The past five years have been the greatest bull run in the history of the biotech industry. Stock market outperformance, significant fundraising levels both private and public, more IPOs in this window than ever before, and huge volumes of M&A. As we head into the annual JPM Healthcare Conference next week, it’s worth reflecting on the state of the industry:

- Valuations remain very strong. The NASDAQ Biotech Index has never been at 3500 heading into a new year (or 3300-ish into a JPM conference) before; despite the volatility, the index was up nearly 11% in 2015 – as compared to the S&P500 being down nearly 1%. Lots of star-performing small-cap biotech names are off their all-time-highs, but many still maintain attractive multi-billion dollar valuations today. A large number of pre-data preclinical and Phase 1 stage companies are being valued north of $300M.

- The IPO window is still open. Over 140 biotech companies had closed successful, significant IPOs since the spring of 2013, marking the most prolific IPO window in history. The sector had at least sixteen biotech IPOs since mid-September, and the queue for new issuances later in January and February of 2016 has ballooned. At least eight S-1’s on file went public Tuesday and Wednesday of this week – including CRISPR play Editas, epigenetics/combo story Syndax, and gene therapy play Audentes, among others (here, here). There will undoubtedly be a substantial number of biotech IPOs in 2016.

- Deal-making continues at a feverish pace. We’ve witnessed tens-of-billions in R&D-stage M&A annually over the past few years. Further, Pharma is engaging in earlier stage partnering more actively; yesterday, we announced two R&D collaborations with structured M&A components – so called “Build-to-Buy” acquisition option deals – with Quartet-Merck and Rodin-Biogen (here).

The big question, though, is whether this cycle, in place since the bottom in 2009, is truly unique or special relative to past investment cycles, and how that might affect its sustainability.

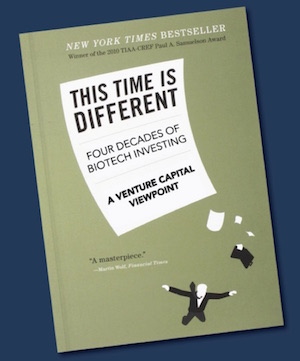

As I outline in a new paper out in the January 2016 issue of Nature Biotechnology, titled “This Time May Be Different”, there’s a strong case to be made that indeed this time is different. I know those are the four most dangerous words in the investing world, and ignoring history is folly. Hence why I’ll hedge and say that it may be different.

A summary of the article is below, but I encourage readers with interest in more depth to read the paper itself, with figures and data supporting each of the points below.

The Commentary first sets some of the context for the current cycle relative to past environments. Since the industry’s inception in the early 1980s, we’ve experienced at least eight cycles, with the current one exceptionally sustained and dynamic.

This Time Is Different.

Against this historic backdrop, there are at least four things about the current cycle that make it different than past periods:

- Advancing Products Over Promise. We are in the midst of a biomedical renaissance that is delivering transformative medicines, like Solvaldi, Ibrutinib, Zydelig, anti-PCSK9s, anti-IL17s, CAR-Ts, gene therapy, and many many others. The industry’s pipeline is incredibly rich today, with over 3400 active clinical stage projects, 70% of which are being advanced by small companies. After nearly four decades of promises, the biotech industry is truly delivering in earnest on its potential for high impact therapeutics; this is indeed a significant new feature of today’s environment versus past cycles.

- Maturing Industry Players. Biotech is no longer an emerging sector as it was in it’s first few decades. There are 2500 US biotech companies, including over 400 traded on major public market exchanges. Further, many have real financial metrics: examining the companies in the NASDAQ Biotech Index in aggregate, the industry’s revenues and earnings have more than doubled over the past five years. In addition, the number of biotech companies with more than $1 billion in market capitalization has gone up 3x during that time. We have a robustly capitalized biotech sector today.

- Deepening Capital Markets. Past bull markets in biotech had very shallow institutional investor pools; when these investors got anxious, sentiment rapidly went negative, provoking a feast-or-famine, open-or-closed market environment. Today, the breadth and depth of the equity capital markets have never been more extensive, across both specialist and generalist firms. Hundreds of institutional IPO buyers have participated frequently over the past three years, not dozens like in past cycles. Positive fund flows in biotech have been a critical driver of demand for biotech over the past five years; watching fund flows in 2016 will be important. Given the lack of other compelling equity sector options, and low interest rates, biotech may resume neutral to positive flows in 2016. So while it remains to be seen how this will play out in 2016, the depth of the biotech capital markets today is very different and reflective of a much deeper and more resilient investor pool – and has supported the longest IPO window ever in biotech (nearly 32 months and counting). The volume of IPO activity in the first quarter of 2016 will be a test of this part of the thesis.

- Improving R&D Productivity. The last point of difference is that after years of declining R&D productivity, the sector may be at a turning point: the ROI on R&D may be improving, according to both BCG and McKinsey. In addition, as a lagging indicator, the number of FDA approvals reached a nearly two-decade high with 44 new therapeutics approved in 2016. These positive R&D productivity trends likely reflect better decision-making and a shift towards more “External R&D” strategies (here).

The above four elements strongly support the idea that this investment cycle may offer some structural differences versus past periods.

What’s Not Different.

To be balanced, it’s worth calling out a few things about the current environment that aren’t different from past expansionary cycles; here are highlights of three:

- Valuation Inflation. Every bull market sees an uptick in valuations, and this one is no different. P/E ratios have expanded, and pre-money valuations for both IPOs and private rounds have moved upwards (here). Historically, when valuations overshoot, two possible outcomes occur: either companies quickly grow into their valuations (newsflow around compelling data, perhaps), or they see their share prices drop back to earth. We’ve seen some of both in recent months.

- Event-driven Hyper-volatility. Biotech is an event-driven sector, and blockbuster clinical data can move stocks, even large ones. Since the launch of the NASDAQ Biotech Index in 1993, one out of every five months has a 10% move up or down in the index. That’s enormous volatility. Furthermore, its been there for twenty years and its not going away.

- Payor and Reimbursement Challenges. Pricing is the perennial issue that plagues our sector; public debate about it (and tweets on the topic) always spooks investors, with fears of price controls cutting back the premium for innovation. That would certainly have dire consequences. We need to get out in front of this issue and focus on value-based pricing, but its an issue we’ve been wrestling with for decades and this cycle is no different.

Conclusion

I’ll leave specific stock predictions to other pundits, but do believe there’s strong support for the premise that structural changes in the industry have enabled a “new normal” today that is intrinsically a more robust biotech investing climate.

While we certainly face common cyclic issues like expansionary valuations, volatility, and pricing concerns, there’s multiple reasons to believe we’ve matured as a sector, and along with that comes deeper, more sustained capital market access that can fuel the continued advancement of new medicines.

This time may indeed be different.

Note: This post is also live at Trade Secrets blog of Nature Biotechnology. Further, the illustration above is a spoof of the cover of the well read business book, This Time Is Different, by Rogoff and Reinhart. A good read about the similarities of financial crises over time.