Biotech just takes too long, especially when compared to the overnight success of technology ventures, or so the oft-cited criticism of venture-backed biotech’s perceived longer holding period goes. Despite being a well-accepted belief held by most venture professionals, LP’s, and industry pundits, there’s little if any published data on the subject. Having just assembled a large dataset looking at company timelines, it’s fair to say the data don’t support the widely held premise at all.

Although surprising given the entrenched dogma, biopharmaceutical companies have experienced M&A and IPO events at a younger age than technology companies in the recent exit vintage. The bias is especially true with M&A events greater than $100M. Although I’ve not conducted rigorous statistical significance calculations on the datasets, the distribution of the timelines allow some interesting observations to be drawn that are not well appreciated by the venture community.

Data Dump.

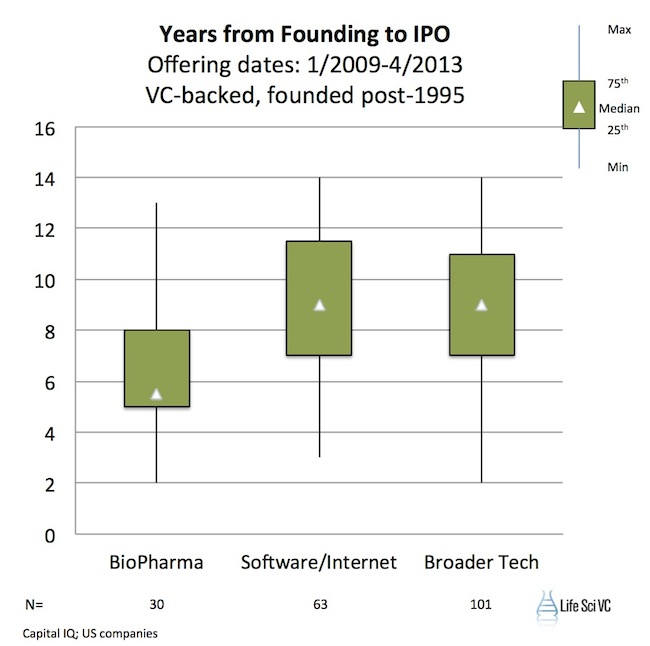

1. Over the past four years, Biopharma IPOs have debuted as “younger” companies than their Tech counterparts. Using Capital IQ data*, and focusing on all the January 2009 – April 2013 IPOs of companies founded after 1995, the median time from company founding to public offering was under 6 years for BioPharma vs. 9 years in Technology, even when looking at the Software and Internet subset of Technology. As examples of speedy biotech plays look at clinical roll-up deals like Clovis and Tesaro that went public within a couple years of founding, as did preclinical play Verastem.

