With the start of the American Society of Clinical Oncology meeting, all eyes in the biopharma investor community are on Chicago. Social media is alive with #ASCO15 tweets and companies big and small are firing out press releases. Signal from noise will be hard to discern over the next few days.

While it’s hard to know if there will be any positive or negative surprises this year, at least until the weekend is over, a quick “Friday fun” data analysis of the nearly 5000 abstracts reveals the rather narrow focus of the community’s attention (though I’m likely contributing more to noise than signal).

As one might expect, the word “patient” and “cancer” show up in 90+% of the abstracts at ASCO. Nearly two-thirds of them mention a “treatment” or contain a “clinical” reference. “Chemotherapy” and related regimens appear in about a third, and “antibodies” close to 10%. I share those because they help calibrate my quick survey of the abstracts’ keywords, which, although unscientific, appears to have some merit and align with what you might expect.

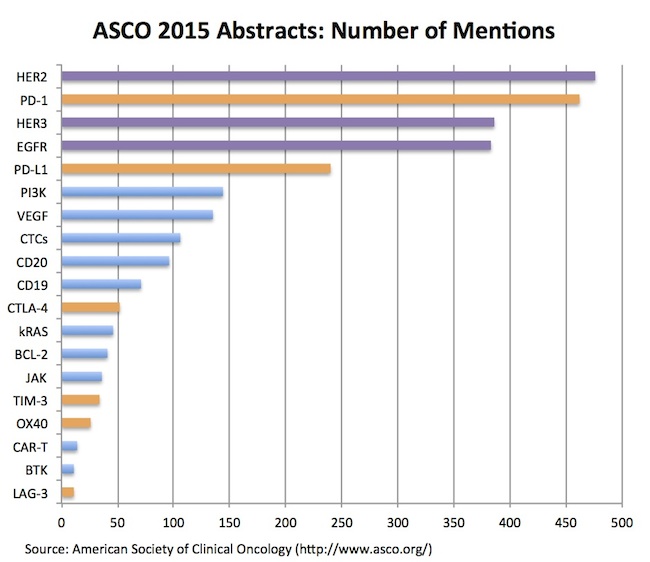

The summary of my data-lite analysis is captured below – a chart showing the number of abstracts that mention a particular therapeutic target (out of a couple dozen targets that I assessed, a group of which are presented here):

Two quick takes:

- The ErbB family – HER2, EGFR, HER3 – continue to capture tons of attention in the oncology world: despite their discovery over 30 years ago, these tyrosine kinase receptors were three of the top four targets mentioned in abstracts this year. With dozens of cancer drugs attacking these targets, and lots of interest in their gene expression patterns across tumor types, it’s not surprising to see these widely presented in abstracts – though their collective abundance at the top of the league tables was eye-opening, at least to me. Beyond a stable of approved agents, programs are being developed for pan-ErbB activity (Puma, others), mutant-selective inhibition (Clovis, AZ), and many other ErbB-related product profiles. Somewhat amazing that after several decades there’s still a lot more to learn, and apparently a lot more drugs to develop against these various ErbB profiles.

- Immuno-oncology checkpoint targets, as expected, light up the list of frequent-fliers in the abstracts: PD-1 and PD-L1 have hundreds of abstracts between them, not surprisingly standing out ahead of other immune targets. Most major oncology players have abstracts involving PD-1, including Merck, BMS, AZ, Novartis, Roche, and pretty much everyone else. Other T-cell related targets like CTLA-4, TIM-3, OX-40, and LAG-3 round out the list of frequent mentions. Engineered immune cell therapies (CAR-Ts) are found in a couple dozen abstracts, but not nearly as abundant as I expected given the market’s level of interest in those stories. The log-order difference of these “newer” approaches vs PD-1 and the ErbB family mentions is also likely a function of ASCO being a later stage and more solid-tumor oriented meeting than AACR or ASH.

To pressure test the distribution in my brief survey, I also ran through a similar search for abstracts from AACR 2015 from last month; a broadly similar concentration of target-related activity exists, highlighting the intense spotlight on PD-1 and ErbB approaches.

Stepping back from this fun data-lite analysis, the other general conclusion one can draw from the abstracts is that the “March of the Lemmings” (see the link for my 2012 ASCO blog on the topic) is still very much in effect. The industry is largely chasing all the same cancer targets; once validated with clinical data, competition on these emerging high impact targets becomes fierce – as is the case with many of the ErbB and immuno-oncology checkpoint targets today, as well as CD-19 in the CAR-T space. Each of these targets has dozens of preclinical development and clinical stage programs lined up against it.

Although many of these targets have little “clinical risk” left in them (though brodalumab teaches us that even mAbs against similar ligand-receptor pairs can have idiosyncratic risks), the “differentiation risk” facing these programs has become enormous. And the prinicple way to discharge differentiation risk is through greater capital intensity and scale – more studies, more indications, more combinations, more head-to-head comparisons – to create broader and better product labels over time. This makes it is especially hard for small venture-backed companies to compete on these targets. Bigger Pharma companies that can aggregate critical mass will clearly have a big advantage in everything from patient access at key clinical centers to “locking up” the key opinion leaders and to share-of-voice with big payors post-approval. Even GSK decided it wasn’t worth competing if you can’t be one of the biggest players in the field.

It will be interesting to watch how the competitive battlefields of erbB, checkpoints, and to a lesser extent CD19 CAR-Ts, play out during the mayhem of #ASCO15 and, more importantly, over the coming few years. When the dust settles, there will be winners and losers that emerge from the ranks of biopharma and their investors – but the real winners from all this competition will ultimately be the cancer patients that get access to better therapies.