Venture capital in biotech has had a great run over the past few years: funding going to private biotech companies is at historic highs, new venture funds are getting raised, and exits have been happening via robust IPO and M&A markets. Yet, although it may come as a surprise to many, in the world of venture capital biotech remains a very minor player and has actually shrunk on a relative basis even during the latest boom.

A quick review of the 3Q 2015 PricewaterhouseCoopers/National Venture Capital Association MoneyTree Report, powered by data from Thomson Reuters, helps put this in perspective. Here are four longitudinal observations on US venture investments since 1995.

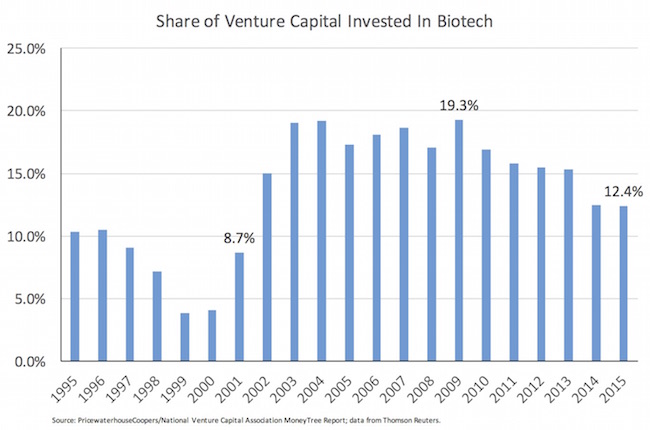

1. Despite a gangbuster string of funding in the last few quarters, Biotech is at it’s lowest share of venture capital investments since George Bush’s inauguration in 2001 – only 12.4% of total venture capital disbursements in 2015. Biotech topped out as a share of the industry in 2009 at 19.3%, in part because the contraction in biotech funding was far less severe than in the tech sector as the financial crisis bottomed out in that year. The percentage has steadily diminished over the past few years, where today only one out of eight dollars in venture goes into biotech.

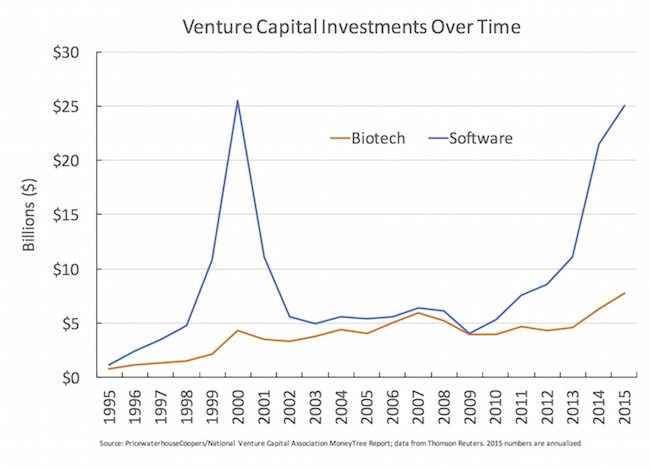

2. Software investing in particular has skyrocketed relative to Biotech, with a spike in funding that echoes the 2000 Bubble. Although biotech venture funding has progressed upwards since the 2009 bottom, now up nearly 2-fold since then, software VC investing is up a staggering ~525%, on track for 2015 to meet or exceed the 2000 funding level of $25B. By comparison, biotech is likely to surpass a paltry $7.5B this year if the fourth quarter looks like the prior three (also an all-time high). As I’ve noted for biotech, much of the “venture” money that’s plowed into biotech in recent quarters has come from crossover investors rather than conventional venture firms – likely as much 67% of the big mezzanine rounds that drive the aggregate number come from these non-venture sources (here). This phenomenon is also in place in the later stage private tech sector as well, with hedge and mutual funds like Tiger Global and T.Rowe investing in many of the unicorns (here), although its not clear what proportion of the overall funding amounts have come from these investors.