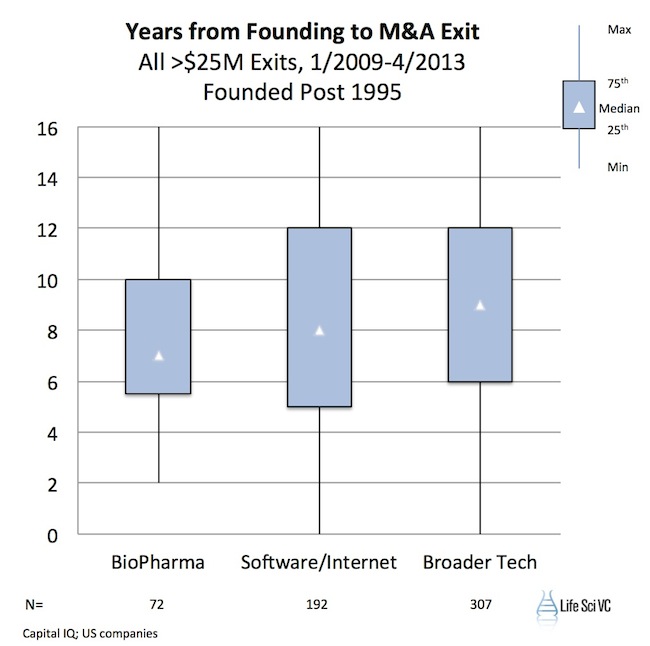

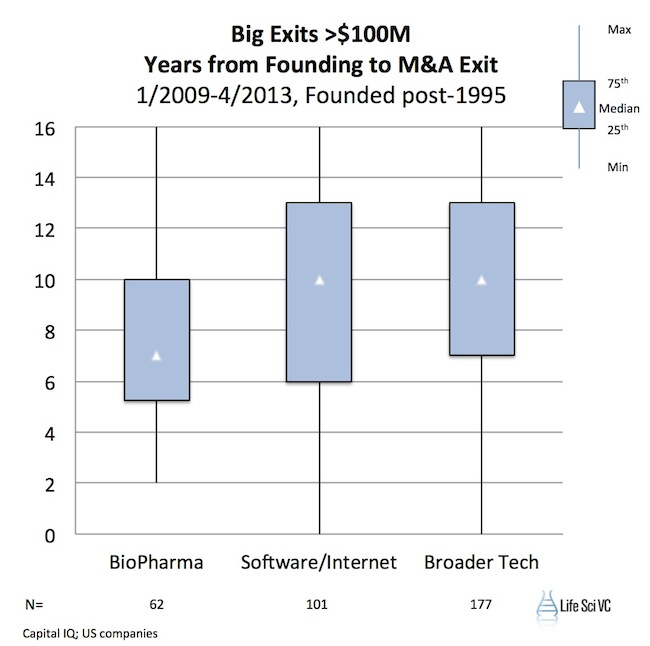

2. Private BioPharma companies got acquired in a shorter time from their founding than their Tech counterparts. Looking at all the private venture-backed M&A deals from 2009-2013 that were larger than $25M (there are tons of micro-deals that bias many datasets), and filtering for those companies founded since 1995, we found that the 70+ BioPharma exits had a median time from founding to exit of 7 years vs 8 years or more in Software/Internet as well as the broader Tech sector. These data resonate with our experience: Avila and Stromedix were both six years from founding to exit. Lastly, if one filters for the larger and hopefully more interesting exits greater than $100M, the difference becomes more profound: Software and broader Tech extend out to~10 years vs “speedy” Biopharma at 7 years. See the two graphs below.

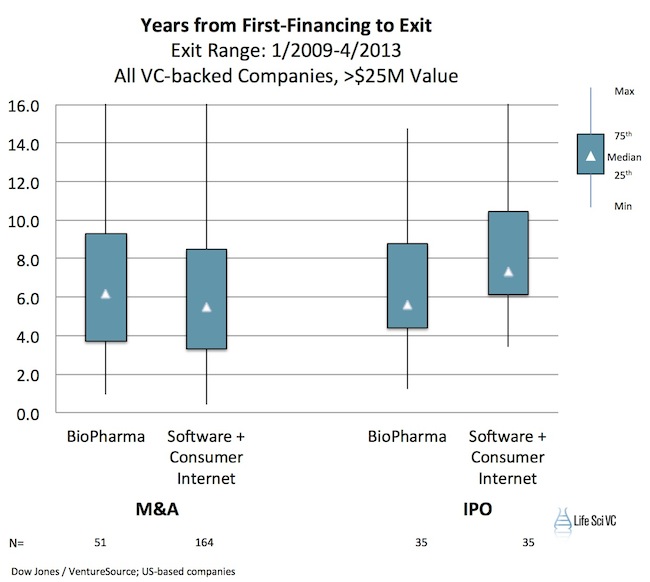

3. Founding a company and getting a first financing are clearly different, but biotech holds its own even in the “time from first financing” to an “exit”. Using a completely different dataset, this one from Dow Jones Venture Source**, the median time from first financing to a >$25M M&A event was roughly the same (6.2 years for BioPharma and 5.5 years for Software/Consumer Internet), and greatly favors BioPharma on the IPO timeline. Software alone was equivalent to BioPharma at 6.1 years, as the addition of Consumer Internet shortens the timelines by ~6 months. These two subsectors are clearly big parts of Technology but not the entire sector; its fair to say other Tech subsectors, like semiconductors, clean tech, hardware, etc.., have longer timelines than these.

Observations, Reflections, Caveats.

First, these data are in striking contrast to the conventional wisdom. The image of the overnight success in Tech vs the decade-long laggard in Biotech is just not born out in these data. One has to wonder about the reason why these findings are so different than widely-held perception. One significant contributor is likely because of the lack of unrealized write-ups in the Biotech venture world. In Tech, a company can get founded, build a team, move up the revenue ramp, and raise money at higher and higher valuations over time. If it takes 7-8 years to get to an IPO, like it did with Facebook, that’s ok because we’re able to communicate the value through unrealized gains on paper. In Biotech, that rarely happens over time. While Biotech holding periods are marginally better than in Tech according to these data, the valuations of these companies typically stay near cost or at very modest step-ups for years in the private markets (~2x or less). This is why we form syndicates that can “go all the way” to an exit, and tranche the financings over many years. The lack of step-ups limits any unrealized “paper” gains, which makes the holding period appear excessively long. Fortunately, as other analyses have shown, the realized returns in biotech at the end of the holding period are amongst the best sector in venture.

Second, there are credible business model reasons why the timelines look like this. In Software and many Technology sectors, predictable monthly recurring revenues in the $5-10M range are often needed before contemplating an IPO. Acquisitions clearly happen earlier as well, but often real revenue ramps are the norm, and building the sales pipeline to support these financials takes time. On the other hand, most BioPharma exits happen pre-revenue: as a sector, we are able to market compelling biomedical data to a set of buyers (Big Pharma or the equity markets) that are willing to put a value on the company’s equity based on that data.

