Jumping into a first-time CEO role in an emerging biotech is a daunting but exciting opportunity – both for the newly-minted chief executive and their Board of Directors. A great hire can be positively catalytic to a startup; and, sadly, the unfortunate inverse is also true. In light of this, helping recruit the leading executive for a startup biotech is probably the most important job of an early stage venture investor.

The choice of CEO has a huge impact on a startup’s future success, so taking a bet on a first-time as yet “unproven” CEO is a big decision. By definition, it’s inherently a more risky choice than backing a veteran “been there, done that” pick, as there’s no prior CEO track record to judge.

But many first-time CEOs massively outperform.

Indeed, some of the best CEO’s in the biotech business today were first-time CEOs at their present companies: John Maraganore at Alnylam, Nick Leschly at bluebird, Hans Bishop at Juno, and David Schenkein at Agios. Their respective boards/investors took bets on them that clearly delivered.

Two years ago, serial CEO Katrine Bosley wrote a From The Trenches blogpost here about the “Rookie Year” as a CEO, noting that over 60% of the 2013-2014 IPOs in her dataset had “rookie” first-time CEOs at the helm. Further, some 70% were more than 50 years old. The takeaway: first-time CEOs with some grey hair are clearly quite common in our industry.

And it’s also common at Atlas.

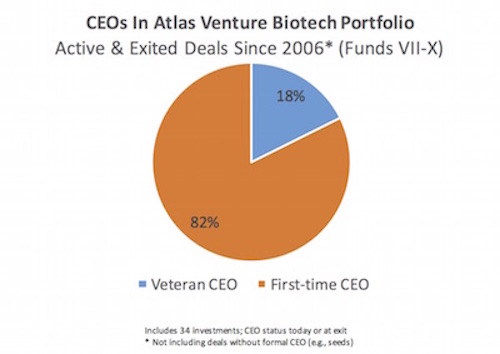

We recently examined the CEOs of our last decade of investments: either the current CEO of active portfolio companies, or the CEOs at the time of the “exit” for realized investments. I’ve excluded seed-stage deals (which often don’t have a CEO). Of the 34 biotech companies, a whopping 82% had first-time CEOs.

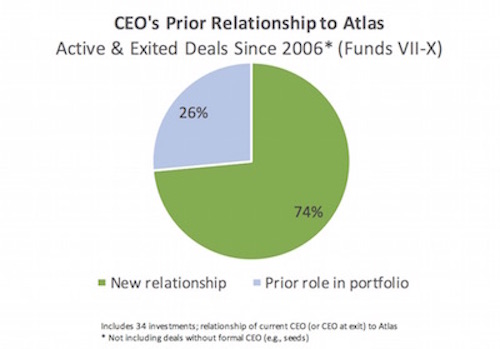

Further, only 26% of our CEOs had worked for prior Atlas companies; the vast majority were, by that definition, “new” relationships in the Atlas portfolio. Many of these were new introductions to our firm, often through referrals or via executive search processes.

I suspect these metrics are very similar for other early stage VCs. These data directly challenge the frequent criticism that VCs only hire “their own” and only bet on veteran, serial executives. While we certainly seek out opportunities to work with repeat offenders, like Mike Gilman of both Padlock and Stromedix, we clearly are open to taking on the “risks” of backing new talent.

It’s also fair to say that, in light of Atlas’ venture creation strategy, most of the CEOs in our portfolio today either worked with us to co-found their startups, or were recruited later as the startup matured: CEOs like Nessan Bermingham at Intellia and Ankit Mahadevia at Spero fit the former profile, and others like Detlev Biniszkiewicz at Surface and JC Gutierrez-Ramos at Synlogic fit the latter. This reflects in part the changing dynamic of venture formation (here). That said, great founder CEOs like Chuck Wilson at Unum were already in place when we co-led the Series A (and an important part of the reason why we invested!).

All this is to say we (like many other early stage VCs) seek out talented executives through as many routes as possible, and are very open to first-time CEOs of all stripes and sizes. Some are ex-Big Pharma, some out of other biotechs, a few are out of academia, etc… Accessing great executive talent is a critical bottleneck in our industry.

The most important thing for their future success is less where they come from, though deep experience is almost always critical, but more about how they approach the role. Successful first-time CEOs throw themselves into their new role with a vengeance, absorbing and integrating as many CEO lessons as they can into their approach.

