Like many things driven by human nature, venture-backed biotech boardrooms often swing between the emotions of fear and greed. Fear of losing your shirt, or the greed of demanding more of the story than is warranted. It’s the age-old imbalance between optimism and pessimism, or credulity and skepticism, and it’s very hard to maintain the right balance.

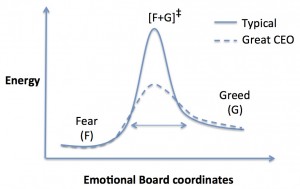

Using a reaction equilibrium metaphor, Fear and Greed are two reasonably stable, low-energy states for a Board, and which one is the preferred resting state depends on the makeup of the group. But there’s typically just one, and it can obviously change over time. Maintaining a Board where its balanced actually requires more free energy – like holding reaction in a transition state – and is rather unusual to do.

Fear is all about loss aversion – and since losses happen to about 40% of biotech investments, there’s plenty of fear in most boardrooms. In biotech, the #1 reason biotech investors lose money is for their company to run out of it. And running out of it can be the consequence of a drug candidate’s failure or a financing failure; the former leads to the latter, but the latter can occur even without bad data. Fear of these losing outcomes often leads to a number of suboptimal choices, including over-capitalizing a company (trying to protect against the downside), cutting the burn so much as to cut corners and impair a program (doing an under-powered clinical study), or doing less-than-optimal business development deals. A example of a “bad” deal: partnering a lead program just to get the cash to “feed” a biotech’s burn rate even though it was the best asset in the company. That may be non-dilutive on the cap table, but its ultimately very dilutive.

Nothing pushes a pendulum faster toward fear than troublesome clinical data or unexplainable findings. Often down-rounds of financing (raising money at lower prices) take advantage of fear from the existing investors – if they were bullish, why wouldn’t they do an insider round in the face of a challenging external financing. Down-rounds also further contribute to the fear factor in a boardroom.

Greed in the boardroom typically manifests as an irrational optimism about the value of a program. Strong clinical data clearly drives this kind of bullishness, but greed often pushes optimism beyond rational basis. Does the data really support such a rosy view of value? Often it doesn’t: Boardrooms where the pendulum has pushed to greed often ignore the deficiencies or challenges of a program and push forward without due caution. Greed is often about ‘keeping up the Jonses’ on the deal front: I’m sure the phrase “if Sirtris is worth $720M, aren’t we?” has been uttered in dozens of biotech boardrooms. Of course, I love it when greed wins in the boardroom and great deals get done – its outliers like this define the best returns in venture.

But beyond the helpful optimism, greed can certainly lead to counterproductive decision-making. For instance, Boards frequently debate the “walkaway” partnering or M&A deal value; nothing signals that greed has taken over the board more than a walkaway value a log-order higher than what the market is bidding on a program. Maybe there’s a rational basis for ignoring the market and pushing ahead, as inefficiencies in the market can be opportunities for making outsized returns. But too often greed’s bullishness becomes bullheadedness in the face of reality – leading to lost deals and impaired relationships.

Greed can often lead to similar suboptimal decision-making outcomes to fear, but for different reasons. In fundraising, the same over-capitalized outcome can occur except the motivation is different. Instead of worrying about loss aversion and raising more than you need, greed-induced overcapitalization is often driven wanting bigger warchests in the face of lots of interest. Why not raise more? Bigger funds eager to put more to work – so why not? The answer is because raising more is excessive dilution, and dilution is the bane of returns. Same goes for conducting the right clinical trial: greed (or more aptly over confidence) can lead to an irrational belief that our drug is so good its likely to turn an underpowered study into a big exit. Raising exactly what you expect to need to do the right set of value-creating steps (no more, no less) is a tricky balance between fear and greed.

As states of nature, fear and greed themselves aren’t that interesting; they are just what you’d expect from human interactions. But the most interesting moments occur when the pendulum swings between fear and greed: the down-round in a tough market followed a year or two later by a great M&A offer; getting into the clinic for the first time only to see a safety signal appear; receiving an FDA complete response letter in the midst of deal discussions; or the successful trial (or so we were told it was successful) that fails to generate any partner or financing interest. It is moments like these when balance seems hard for many boards to maintain, and often you can feel the board’s emotions shift between greed and fear and vice versa in real time. The tenor of the discussion just shifts and its palpable.

Great CEOs know how to manage their boards’ manic pendulum swings in good times and bad. Sort of like enzymes, they stabilize the unfavorable transition state in between fear and greed – making it energetically less unstable and bringing some balance to a board’s emotional state. This sort of maturity can be incredibly helpful in biotech. “Do you fancy yourself as an enzyme?” might be added to my CEO interview list.