The numbers are in on the 2012 Pharma/Biotech M&A performance, at least according to our friends at HBM Partners. They’ve released another well-annotated deal report and database.

The quick summary from a venture-backed biotech perspective: it was a good year although not a great one. Upfront and total deal values for venture-backed M&A of $3.5B and $8.5B, respectively in 2012. Those total upfronts are smaller than 2011, but larger than 2008-2010 annual numbers. Total annual deal numbers for VC-backed private acquisitions have been relatively steady since 2005 around ~30 deals, except for 2009 when only 19 occurred. About two-thirds of those deals have financials disclosed.

Here’s my quick take on the Good, Bad, and Ugly:

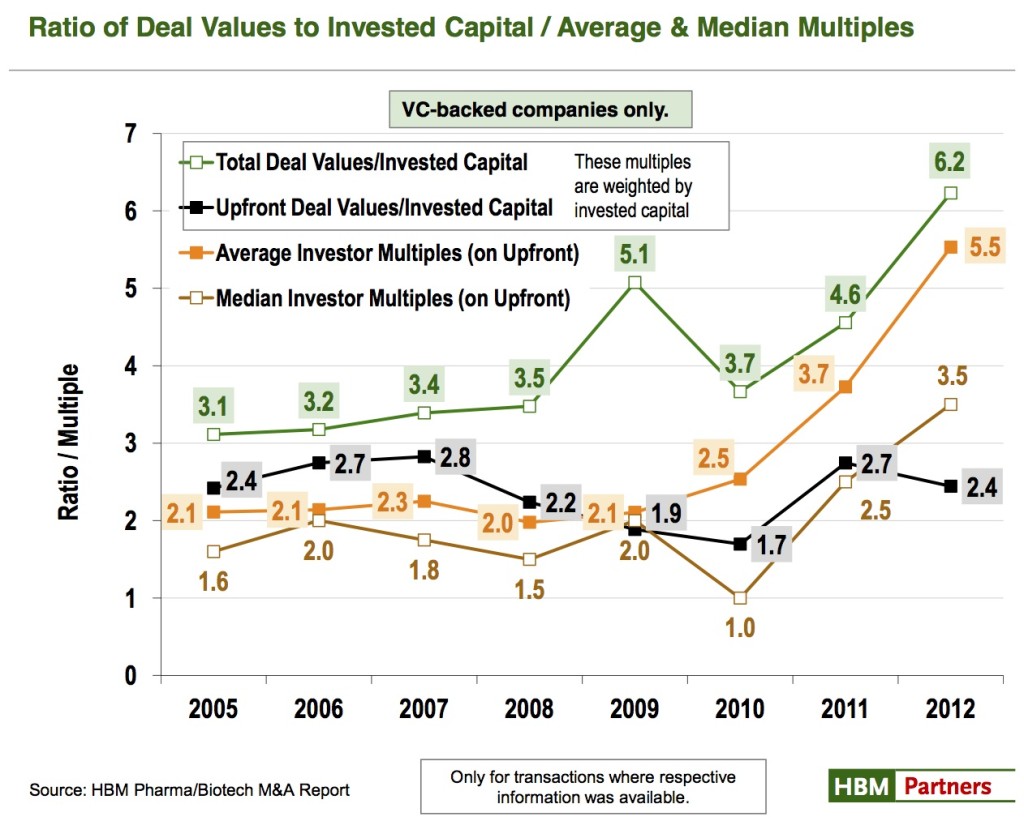

The Good: median investor multiples on upfront have risen from 1-2x during 2005-2010 up to 2.5x in 2011 and an attractive 3.5x in 2012. This trend bodes well for returns in the LS venture sector.