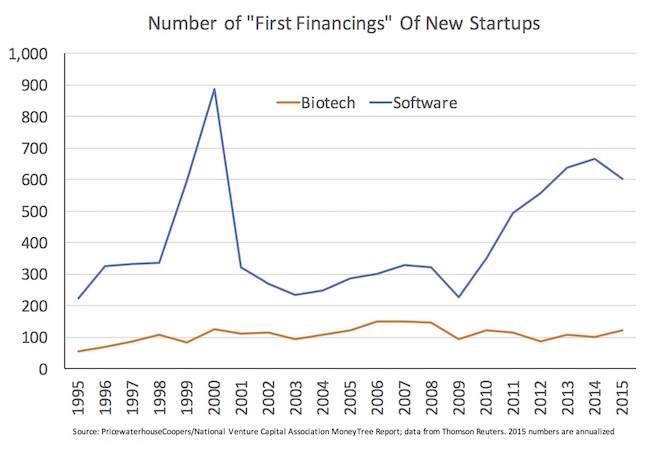

3. The pace of new startup formation remains largely flat in biotech, unlike the explosion in tech startups. The substrate entering the venture formation cycle creates the supply of startups that consumes future venture funding over the next 4-7 years in the private markets. As I’ve noted before and remains the case, even in 2015, the pace of biotech “first financings” (a good proxy for startup formation) remains largely flat, tracking to 100-120 companies per year over the past decade. In software, this number has risen by ~100% over the past few years, pushing out over 1600 new tech companies in the past three years. It’s worth noting, however, that both sectors have experienced higher funding rates per new startup – and biotech in particular: the average funding level per first financing in biotech is up nearly 2x in 2015 vs 2014 (an observation captured in part in my recent valuation blog post, here). Powering up young companies with lots of capital is great if there’s a “premium value” off-ramp via a accommodative IPO market; otherwise, over-capitalizing young companies is a recipe for future down-rounds.

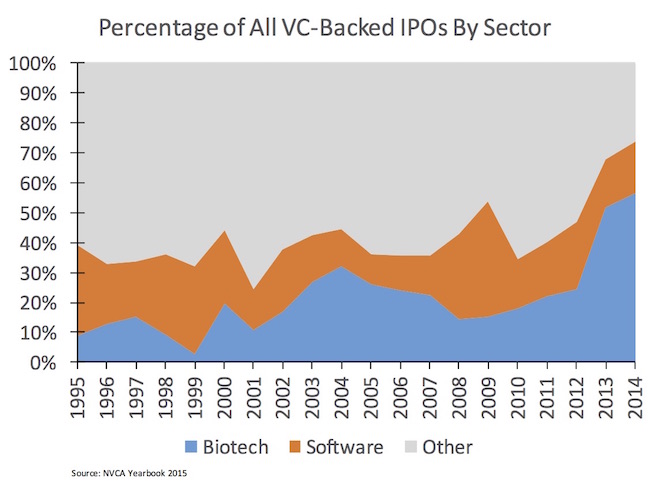

4. Fortunately, biotech has grown in its share of the number of IPO offerings. This isn’t a surprise to those observing the biotech IPO window over the past couple years, and the increasing number of private tech unicorns struggling to get public (here). This surge in offerings has impacted the number of innovative biotech companies in the private investing universe; a good deal of substrate has graduated into the public markets, driving up the demand for interesting new and emerging private companies.

In light of the pace of IPOs (#4), as well as M&A exits, it’s worth continuing to question whether the rate of formation (#3) is enough to support the long-term growth the industry. Should more funding be going into a larger number of young startups, exploring a broader range of science (maybe beyond just I/O)? Or does the increase in funds-per-startup mean that we’re building fewer, but healthier companies? I’m probably more biased to the former, and think the latter rests on an often faulty premise that picking winning science early and powering it up quickly is smart. History would suggest it’s not that easy, especially where the false positive rate (e.g., irreproducible science) is so high.

None of these four observations are an indication (or not) of whether there’s been an investing or valuation bubble in biotech; they are just useful as a comparative framework to the dynamics of other venture sectors. With regard to biotech, we’ve certainly witnessed an incredible period over the past coupe years across the value chain – from Big Biotech’s outperformance with the likes of Celgene and Biogen, to the small cap and IPO marketplace – even with the recent market “correction” taken into consideration.

But since the universe of LP’s that invests in tech and biotech venture capital is largely the same, it’s worth stepping back and looking at the macro funding and venture formation trends in different sectors. The charts above paint an interesting picture to put sectors in context. As I covered in a post from September 2013 (here), there are dramatically different supply and demand forces at work across sectors in the VC-backed private company arena. First Round Capital’s letter to its LP’s spells out some of these issues from the tech perspective (here), and highlights the potential dangers of investing in overly-heated markets. I’m sure a number of biotech investors are thinking about that concept right now with the NASDAQ Biotech Index off more than 25% in a couple months, but it’s fair to say that the venture-backed private biotech investing climate isn’t anything like the startup funding markets of other venture brethren.