The ever-shrinking number of biotech venture capital firms was a common refrain during the 2008-2012 period; it’s true that a large number of firms went under, closed their doors for new investments, or moved into zombie status. I wrote on the subject back in July 2012 (here). The biotech investing environment then, with a relatively bleak IPO landscape and venture funding off some 40% from the prior year, was very different from the past two years with an “open” IPO window and steady pace of venture funding.

Last week’s post on the “flux” in the ecosystem (here) highlighted one perspective on this issue: right now there’s a big disconnect between the incredible demand for innovative biotech equity from the buyside (public markets and Pharma), and the relatively constrained, “slow, low, and steady” number of new biotech startups being formed. The latter is driven by a number of factors, but a significant contributor is the very limited pool of early stage venture investors.

I thought it would be worth revisiting those numbers to frame the magnitude of the issue – and the relative scarcity of early stage investors in biotech venture today.

Data.

Getting a handle on the number of actual venture investors, and more importantly the “active” investors, isn’t easy as most financial data firms track the numbers in different ways – and its hard to separate different kinds of investors (venture firms, angels, family offices, institutions, cross-overs, etc…). Below are a few charts coming at the data from different angles.

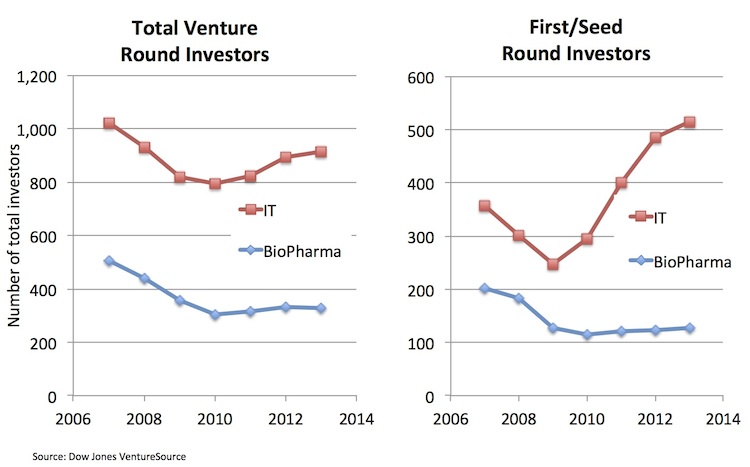

First, Dow Jones Venture Source tracks the total number of participating investors (including the full list above) in BioPharma funding rounds. I’ve plotted both total numbers and those that participating in early stage financings (first or seed rounds), comparing BioPharma to Information Technology rounds. The early stage expansion in IT is clearly a big driver behind the explosion in the number of tech startups mentioned last week in this chart (i.e. the tech startup glut).

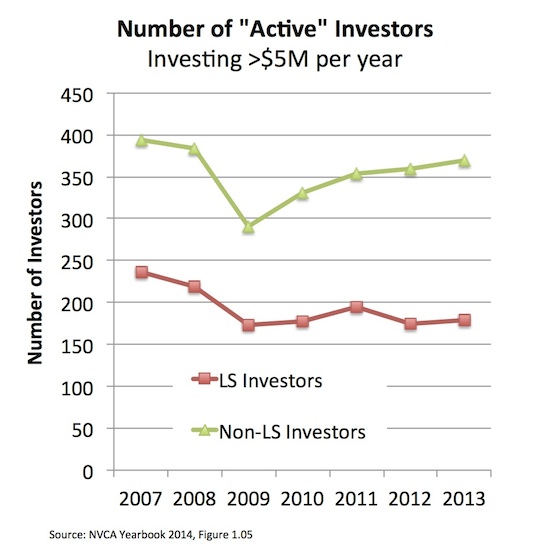

Second, to look at more “active” investors, the graph below reflects data from the National Venture Capital Association (NVCA) 2014 Yearbook, which for the first time tracks the number of “active” life science investors, defined by any investor putting more than $5M to work annually in BioPharma or MedTech sectors.

