Over the past seven years, Celgene has emerged as one of the most active and creative deal-makers in the biopharma industry.

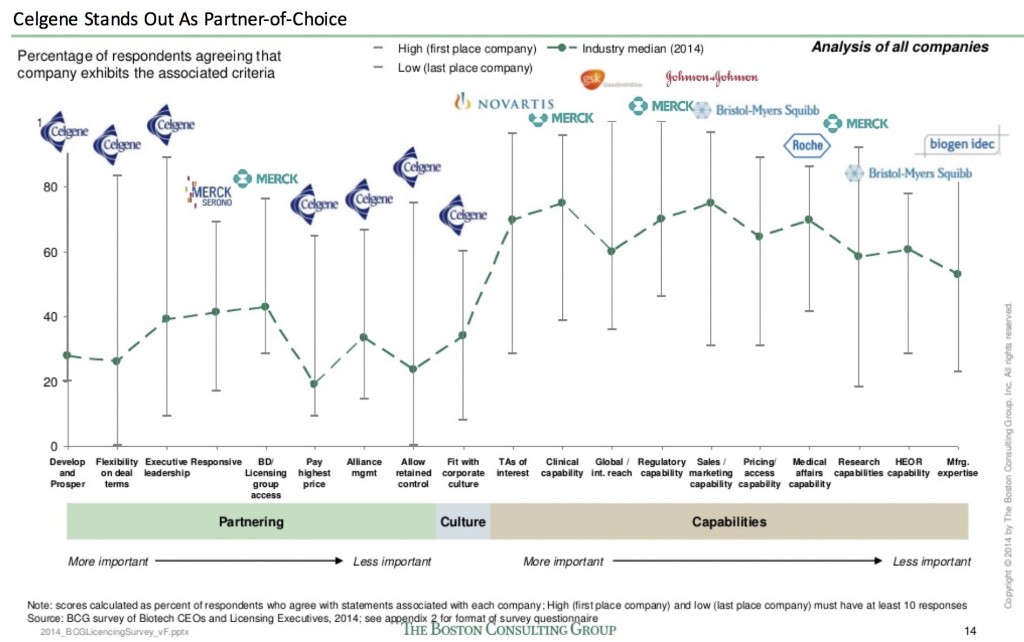

The Boston Consulting Group’s Biopharma Partnering Survey and Benchmarking analysis examines BD activity and perceptions across the industry, and their 2014 analysis was very telling. Celgene scored as the best partner on 78% of the partnering and culture metrics (7/9), as perceived by the sell-side biotechs (Figure below). Back in 2012, they were tops in “only” 44% of those nine metrics; in 2008, their first year in the survey, they weren’t in the pole position in any of rankings. In seven years, they went straight to the top of the charts. Their impressive trajectory into the industry’s ‘partner of choice’ implies they are doing something right.

