Cambridge/Boston continues to separate itself from other clusters around the U.S. as an area of significant growth: more Pharma hires are happening here with layoffs elsewhere, significant talent inflows from around the world, more lab space than most markets, and just this morning John Carroll at FierceBiotech highlighted a WSJ report on the buildout of new Pfizer labs.

But one area Cambridge/Boston is also unfortunately leading is lab facility costs.

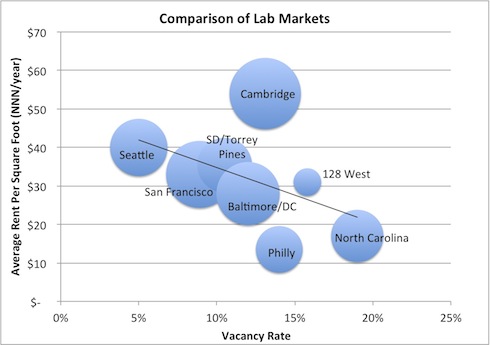

Through discussions with Adam Brinch and his colleagues at CB Richard Ellis and Juliette Reiter at Cushman & Wakefield, I managed to construct an approximate comparison of lab space in different US markets in 2Q 2011. The size of the bubbles reflect their estimates on total lab market size (including government labs in Maryland/DC, Pharma, etc…).

The conclusions:

- The lab market is reasonably efficient across most geographies: higher vacancies (more lab space available), lower prices per square foot. Since its local supply that sets the price, in some ways I was surprised to see how linear most markets were.

- Cambridge/Boston is an outlier: moderately high vacancy rate, but maintaining the highest rental costs in the country. I suspect this is due to expectations for continued demand growth. Interestingly, Route 128 in the Boston cluster is right back in line with other supply/demand rates

- Philly suffers from below average pricing – probably reflecting the glut of lab space being moved or likely to move into the market through Pharma’s contraction in the Mid-Atlantic.