Third, it’s fair to say that a BioPharma IPO is not an exit for investors. It’s a financing event for the company, and insiders typically participate and hold well after the lock-up period. This could explain some of the difference in timing. In Technology IPOs, insiders rarely participate in purchasing shares in the offering, and in some cases they sell their shares. More often than not though, insiders begin to sell after the IPO lock-up period – but this usually takes months to years to exit a position completely (both in Tech and Biotech). Furthermore, as Groupon and Zynga demonstrate, the IPO price and the exit price are vastly different things, and many late stage investors are licking their wounds (although early investors in both still crushed it even at current prices).

Fourth, an investor’s holding period is not the same thing as time from founding to an exit event. I’ve focused on the start-to-finish timeline here as a proxy for how long it takes to generate returns, but obviously later stage rounds of financing would have shorter holding periods – a point that holds in any venture sector. In addition, even the time from founding to the close of the first financing shortens the timelines in #1 and #2 datasets above.

Fifth, the lack of micro-M&A deals in these datasets could bias the findings. The datasets are filtered to only include those greater than $25M and therefore eliminate micro-deals. Importantly, the findings above around founding-to-exit timelines aren’t sensitive to a cutoff at $25M vs $10M – the same pattern of differences in exists. But these micro-deals could be two very different types of outcomes: companies that sell on tiny amounts of equity (bootstrapped, angel-backed, or “acqui-hire” deals), or they could be “garage sales” for failed companies. Hard to know based on the dataset here. But the timelines in the sub-$10M exit range interesting: Tech micro M&A exits have a median time from founding to M&A of 6 years (n=828) vs. 9 years in Biotech (n=29). Neither of those sounds like a quick flip on tiny amounts of angel capital, even less so for biotech. However, as these sub-$10M exits aren’t of great interest for venture returns, I’ll stop there but certainly lots of possible hypotheses to ponder.

Conclusions.

Venture capital as an asset class may have a holding period problem, but Biotech isn’t the worst offender. Achieving liquidity in 5-8 years should be considered a successful path from founding to an exit, irrespective of sector; if this is too long for GP’s and their LP’s, than early stage venture investing is probably not for them. This is why venture funds are 10-12 years in duration.

Founding entrepreneurs, prepare for a long road. Fast exits are rare in any sector. Building great companies takes time, as does building mediocre ones frankly. These exit data suggest that you should expect to hammer away at for the better part of a decade before liquidity.

Working on capital velocity – shortening holding periods – is an important element for improving returns. This post isn’t meant to downplay the importance of holding periods in generating returns, just to share data on the recent 4-year vintage of exits to challenge the conventional wisdom/biases. Holding periods are a key driver of rates of return. In early stage investing, returns could undoubtedly be improved if we can shorten the holding period by accelerating the “capital velocity” within a deal and portfolio. We and others in early stage biotech venture are working closely with Pharma to help address this issue, as earlier liquidity-generating partnerships are a key component of this. By exploring novel corporate structures like LLC-holding companies (like Nimbus, RaNA, Forma, Viamet, and others), or by structuring buyout timelines at the outset of a new investment (like our AVDC deals Arteaus and Annovaiton), the capital velocity of early stage biotech deals can be greatly improved. This might also address the lack of unrealized step-ups in value by smoothing out the liquidity and valuation curves in biotech.

Lastly, there are lots of myths in the venture capital and startup world – about returns, losses, timelines – many of which aren’t supported by data (which will be summarized in a blog post coming soon). While I would love data-driven analyses to change sentiment on their own, that’s not going to happen. But it will help us dig into the real issues facing both biotech and the broader venture business, rather than wasting time chasing phantoms that don’t exist.

There’s much to be done in biotech today to improve returns, just as there is much to be done in venture capital as a whole. But these data are clear: with timelines like these, venture capital needs to be patient capital.

Data Footnotes:

Data was assembled from two sources: Capital IQ and Dow Jones Venture Source. A number of groups helped me wrestle down the right ways of cutting those data appropriately, including Capital IQ’s Andrew Centauro, Dow Jones’ Hind Wildman, E&Y’s Sandra Feldner Vandergriff, and Torreya Partners’ Margaux Babich. Two analyses were done: time from founding to an “exit” event (Capital IQ), and time from first financing to an exit event (Venture Source). Both analyses focused on the ~4 year period from Jan 2009 until April 2013.

* The Capital IQ dataset included all companies with at least one “venture capital” investor where there was a disclosed founding date later than 1995 (to eliminate the old private firm from biasing the data). For M&A, it was limited to those exits >$25M to eliminate the huge number of micro-exits. Technology included fifteen primary industries including Internet Software & Services, Application Software, Systems Software, Internet Retail, Communications Equipment, Computer Hardware, Data Processing Services, Semiconductors, Electrical Components, Wireless, etc… Most of the data points come from the first four sectors. BioPharma included both Biotech and Pharma. Capital IQ provides founding dates in years. To treat all companies the same, the calendar year of their event date (IPO, M&A) was used. This leads to a rounding off of the numbers of years.

** Dow Jones Venture Source dataset included all venture-backed companies with an IPO or M&A between Jan 2009 and today, according to their criteria. M&A was again limited to those deals above $25M in disclosed value. Timelines were constructed from first financing date to exit date.