Several observations from these two sets of data:

- Total numbers of participating investors declined in all sectors after 2007, as is widely appreciated. Investors participating in BioPharma venture deals declined by ~40%, but interestingly have never recovered their numbers. This represents a major culling of the herd, so to speak. IT investors also saw their numbers contract after 2007, by ~20% or so, but the number of investors has largely rebounded in aggregate, and in fact has doubled (up ~100%) for early stage investors (reflective of the startup glut discussed here and elsewhere).

- The number of “active” investors (as defined above by the NVCA) show similar trends, albeit more muted. Active life science investor numbers (including BioPharma and MedTech) dropped by 25% since 2007, and again haven’t rebounded; on the contrary, active non-LS (Tech largely) investors have essentially regained their full 2007 ranks.

Neither of these two metrics are very fulfilling for identifying the number of venture investors who are actively making “new” investments; even NVCA’s “active” metric could be simply funds continuing to back their existing legacy portfolios, rather than making new deals.

To address this issue, FLAG Capital Management did a further refinement of “active” investors and shared it with me earlier this year (thanks to Kirsten Morin): by filtering ThomsonOne’s dataset for only investors that had made at least four new investments with at least $4M in aggregate during 2013, they identified only ~25 active healthcare venture capital investors. That’s not a big pool. And only a subset of those VCs actually help start or back drug discovery and research stage biotechs – probably only a dozen firms regularly start or fund more than 4-6 new biotech companies a year.

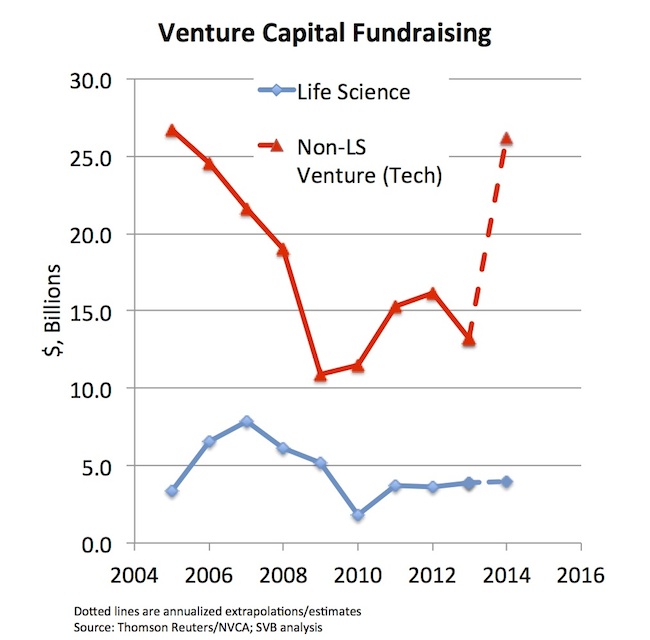

Startup financing activity is one way to look at the venture ecosystem; another perspective is through the lens of venture firm fundraising. According to Thomson Reuters and the NVCA data, the fundraising environment is red hot in venture today, with $16B raised in the first half of 2014 (here). This is nearly as much as all of 2012 or 2013, and has been driven by some large technology funds raising large amounts of fresh capital, like Andreessen Horowitz’s $1.7B fund. To estimate how much has gone into Life Science allocations, either pureplay funds or LS-allocations in diversified funds, Jon Norris at Silicon Valley Bank leveraged the Thomson Reuters data and calculated the number flowing into LS venture at $3.5-4B a year over the past three years (Exhibit 2, here). This year a number of high quality venture funds have been raised this year, including Sofinnova, Arch, and Abingworth (here), but its been dwarfed by the funds flowing into technology. To add a further data point, Franklin Park Associates shared an analysis of the $26B that’s been raised to date by venture firms in 2014 – only $3.5B is for healthcare funds – a far smaller percentage than in recent years (15% vs 20-23% of venture fundraisings in 2011-2013).

The takehome message from these data is clear: there’s a huge influx of capital into venture, mostly into technology, and there remains a limited pool of capital flowing into life science venture, and even smaller into early stage funds – despite the booming IPO and M&A markets.

Implications.

Benchmark’s Bill Gurley made a great Darwinian comment in an interview with the WSJ earlier this week that sums up the situation from my perspective: “Excessive amounts of capital lead to a lower average fitness”. And by the converse, constrained flow of capital leads to higher average fitness as firms and startups have to evolve, adapt, and compete for capital.

