Understanding the impact of different venture capital deal terms is not well appreciated by most Life Science entrepreneurs, especially in the early stage ecosystem. Moreover, knowing what the “market rate” for these terms are is rarely data-driven and often more than anecdotal.

Thankfully, to help with transparency, Cooley puts out a report on trends in venture deal terms. A great summary of the trends on a bunch of common deal terms in venture capital financings, like the type of anti-dilution, liquidation preferences, pay to plays, and such. One of the items caught my attention and warrants highlighting: fully participating preferred stock, also known as “double dip” preferred, and its use in Life Science deals.

This may be rather esoteric stuff about valuation and economics, but can be hugely meaningful to a management team and their potential financial returns so shouldn’t be dismissed.

Quick definitions. Others have covered this many times, but here’s the short take: When a company exits, “participating preferred stock” (PP) essentially returns its principle (1x “preference”) first, and then converts to common and shares the remainder (if there is any) on an as converted basis with the rest of the common stock (like that held by mgt teams). So it’s a stock that gets paid twice, hence the short name of “double dip” preferred. It’s more entrepreneur-friendly counterpart is “straight or non-participating preferred stock” (NPP), where the holders can choose to either get their 1x back, or to convert to common, but not both. Participation can be “capped” at certain returns (2x, 3x) where the common stockholders catch up to what they would have received under NPP terms after investors make some multiple on their investment.

What’s particularly interesting to note is the “market rate” in the Life Science is to use PP stock, where in Tech its become standard to see NPP stock. Here’s the data that parses out the LS piece from the report: ~60% of the 77 Life Science financings in 2010 involved participation vs only ~30% of Tech deals.

Why is participating preferred more common in the Life Sciences?

- Valuations. As an economic instrument, PP helps bridge valuation gaps between entrepreneurs and investors (e.g,. a VC might give a pre-money of $5M for PP, and $2.5M for NPP). In LS, where our drug discovery companies work on therapeutics a decade or more away from approval, coming up with reasonable valuations is hard. True product-based DCFs with realistic risk-adjustment would render most startup valuations well below $1M. So when Cooley cites a median pre-money of $6M+ for the LS Series As of 2009-2010, the use of PP clearly helps justify those higher valuations (note, obviously not all those are drug discovery Series A’s, btw).

- Capital intensity. PP can be viewed a protection against the drag on returns from high capital intensity. For companies that are capital efficient and have raised relatively small amounts of equity, PP has a marginal impact on common stockholder returns. And large, high multiple exits also make participation irrelevant. But once a company has raised a lot of equity (e.g., >$50M) and only achieves a modest exit multiple, the impacts become profound and it helps protect further dilution of a very limited upside. The drawback of this is that it creates a big wall of preferences in front of a management team that can distort incentives.

- Follow the money. Others have speculated on this point previously, but the first payments from investors to management are the salaries. Value is expected to be created of course, but those are the first economic transfers. Burn rates for executive compensation are higher in LS, as biotech management teams typically get paid more than Tech, on average 25% more. In purist terms, this is an economic tax that Tech doesn’t have, and so the economic terms for deals are different.

- Scarcity and habit. There are relatively few early stage biotech VCs today, and most use PP nearly 100% of the time. If there were lots of biotech VCs competing for startups, like there are in the seed/startup world in Tech, this might lead to different ‘market rates’ but its just not the case today for LS. Furthermore, once PP is a feature of a company’s DNA, it very rarely gets removed in subsequent financings.

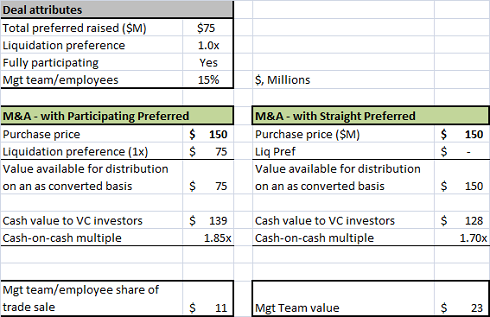

So what’s the impact of participation on returns? This has also been blogged on by others, but here’s a biotech example. Consider a biotech that has raised $75M to date in equity across a series of rounds, struggled over the years but finally has a lead product into early clinical studies and so could be sold today for $150M. Not a great return, but better than a loss.

The difference on the economics for the management team/employees is huge: 2x more with NPP/straight preferred than with PP. As noted above, if the company had raised a lot less equity capital, the difference between the two scenarios becomes quite small. For instance, raising $25M to achieve this outcome, the difference is a <$4M, not $12M.

Importantly, its impact is only manifest in an M&A exit, not an IPO. In a typical IPO all the preferred stock gets converted to common, so all these preferences disappear. For the management team of biotechs that have raised >$75M or more, this feature creates a huge incentive to go public vs. execute a modest trade sale. With the elimination of these preferences in an IPO, a management team can instantly get much significant share of the value of a business even if its below the total invested capital to date. This creates a huge distortion of incentives. And today there are over 75 private biotech companies that have raised over $75M. If the IPO window ever really opens back up for biotechs, I’m sure those management teams will be rushing to get out.

The last nuance around PP stock is the use of “caps” on participation. As noted in the data, a lot of deals kickout the participation feature once an investor has made 2x or 3x their invested capital. This has several issues with it in my opinion: first and most importantly, during the “catch up” period above the cap, investors have flat spot in their returns until the common stockholders get back to as NPP return level. The size of this flat spot is essentially as big as the value of the non-preferred valuation of the company. Second, every series of investor has different flat spots given the seniority of their payouts. This creates enormous layers of complexity and can distort alignment and incentives. Lastly, if a company delivers a higher multiple exit, its all irrelevant since the impact of PP becomes negligible.

Fully participating preferred is unlikely to shift much in LS, so entrepreneurs should focus on equity capital efficiency (making PP less relevant) and a healthy transparency with their Boards about its impact on their companies.

[Note: this blogpost’s data was edited in March 2012 to account for an error discovered in the Cooley dataset; key takeaway that a meaningful differential between LS and Tech with regard to participation remains in place]