In light of the continued interest in biotech IPOs by the capital markets, there’s probably not a venture-backed biotech boardroom that hasn’t been discussing the merits of going public. Whether warranted or not, taking a company public via an IPO is tantamount to grabbing the proverbial brass ring, a publicly recognized marker of success. Unfortunately, it’s not always the right choice for shareholders.

Weighing the opportunity of an IPO versus alternatives isn’t always straightforward. If it’s just about raising another financing, then getting public has some advantages over staying private, especially for management teams looking to lift an onerous liquidation preference off their heads. With valuations that appropriately reward early stage innovators, getting public is often smart relative to raising more “costly” private money.

So, how do we compare an IPO to an M&A alternative? Parallel tracking an IPO and M&A process is difficult, but when done effectively it can generate real choices for a company. How should a board weight these alternatives? There are lots of softer issues around the alternatives related to the team and culture, the long term vision of the company and its aspirations, as well as financial issues around future burn rate, updating internal reporting and accounting capabilities, dealing with the Street, etc..

But from a shareholder perspective, there are at least three important issues to consider:

- Risk/Return Profiles: Biotech is a risky business; getting paid for taking earlier risks, and sharing downstream upside with a partner via milestones, has to be weighed against “going longer” in the public markets where the upside may exist but so too the downside.

- Time to liquidity: M&A typically offers realized returns today, whereas IPOs can take years to exit (especially for thinly traded stocks or for insider shareholders). Future payouts via milestones obviously represent future liquidity points in an M&A deal.

- Dilution: Taking a company public implies selling a piece of the company to others; typical dilution can be 20-40% for an IPO. Some pre-2013 IPOs were north of 50%. Pre-IPO shareholders need to factor this into their return calculus.

The first two are fundamental drivers of how a company’s cost-of-capital can impact expectations and the relative merits of IPO vs M&A. More risk requires higher returns, and biotech’s risk profile (vs. other equities) therefore implies a higher return expectation – i.e., a higher cost-of-capital. Furthermore, time costs money; investors only want their cash locked up if they are generating a sufficient return. The cost of capital represents the required annualized return to make an investment worthwhile. Most analysts would suggest small cap R&D-stage biotech stocks have a cost of capital of 25-35%, if not higher.

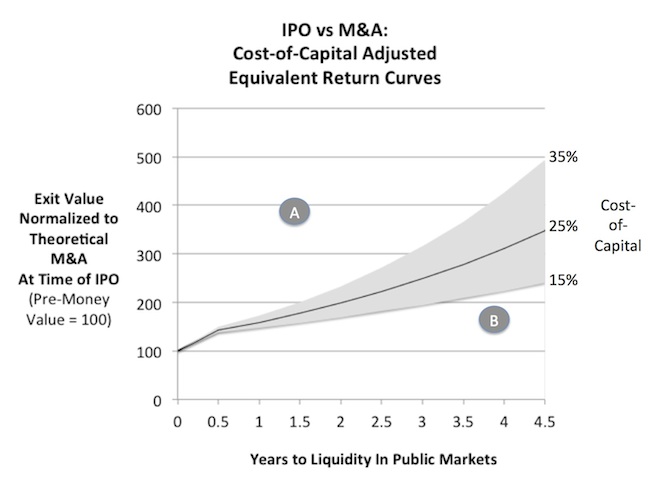

To illustrate how these three issues play into decision-making, I’ve constructed a chart below. Assume for a moment that there was a theoretical M&A deal on the table with an all-upfront value equal to the “pre-money” valuation of the IPO at the time of offering. Would it have been smart to take it, or should the company have gone ahead with the offering? I’ve normalized the chart to 100 as the theoretical M&A value. The lines and shading represent the “equivalency” of returns from an Internal Rate of Return perspective between an M&A today and the company’s valuation at a future liquidity point.

The first impact is dilution at the time of the offering; this model assumes 25% dilution from the issuance of new shares in the IPO. The slopes over time are the increase in value expected under different cost-of-capital assumptions over time. For instance, if it takes 2 years to get liquid following an IPO (not an unreasonable expectation actually), and the cost-of-capital is 25%, the minimum required valuation to make the offering a smart decision for pre-IPO shareholders is a doubling of the valuation over that time period, e.g., a $400M IPO needs to be an $800M company within 24 months.

What’s the right expectation for time-to-liquidity? I don’t have the data on the average, but my guess is that two years is the median. A quick look at some of the 2010-2012 IPOs and their major holders is instructive. NEA is still well invested in Tesaro, two years later (here). Bessemer just exited a majority of its position in Verastem, two years later (here). And Alta sold in 4Q its Chemocentryx position (here). Holding periods in the public markets depend on several things: an institutional interest in “going long” (or not), insider knowledge restricting the sale of shares, and daily trading volume. Again, I’d argue that historically it has taken 2+ years to exit most positions so the middle of this chart is a reasonable expectation.