This is certainly true of startups, which was Gurley’s point relative to the tech startup bubble; fitness in his eyes is all about cash flow and future monetization for tech startups. In biotech, “fitness” is all about capital efficiency – how well does a startup convert invested capital into value through the invention, translational and eventual commercialization of new and differentiated biotech drugs (as discussed here).

If significantly more funding, and more early stage investors, were flowing into the sector with hundreds more startups being formed, I’d argue strongly the average quality of the investments being made would go down – there aren’t enough breakthrough ideas and superb R&D-seasoned entrepreneurs to run them.

With the booming IPO market today, new investors have been flooding into the later stages of the ecosystem: mezzanine rounds led by cross-overs and over-subscribed IPOs have seen significant capital inflows. I think its reasonable to argue that this exciting IPO market has witnessed its fair share of undisciplined pricing caused by this flood of public market capital into that part of the ecosystem, though I won’t name names on my short-list; interestingly, this exuberance hasn’t really been flowing back into a proliferation of startup-stage companies (as I noted in last week’s post), which are the lifeblood of biotech and required to satisfy future biotech demand.

The same competitive forces at play in startups are at play with venture firms. The 40% reduction in the number of biotech investors, and the small number of early stage firms, has been a good thing for the health of the sector. Fitness has improved. I’ve heard LPs comment that the healthcare firms that are out raising funds today have better returns than many of the ones that raised in 2005-2010 – and that this “survivor-bias” in who is actually out talking about biotech venture to LPs is part of what’s improving the sentiment towards the space. The culling of the herd has improved the average fitness.

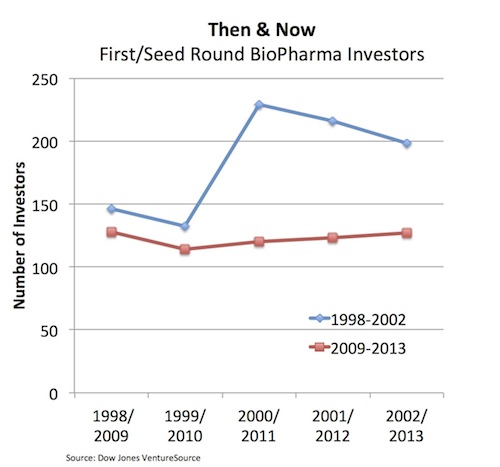

As Gurley and Darwin suggest, a flood of new early stage biotech investors would likely be a bad thing for the sector – potentially creating a glut of below average startups with little chance of survival. That’s happened before – the Genomics Bubble back in 2000-2001. The chart below highlights the numbers of participating investors in first and seed stage biopharma deals, again from Dow Jones VentureSource data. The obvious observation is the difference between then and now: in 2000, the number of early stage investors spiked 75% as the IPO window for biotech began to open up, and stayed high through the collapse of the bubble in 2002. By contrast, the last few years – even with one of the biggest/longest IPO windows in biotech history – have been defined by restraint and constraint in terms of early stage biotech venture and startup formation.

With only ~100 new biotech startups being formed each year, and only a few dozen firms actively doing it, there’s a tiny universe of players responsible for creating the next wave of biotechs likely to mature in the second half of this decade.

To repeat the macroeconomics theme from last week’s blog: “I’m bullish on the long-term equilibrium favoring the continued (and increasing) attractiveness of Biotech as a sector in the venture asset class: tightly-funded and supply-constrained, with exit demand outpacing investments, Biotech has the right macro fundamentals to be a good place to be investing.” Indeed, this could end up being one of the best vintages to be investing in biotech.

All that said, there’s plenty to be concerned about in today’s markets – Warren Buffet’s famous investing axiom comes to mind: “Be fearful when others are greedy and greedy when others are fearful.” There may not be enough fear in the public markets in general, across biotech or technology; lots of stocks appear priced for perfection, and lots of generalists fund flows have poured in. But, as the above data suggest, early stage biotech remains a place where few investors tread – reflecting a fear of the challenge investing in new drug discovery companies – which is why we believe its a good time for us to continue being “greedy” about early stage biotech venture creation.