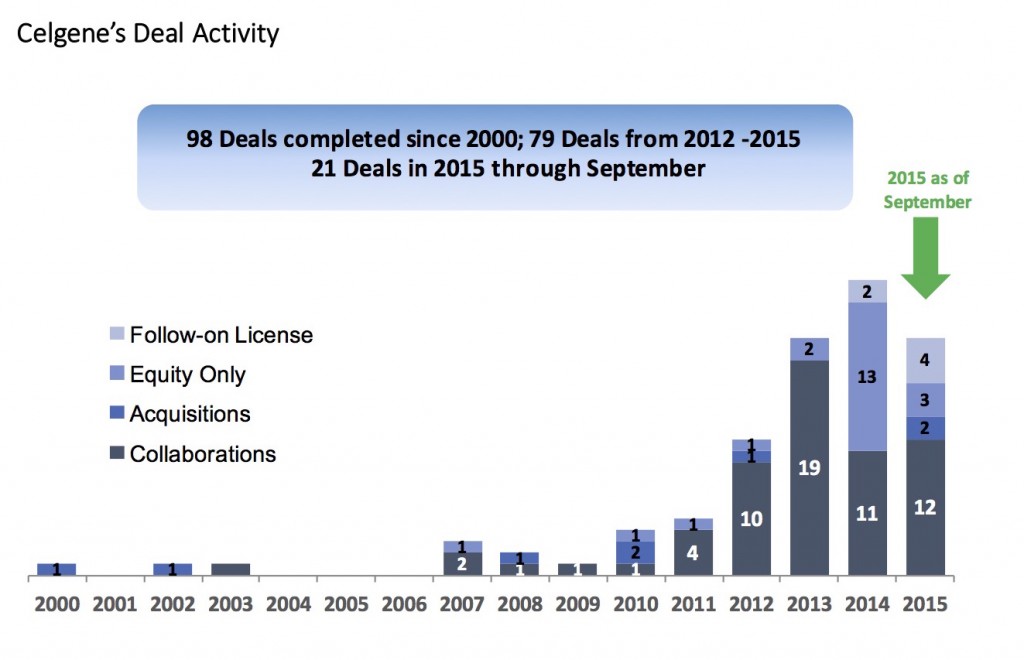

A quick snapshot of their deal activity over the past fifteen years illustrates the numbers behind that trajectory. Celgene has done nearly 80 deals in the past four years, inclusive of licenses, direct equity, M&A, and collaborations. We all the know many of the names of their partners: Acceleron, Agios, Array, Avila, bluebird, Epizyme, Juno, Nogra, OncoMed, VentiRx, and many others.

As a consequence of this external R&D performance, I’m frequently asked by executives at other Pharma companies what makes for the “special sauce” at Celgene. With our biotech portfolio out there on the front lines with partnering discussions across the industry, Atlas certainly has a perspective as to what makes Celgene one of the preferred partners in the industry.

But to probe this topic further, I had the pleasure of going straight to the source at our recent Atlas Retreat, where both Tom Daniel and George Golumbeski, heads of Celgene’s R&D and BD, respectively, joined me on the stage. I was surprised to learn that they’ve never been on a panel together to talk about what underpins the Celgene external R&D strategy, so it was privilege to moderate the discussion.

Using my descriptors, not their’s (in case they don’t like them), here are the “seven habits”, or more aptly just attributes, of Celgene’s highly successful external R&D strategy, spanning their unique leadership context and unusual culture:

Exhibiting more David, less Goliath. Immediately prior to taking on their current roles at Celgene, both Tom and George were executives in small venture-backed biotech companies. Tom was the founding CSO at Ambrx, and George was the CEO of Nabriva Therapeutics. Both of these experiences, and a set of biotech roles earlier in their careers, helped shape their appreciation for (and empathy with) the biotech executives that sit across from them. They know what its like to manage Boards, handle demanding investors, stress about cash runways, and all the other fun elements of running small companies; they’ve been on the other side of the table. Very few large $90B+ market cap companies have a biotech-experienced head of R&D or BD, let alone both roles simultaneously. In short, they understand and embrace what its like to be biotech (David) navigating a deal with Big BioPharma (Goliath), and that experiential difference manifests in how Celgene approaches its potential partners.

Starting with a clean sheet of paper. A decade ago Celgene had no real legacy organizational constraints. It had a very small physical R&D footprint, and as the chart above shows, its deal activity was relatively anemic. With the success of the IMiD franchise in the mid-2000s, they increasingly had the financial wherewithal to expand – yet, they resisted the urge to build extensively inside of Celgene and instead adopted a model of external R&D with distributed set of partnerships. In balance with a small, focused and productive internal research organization, Tom set up a dedicated External R&D function, which Peter Worland led very successfully. With each new deal, the virtuous cycle amplified the perception of success, leading to more deals, more activity, and even broader R&D reach. Today they have a distributed research model, including one of the most extensive and innovative external R&D portfolios in the industry with a broad range of significant product rights. All of this was built without the encumbrances and burdens of a huge legacy installed base of R&D campuses, physical and depreciating infrastructure, and armies of internal scientists; this difference in “starting” context has allowed Celgene to move with the agility and creativity that few larger players have.