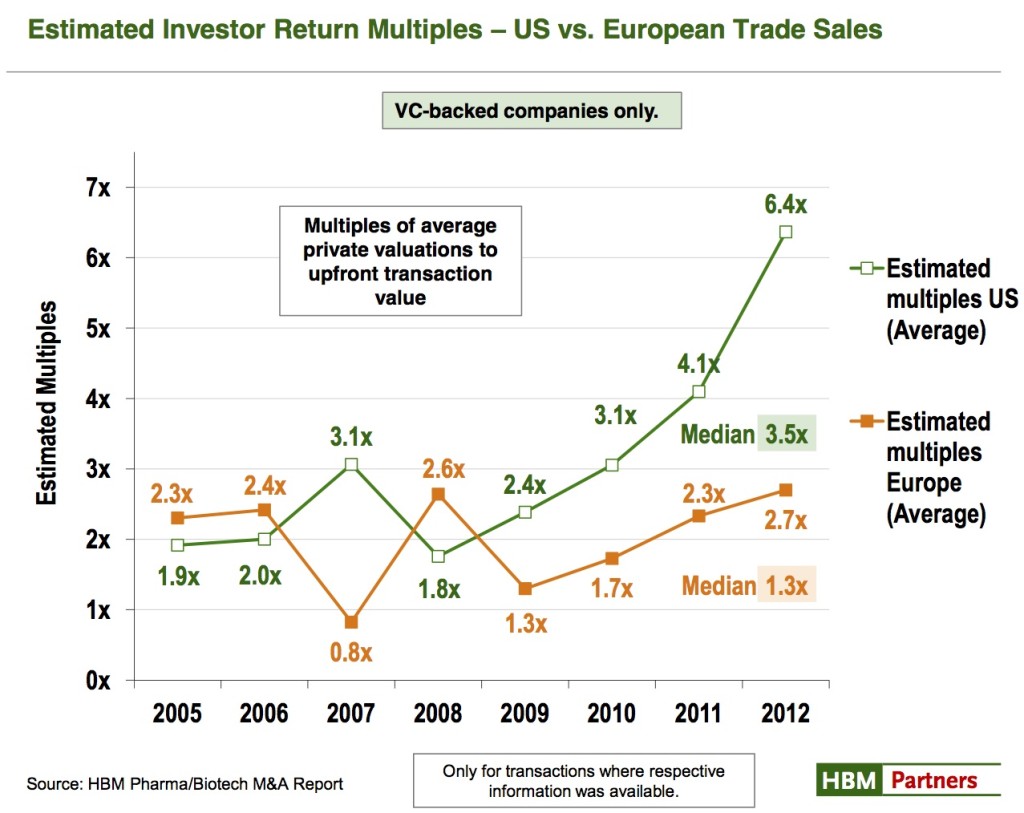

The Bad: European biotech exits have lagged in this data. The median exit value to invested capital multiple in European deals in 2012 was 1.3x vs. 3.5x in the US. For all but one of the last five years the US multiple has been higher by 50% or more. While small deal numbers start to test the significance of this, it’s certainly in line with sentiment that it’s been hard to drive great returns in Europe. Certainly a number of outliers to this point, and a few top venture firms have been able to consistently deliver, but as a sector its been even more challenging than in the US.

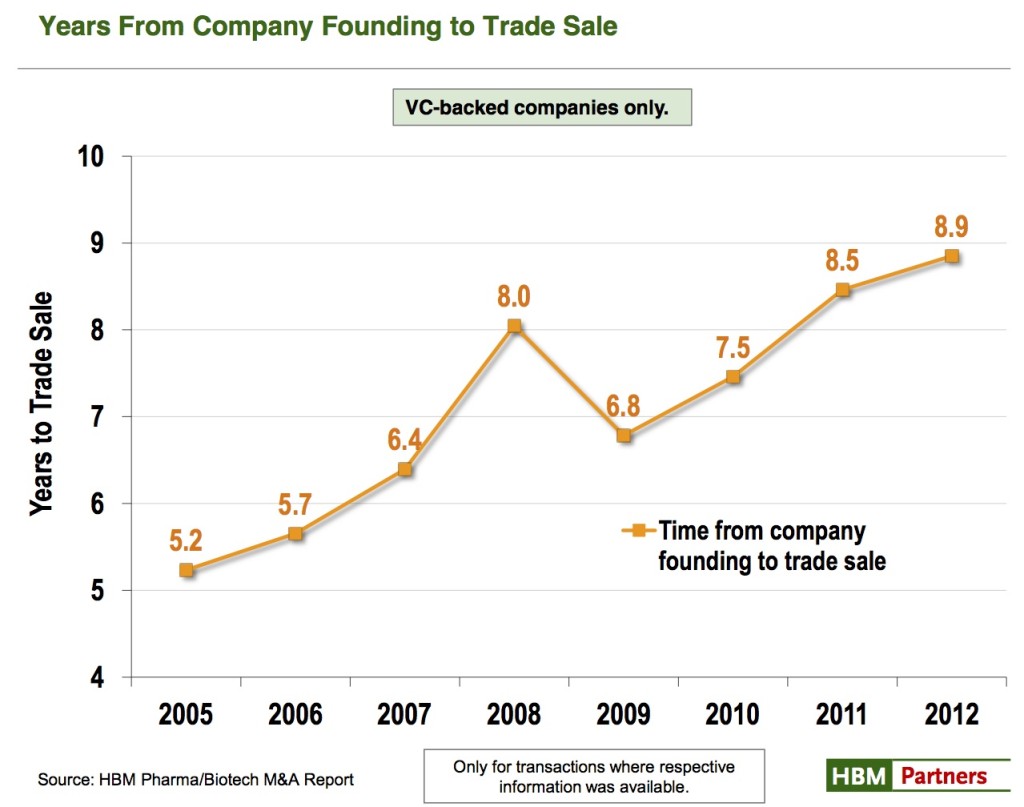

The Ugly: The trend on time from founding to trade sale looks painful. This appears to have gone up considerably from 2005 (~5 years) to 2012 (~9 yrs) in this dataset. I don’t have the raw numbers per deal around this, so don’t know how much these numbers are skewed by a few ‘older’ companies in each year (e.g., in 2012 DeCode and Enobia were founded 16 and 15 years before, respectively; both had recaps more recently). But its fair to say the trend line makes the signal hard to argue with and clearly of concern. Fortunately, time from founding to exit isn’t all that related to product stage and its possible to shorten the investment cycle time with different investment models: of 2012 exits, Skinmedica was 13 years from founding to exit with a marketed product, whereas Avila and Stromedix were less than 6 years from founding to exit with Phase 1 assets.

Lots of food for thought, as usual, in the HBM M&A report. Thanks to Uli and team for putting it out.