Our friends at HBM Partners in Switzerland have just published their 2010 Biotech M&A Survey based on a reasonably large set of deals last year. A few observations I’ve gleaned from their analysis:

- Acquisitions of VC-backed biotech companies were up considerably in 2009-2010 according to their data. Over 2x more deals were done than in the tough times of 2008, and its back up to 2007 levels. Given the strong start to 2011 with Plexxikon, BioVex, and Calistoga, among others, I’m betting we’re in for continued M&A acceleration

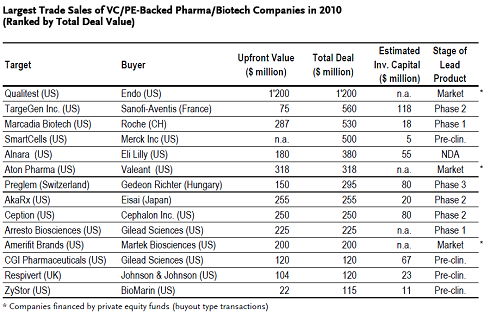

- Looks like some very interesting return-on-invested-capital multiples on the aggregate deal values: Marcardia, SmartCells, AkaRx, and Respivert all raised relatively little before being taken out for what could be very nice multiples. Several of these even had nice upfronts. As have many of the deals in 1Q 2011, as noted above.

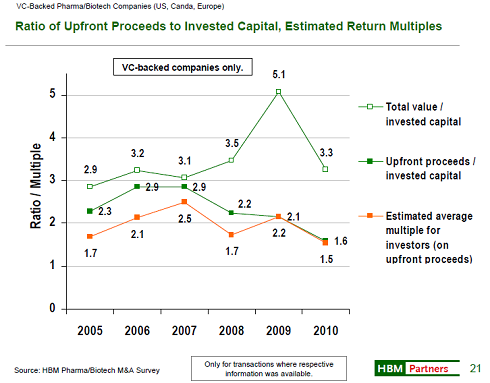

- However, the average upfronts in these earnout acquisition deals have come down to an uncomfortable 1.5-2x, with 3-4x as the overall payment. This is clearly a trend to watch as it will dramatically impact long term returns and the sector’s sustainability: startup biotech can’t sustain spending millions in drug R&D over 6-8 years only to make 1.5-2x as this is roughly only a 7-10% IRR. Most venture LPs expect 20+% IRR from their venture asset class allocation.

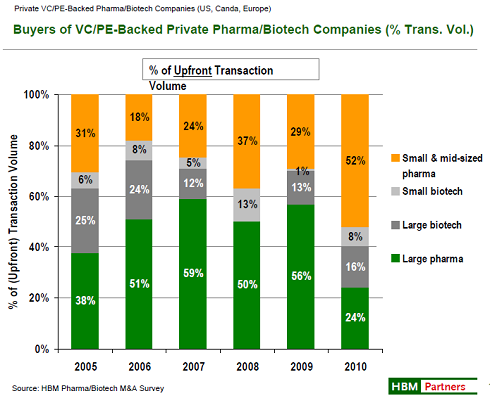

- The mix of ‘predators’ is changing. Small/Mid-Cap public drug companies are now driving 60% of the M&A volume, whereas in 2006-2007 they were less than 30%. This trend is likely to continue given their growth rates and Big Pharma’s endless restructuring.

Good food for thought. Thanks to Uli and his team at HBM for putting it together.