We’re in an era of consolidation in our country’s biotech clusters. The few regions with critical mass are accelerating their leadership in terms of both ‘mindshare’ and market share, and appear to be increasing the gap between themselves and the smaller clusters. Unfortunately, many regions are suffering from a lack of early stage capital to fund innovation, shrinking corporate footprints that drain region of vibrant pools of talent, and a lack of entrepreneurial bench strength. This is disappointing, and bad for biotech as a whole.

But rather than make a broad commentary on the state of biotech clusters across the country, I thought it would be worth highlighting how the Greater Boston Metro area has steadily been solidifying its leadership as the top biotech cluster for early stage innovation.

Here are a few data points:

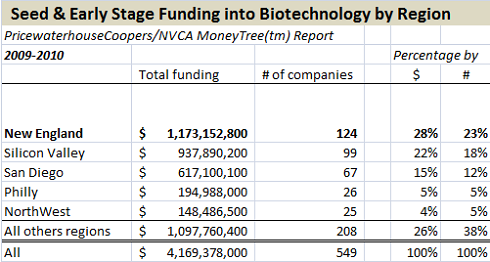

- More seed and early stage funding is flowing into life science companies into the Greater Boston area than any other part of the country over the past two years. See table below for both $ and #’s of new life science companies. These data suggest that for the past couple years the Greater Boston area has started and funded 25% more early stage companies than even the San Francisco region, the “birthplace of biotech”, and has consumed over a quarter of the country’s early stage capital. (Note this is just seed and early stage capital; San Fran catches up with larger late stage rounds and may even edge-out Boston in total capital flowing into the region’s biotechs).

- The Big Players in the life science industry have doubled-down on Boston at the expense of most other regions. Big Pharma in particular has recommitted to Boston over the past few years. While they are sadly having mass layoffs across the globe and most regions of the US, one major Metro that’s actually seen a net increase in hiring for R&D jobs is the Greater Boston area. This expanded footprint by Big Pharma brings a lot more than just jobs to the Boston Metro ecosystem: experienced R&D talent for startups, capital projects to foster lab development, a plethora of advisory and ancillary support firms catering to their needs, and more corporate ‘mindshare’ for the companies in the cluster. Here are some examples of this doubling down:

- Pfizer: While laying off thousands and shutting down uber-site Sandwich in the UK and others, and even closing its RTC Memorial Drive site in Cambridge, it is anticipating a “net increase” in new Boston-area hiring.

- Sanofi: In addition to acquiring Genzyme, Sanofi has committed to build its oncology global R&D headquarters in Cambridge – more than doubling its footprint in this area while laying off thousands in New Jersey and elsewhere.

- Novartis: Despite announcing thousands of layoffs in late 2010, they also announced expanding NIBR’s footprint in Cambridge by >15% (where it is already the city’s #1 employer)

- Shire, Genzyme have also been adding hires in the Boston area as well. Not to mention Merck’s Longwood facility, Biogen’s reinvigoration with George Scangos at the helm, Vertex’s pending launch of Telaprivir and likely expansion, Amgen’s hiring on top of its BioVex acquisition, etc…

- NIH support for basic research funding into Greater Boston academic labs continues to be at the top of the charts. With more NIH dollars flowing into the region’s labs than any other cluster, there’s a rich set of substrate of great science for creating the next generation of translationally-focused emerging biotech companies.

- Lastly, the Greater Boston area benefits from what is likely the highest “ecosystem density” in the country. I’d guess that 80% of the cluster operates inside the roughly 300 sq miles delineated by Route 128 or close to it. Silicon Valley alone is nearly 2x bigger than this, not to mention the sprawl into South San Fran and the rest of the Bay area’s life sciences. This means Boston area probably has at least 3x more biotech startups per square mile than San Fran area. San Diego is about the same size but 50% smaller in terms of startup biotech activity (see Table above). Other region’s may also have a high density (like the Philly area), but they lack the full complement of critical mass that one can find in Boston.

While the biotech industry is certainly global, startups are all about the local ecosystem. Distance and density definitely matter. With its deep concentration of academics, companies, talent, and capital, and the real challenges facing other biotech clusters around the country, it’s no wonder the Boston Metro area has emerged as the top early stage ecosystem.

It’s hard to beat Boston right now. In Biotech startups, at least. Please don’t mention baseball or jinx the Red Sox before the season.