The past year has certainly been the most exciting one for Biotech IPOs since 2000, with dozens of new offerings and compelling therapeutic narratives. But focusing on these new IPOs misses an equal if not more exciting story: the significant outperformance of the 2011-2012 Biotech IPO classes.

The reality of biotech venture capital is that even after an IPO it can take years to achieve liquidity and “send cash home” to our LPs. These realizations can happen from either secondary offerings (which are relatively rare in biotech), slowly trading out of a position on higher volume days, or via organized block trades. Even post lock-up, the trading liquidity of most new biotech stocks is very limited (a challenge discussed here).

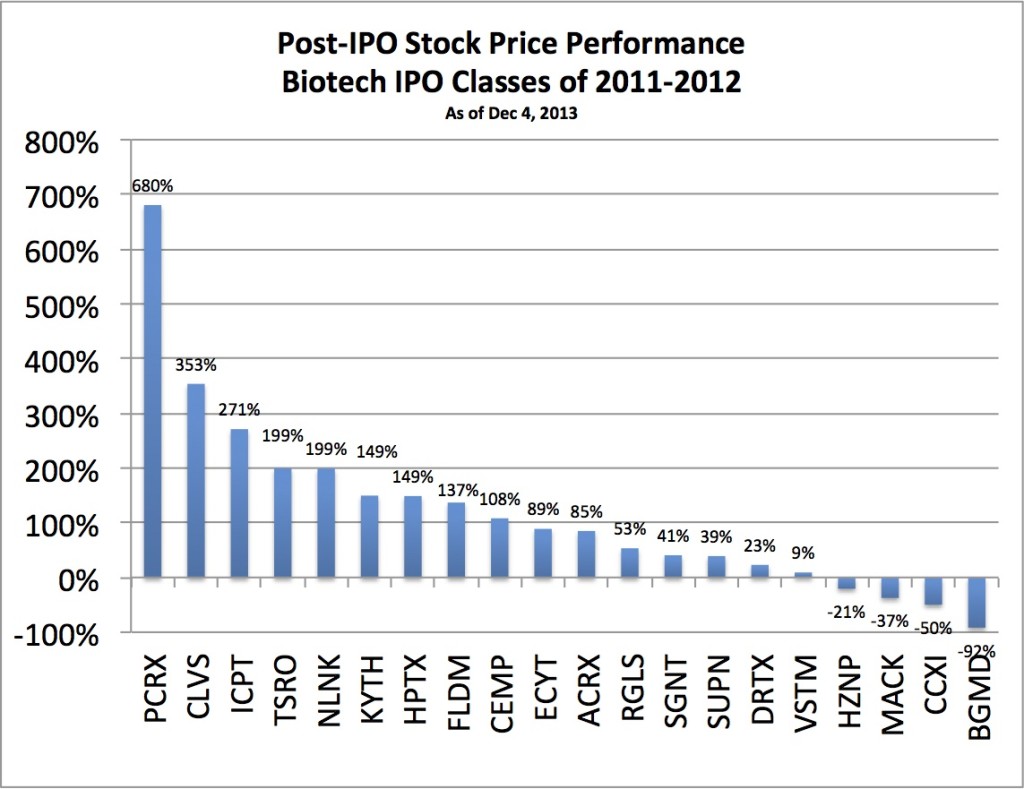

With that in mind, the current realized returns in the public capital markets are likely coming from the more seasoned “year-lings” of Biotech – the twenty new offerings that got public in 2011 and 2012. Here are a few observations on this group:

- These biotech offerings have crushed it: on average, their prices have gone up 119% and their market caps (because of subsequent issuances) are up 236%

- These offerings have, on average, outperformed the Nasdaq Biotech Index (NBI). If an investor put a $1 into each offering vs $1 into the index on the day of the IPO, these offerings would have beaten the NBI by 2200 basis points (119% vs 98%). And the NBI has been one of the best performing indices of the stock market.

- Only 20% of the companies (4/20) are below their IPO price. This is astoundingly good performance relative to prior IPO classes; at the October 2007 NASDAQ peak, 59% of the 2003-2007 IPO classes in biotech were below their IPO prices (see this Nature Biotech article)

- 95% of these companies (19/20) have market capitalizations today above $200M; only one, BG Medicine, has slipped into the “micro-cap” world. This is also impressive. These market cap’s bode well for this group if you believe the Feuerstein-Ratain Rule of late stage oncology trials (i.e., good things can only happen in Phase 3 to companies worth more than $300M) applies more generally to drug R&D.

- Early and late stage assets have done well. Clovis is largely valued today (and a big part of its rise in valuation) on its early stage EGFR program (from Avila!); Pacira is a commercial stage acute care spec pharma company. ChemoCentryx has late stage assets but has struggled, whereas Regulus is still preclinical but is up 50%. No differential performance is apparent by the stage of the assets.

- While several have utilized secondary offerings (Intercept, Endocyte), the majority of the liquidity from this group has likely come through trading out of their positions on high volume news/events.

Here’s a chart that captures their performance:

Lastly, it’s worth noting also that in June 2012, I blogged about three new oncology IPOs: Clovis, Tesaro, and Merrimack (link to post here). I was somewhat skeptical they would deliver the kind of value commensurate with their high capital intensity (all had raised $200-400M from inception through their IPOs). But I was wrong, at least about Clovis and Tesaro. They both have gone up 3-5 fold since their IPOs, and are amongst the top performers in this group. Great teams matter, and those teams have delivered and beaten the statistics. Merrimack’s disappointing data of late has unfortunately put it amongst the laggards.

The solid performance of the 2011-2012 IPO classes is great news for biotech venture capital, and has been largely overlooked in the excitement around this year’s offerings. But since these more seasoned stocks are actually the one’s driving liquidity and realized returns for their venture backers, the performance of this group is in many ways the great untold story of 2013. Until VCs generate real returns from the 2013 offerings, the transient, volatile value of a stock on paper is hard to get overly excited about. But I’m hoping to write something similar to this piece in December 2014 about the performance of the “year-lings” in the 2013 IPO Class.