Embracing risk, empowerment, and trust. Celgene’s philosophy towards deal-making involves taking risk around great science, empowering their partners to know what’s best, and trusting in great management teams to do the right thing. This has largely led to a model where large upfront payments help to financially support their partners, while a more arms-length governance model leaves decision-making and control with the biotech itself. Prior to Agios, the first of Celgene’s deals of this type, this deal configuration was very uncommon in the industry. Celgene has now replicated this or various permutations of it across a broad range of transactions – be they collaborations, licenses, or built-to-buy structured M&A deals. Fundamentally, it all comes down to great science and a lot of trust, which has worked well for them.

Governing with unconventional out-of-the-box leadership. Celgene’s senior leadership and Board have been exceptionally supportive of this external R&D strategy and the financial flexibility it required. CEO Bob Hugin and a trifecta of CFOs (David Gryska 2006-2010, Jacqualyn Fouse 2010-2014, and Peter Kellogg 2014-today) have been critically important catalysts for enabling Celgene’s external R&D strategy and deal-making activity. They endorsed and indeed encouraged the unorthodox deal structure described above, and in doing so gave George and Tom the ability to experiment with and push the external R&D model in new directions.

Inverting and resizing the talent model. Celgene has a small tight-knit group of deal-makers in their BD organization – in the neighborhood of six professionals dedicated to doing deals. This is a tiny fraction of the size of most BD organizations with similar deal-making activity; most of Big BioPharma have rooms full of BD people. Beyond the striking scale differences, Celgene also has different staffing model. In many organizations, BD is frequently a place where scientists go mid-career to become scouts first and eventually deal-doers. At Celgene, it’s a place for dynamic young people with super high-energy and enormous potential. This changes the tone and tenor of the group, as they don’t have pre-existing perspectives of “the only way you do a deal is XYZ”. This also probably drops the average age of their BD organization by 1-2 decades relative to most of Big Pharma. The idea is these young high potentials come to Celgene, do some great deals, and then move throughout the organization. BD becomes a portal to access some of the best-and-brightest 25-35 year olds. Interestingly, many of these stars have found their way recently into executive roles in a new crop of biotech startups.

Learning at every opportunity. Tom calls it the “Learner mindset” – take every deal, every experience, every interaction with a biotech and learn from it. Letting success (or for that matter, failure) box a team into thinking there’s only one way to do deals or structure collaborations is anathema to this listen and learn mentality. One sees this in the evolution of their deal structures since Agios and the “early” deals – especially in the diversity of deal configurations they are employing today.

Living better through (personal) chemistry. Saving the most important for last – like all things, the “special sauce” is about the people and relationships. The personal chemistry between Tom and George is impressive to watch. They talk every day, and they finish each others’ sentences like a married couple might. And amazingly, they actually really do like each other, respect each other, and don’t feel they have to compete with each other. In the politics of big organizations, its unusual to have a Head of R&D and Head of BD that aren’t competing for budget, prestige, or promotion in some shape or form. That really doesn’t appear to be the case at Celgene.

As a final thought, and important note of balance, there are several other large biopharma companies who are also great at external R&D and the deal-making required to drive it forward. Some of the attributes above could appropriately be ascribed to their models as well. But given Celgene’s impressive trajectory over the past few years, and my opportunity to moderate a fun dialogue with both Tom and George, I figured that highlighting a few elements of their particular “special sauce” was appropriate.

Two questions are worth raising as a conclusion.

First, Celgene has grown enormously over the past 5-7 years, including more than tripling its internal headcount. A critical question for them is whether they will be able to maintain their unique external R&D “context and culture”, or will they morph into Big Pharma? This is the challenge that Tom, George, and the rest of the Celgene leadership have in front of them.

Second, is who will be the partner of choice over the next few years? Are others likely to take a few pages out of the Celgene playbook, or perhaps innovate on deal-making in their own ways? It will be interesting to see who’s at the top when BCG does their 2018 Survey. It very well could be Celgene, but it’s an open playing field at this point.