Today’s headlines were replete with the customary quarterly whinging about biotech funding. Several pieces emphasize the doom and gloom in the startup biotech landscape, and include quotes from respected venture investors lamenting the end of early stage and the broken model of funding innovation. Sadly this has become an expected part of the self-flagellation we put ourselves through as a sector.

Bloomberg’s Ryan Flinn titled his piece “Biotechnology Funding Hits 4-Year High as Startups Suffer“, and cited the data showing that Life Science venture (Biotech & Medtech) only financed 153 “first rounds” last year. A couple other pieces citing that article highlight that “Startups are Hurting” and “…startup rounds shrivel“. They are good attention grabbing headlines.

But what is baffling is it doesn’t seem like anyone really dug into the data. I don’t like publishing blogs twice in a day, but this topic provoked a response. To quote our President, “You are entitled to your opinion, but not your own facts”. The data are what they are.

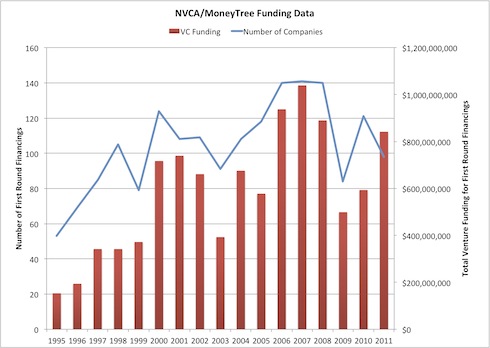

Citing the same source as everybody else I come to a very different conclusion. Using the recently released NVCA/MoneyTree data (where you can see and play with the spreadsheet yourself), I graphed a couple of the long term trends from the funding data on the “First Sequence by Industry” tab (where Ryan got his 153 startups number). Looking at Biotech alone (not including Med Tech) I can offer three observations:

1. Total VC funding into First Rounds in Biotech hit a 3-year high in 2011 and was one of the 4 highest years since 1995 (red bars below).

2. Last year, 98 First Round startups were funded; the 15-year average is 104 – so in line with long term averages. There’s been volatility (blue line below) and a drop since 2006-2008, but not a melt down. And we’re up over 2009.

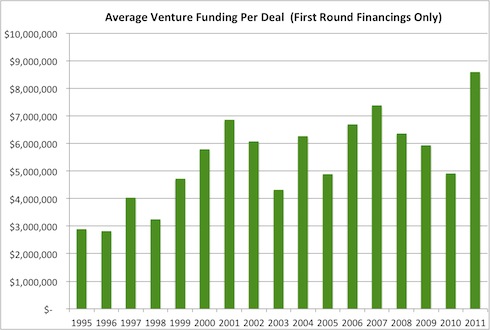

3. The average funding size of a First Round hit a 16-year high, and broke a 4-year trend of declining average first round funding (green bars below)

So if the data are positive, at least on a couple dimensions, how come all the media attention seems so negative? I’m not sure. But the negativity has pervaded our view of the funding landscape for years. 2007 was the biggest year on record above for both numbers of new first round startups and overall venture dollars, but E&Y’s Beyond Borders and many trade magazine articles cited the funding gap, the broken early stage model, and the challenge for startups. It seems that it is in our DNA as a sector to whinge about funding.

We need to remove our pessimistic lenses because over time everyone, including LPs, have started to believe there’s a major crisis in the startup biotech world. The data are what they are, and while its tough, they don’t cry out that biotechs are hurting, shriveling, or suffering immensely. There’s an ecosystem here that works: it funds ~100 new startups a year, not a bad pace of venture formation.

Don’t get me wrong, its a tough environment for biotech startups. And it might be abit tougher than in 2007 or 2000. But is it as tough as 2003, 1998, or 1995? I don’t know, but those were tough times. But tough is the nature of any startup in the venture ecosystem. Fundraising has never been easy. Its entrepreneurial capitalism. Lets get on with it.