44% as of today. Yet during the past 12-18 months, new Biotech IPOs have quietly been putting points on the board with their post-IPO performance. It’s now fair to say they have resoundingly outperformed their Tech cousins in the public markets.

According to the National Venture Capital Association, 83 venture-backed IPOs occurred since January 2011 through end of 2Q 2012: 15 Life Science deals and 68 “Technology” deals (which include social media, retail, software, etc…). I’ve taken a crack at examining the relative performance of these Biotech vs Tech IPOs, and here are the takeaways.

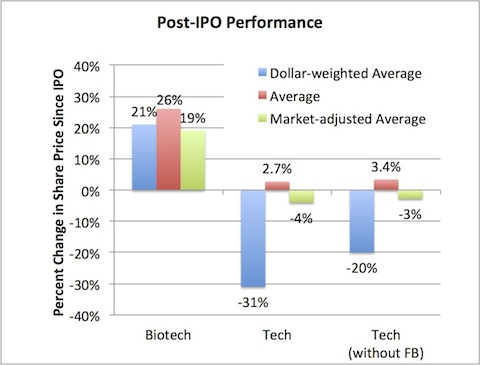

Biotech IPOs have massively outperformed Tech in their post-offering trading. Biotech median and average percent change since IPO are +19% and +26% versus Tech performance of -9% and +3%, respectively. This is ~2000+ basis points of outperformance – an impressive metric. To put that in perspective, asset managers often talk about beating benchmarks by 300-500 bps as a success, so this type of outperformance is remarkable. Below is a graph comparison across a few dimensions.

But all deals aren’t created equal. Big deals need to be weighted as much more impactful than tiny ones. Adjusting performance by the market capitalization immediately post-IPO, the Biotech basket’s weighted average is up 21%. Tech IPOs are down 31%. Excluding Facebook, which accounts for close to 50% of the aggregate Tech market cap, the Tech performance is still poor: -20%. So on a dollar-weighted basis, Biotech has outperformed Tech by 4000 basis points.

Lastly, when comparing performance of IPOs to the market, Biotechs have also done well. By taking the S&P500 performance since the day of their offerings and subtracting it from their change since IPO, stock performance adjusted by market returns can be calculated. As shown in green bars above, Biotech IPOs have, on average, maintained a market-adjusted average stock performance of +19% (implying S&P500 is, on average, up 7% during this period). Tech has underperformed with a market-adjusted stock change of -4%. So Biotech is not only doing well against Tech, but also very well against the overall stock market.

The outliers don’t even breakout in favor of Tech. The top decile performers in biotech beat their tech counterparts: biotech’s 90th percentile saw stock appreciation of 98% (top ~2 biotech deals) vs 84% in Tech (top ~7 deals). With regard to the big Tech IPOs that have become household names, there were 20 offerings with >1B valuations in this dataset. Only four of them are positive today (LinkedIn being the most impressive, up 126%). Sadly, not one of the biotechs is valued at >$1B, at its offering or today.

The aggregate market capitalization statistics are also interesting. The total market cap of all fifteen Biotech’s immediately following their IPOs was $3.6B. Tech dwarfed that with $172B, or excluding Facebook at $91B. Today the Biotech market cap’s have gone up to $5B, or up 39% (slightly higher than the dollar-weighted number above because of additional share offerings). Tech has dropped to $119B or $72B without Facebook, which is the destruction of some $54B (or $19B) in value since they went pubic. Lets put that in perspective: The 68 Tech IPOs have lost more market capitalization in aggregate than 10x the entire value of the 15 Biotech IPOs that squeezed onto the public markets. It’s also more than 10x the annual pace of venture capital funding into private biotechs.

So since January 2011, the underdogs of Biotech have surprisingly done pretty well.

Reflections on the Data.

It’s clear that on the Tech side, and in social media in particular, there has been a massive wealth transfer from the public investor (retail and IPO-buying funds) to the entrepreneur and private investor. A handful of these big deals have driven massive (100x) returns to their venture investors (assuming they sold a chunk at the IPOs). For those that have held their shares with hope of trading out after a post-IPO runup, I’m sure the paper write-ups and write-downs have been a rollercoaster. But in the end, this type of massive wealth transfer isn’t helpful to the venture-backed ecosystem: this pump-and-dump IPO model isn’t sustainable at these levels, nor will it make going public in the future easier for Tech companies.

On the Biotech side, the stellar post-IPO performance is little consolation to the venture investors in those deals. Most went out at or near their invested capital (~1.5x) so even 26% share increase doesn’t transform the multiple into something to get excited about. But it’s better than the poor performance of prior IPO classes of the 2000s (described here), and hopefully will continue.

Generalist public market investors remain on the sideline from Biotech IPOs, which has limited demand and created a cartel of hedge funds that control access to the IPO market. One would hope that with relative performance numbers like these we’d see some greater interest in Biotech IPOs from the broader investment community.

Many long-term Specialist Biotech buysiders are frustrated that the great Biotech’s of tomorrow are being cherry-picked pre-IPO by Pharma buyers. This is certainly the case for companies like Avila Therapeutics. But the challenge has been pricing: Pharma is paying more than these buysiders are willing to. With strong continued post-IPO performance, perhaps the Biotech classes of 2011-2012 will help support a more attractive IPO window in the near future.

The JOBS Act was signed into law in April 2012, and a part of the legislation was aimed at increasing the number of IPOs. Yet the data doesn’t suggest a lack of IPOs was the problem., as most of the 150+ IPOs of the past 18 months came before that. Post-IPO performance may be the bigger problem (hopefully Congress will tackle that next). On a more serious note, one of the provisions of the JOBS Act will enable confidential S1s – and greatly facilitate the pre-marketing of potential IPOs stories before the formal roadshow. This could greatly help with marketing more complicated stories, like Biotech, where potential investors can’t just go try out a new photo-sharing website.

I’m hopeful that the confluence of better stock performance, increased interest in innovation from the buyside, and new legislative changes to the IPO process will combine to make for a more interesting IPO market in Biotech over the next couple years. But I won’t hold my breath – I’ll just keep rooting for the Biotech underdogs.