For a Board and its shareholders, if you are confident (or optimistic) that you’ll be in Zone A when you want to achieve liquidity of your shares, than the IPO is obviously the right choice. If you think there’s a higher likelihood of being in Zone B at that point, below the curves but still above the IPO valuation, its smarter to take the M&A deal now. This is the critical takeaway of this chart. Higher future valuations, above the IPO price, could still make an M&A deal today more attractive if they aren’t high enough to compensate for dilution and the cost-of-capital. It all comes down to whether you have realistic valuation and time-to-liquidity expectations.

The above analysis obviously ignores two things that could change the analysis from the shareholders perspective. First, most M&A deals today aren’t all upfront, and the milestones can represent big increases in value in the future; this would push the “return equivalent” valuation line upward. This isn’t illustrated in the chart because it gets too complicated. Second, most biotech’s issue follow-on primary offerings within the first two years following an IPO; these are dilutive and would further push the “return equivalent” valuation line upward for pre-IPO shareholders.

This also ignores another important factor – liquidation preferences and their impact on management teams. Its common for biotech deals to issue stock called participating preferred, as I’ve blogged on in the past (here). In that post, the impact of participation on the value of a management team’s ownership can be dramatic in deals that raise large amounts of equity capital. So there’s a huge incentive for going public, where the participation feature disappears. For instance, in a deal that has raised $100M of participating preferred stock, there’s a nearly 2x difference in favor of a $200M IPO for a management team vs a $200M M&A deal (ignoring dilution for a moment, since ownership/options are at least partially reloaded in many cases). This is material, and obviously impacts enthusiasm for one alternative over the other. Its important for Boards and management teams to have an open and transparent dialogue about these topics.

This IPO vs M&A analysis may seem totally theoretical, but it has real implications. Take Forma’s recent decision to do a deal with Celgene vs going IPO; it clearly mapped out a path of little dilution, and significant funding, to achieve its vision and line up a successful exit down the road. Or Aragon’s decision to sell to J&J a year ago: $650M upfront with $350 in milestones would need to be a $1.5-2.0B biotech today to on a “rate of return equivalent” basis.

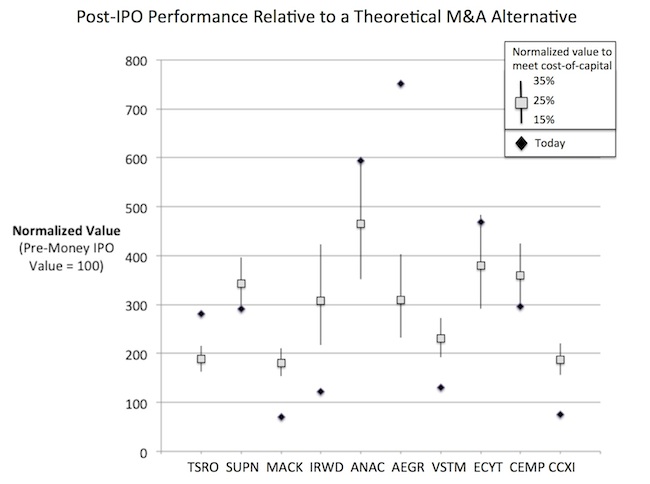

For more practical examples, lets take a look at some practical examples from the 2010-2012 IPO classes (where enough time has passed that cost-of-capital impacts are meaningful). Below is a chart of some case studies. The pre-money valuations were normalized to 100 for each of these stocks, and then the actual IPO dilution was factored in along with a range of “required” returns implied by the cost-of-capital range; these are banded by the ranges on the chart. Today’s valuation is a diamond. As you’ll see, a few stocks would have been better off selling instead of going public if, as a mental exercise, they had an M&A alternative at the pre-money offering valuation. These include the obvious underperformers Merrimack and Chemocentryx (below their IPO valuations), but also Ironwood and Verastem. The latter two haven’t delivered a cost-of-capital commensurate with biotech following their IPOs. The future could change for all four of these stocks – if Ironwood’s new drug sales exceed expectations or Verastem’s cancer stem cell drugs show great efficacy, they could achieve valuations that provide compelling returns above their cost-of-capital. But as of right now, these have not fulfilled that promise. Aegerion on the other hand has massively outperformed, way above any cost-of-capital expectation.

Boards need to understand that institutional investors have other choices. Although we focus on cash-on-cash multiples in venture, the rate of return is an important comparative metric across asset classes. And the above analysis shows that, when appropriately framed with realistic assumptions, the expected returns (and therefore cost-of-capital) can have material impacts on choices between an IPO and an M&A alternative.