In surveying our experience, there are at least five behaviors that we commonly see in successful first-time CEOs – here’s a brief summary:

Own the culture of your startup.

Culture just doesn’t form organically like yogurt; it has to be owned by the company’s leadership, and the CEO in particular. What’s the startup really trying to accomplish? What kind of a culture is needed to deliver that vision and mission? As a first-time CEO, dedicating real time to thinking through how you want the culture to form or evolve is really important.

It may sound like an overused platitude but “leading by example” is indeed critical. Startups thrive in open dynamic cultures, with little of the hierarchy, bureaucracy, and politics so common in large BioPharma. Reinforcing a positive “champion and challenge” culture is vital, where teams are able to engage constructively to shape and reshape ideas, initial therapeutic programs, and overall startup strategy. Pivoting a NewCo’s early plans around new input or data is often a hallmark of future success.

Further, it’s not about knowing the answer all the time. First-time CEO’s frequently think they have to have all the answers, which creates a negative dynamic of being over-extended (a.k.a. hand-waving), frequently followed by subsequent anxiety of back-filling. What is far more important to future success is acknowledging the gap with some version of “I don’t know”, and articulating a plan for how to find the answer. All of these elements contribute to a positive culture of leadership.

Hire the best and demand great things.

The oft-cited maxim of “A’s hire A’s and B’s hire C’s” is certainly true of biotech startups. A sign of a strong CEO, first-time or otherwise, is when they surround themselves with people with distinctive competencies – recruiting the best in their respective disciplines. Weak CEOs are often threatened by really strong executive reports, and fear that their role might be overshadowed; great CEOs recognize that recruiting the best, and empowering them with meaningful opportunities to grow, is the key to high performance. To all the new/soon-to-be CEOs reading this, you get to decide whether you’re an “A hiring A’s” by the approach you take in your recruiting.

Once recruited, setting a high bar for performance is critical. Holding team members accountable to their personal goals, and to pushing for the broader corporate goals, is essential. Seeing slacker coworkers just coast along in an otherwise hard-charging biotech startup has an insidious negative impact on the culture; under-performance that doesn’t respond to feedback has to be dealt with head-on. Firing folks (or “transitioning” them to new careers) on your team is never pleasant, but it’s often particularly challenging for a first-time CEO. In some ways, it’s an acknowledgement of an HR failure: the CEO may not want to fire a legacy employee (especially if that earlier hire is close to the Board), or may not want to highlight a bad recruitment decision on their part. But having under-performance or culture-killing employees fester in a company leads to far bigger and more damaging failure modes down the road. Building and maintaining a great team is a critical ingredient to both CEO and corporate success.

Engage your Board and make them work for you.

I’ve previously opined on the characteristics of high-performing boards (here), and the list of themes remain true, e.g., insist your board members come prepared, start every Board meeting with strategic context, get independent voices on the board as soon as possible, don’t have surprises at Board meetings, etc…

One of the themes worth emphasizing here is “communicate frequently with your board.” All CEOs should do it: set up one-on-one meetings or calls on a regular basis, and send out CEO updates in between board cycles. These communications aren’t meant for “reporting” – they are meant for faster feedback loops as you wrestle down the important issues facing the company.

It’s key to recognize, however, that getting your Board members’ opinions and perspectives on a topic is very different than asking your board open-ended “what should we do” questions; instead, for a given strategic decision, highlight the set of possible options that were considered, and articulate a rationale for why you as the CEO (or collective management team) are recommending to do XYZ. It’s not to say you won’t be open to feedback, or even changing your recommendation in light of new input, but you are leading rather than being led by your Board. Getting this balance right with a Board is really important for all CEOs, but especially first-timers.

Build your CEO network with a “learner” mindset.

Being CEO can be a lonely job, especially if you are trying to learn the ropes by yourself while simultaneously being the ultimate decision-maker. But many other biotech CEOs have come before you, so there’s no sense in reinventing the wheel on every issue or problem you are solving. The best thing a first-time CEO can do is to find a set of informal advisors, mentors, and coaches outside their company and get on a regular meeting cycle with them.

These folks can be “peer-advisors” that are CEOs of other biotech startups fighting down the same issues, or successful veterans that have already been through the gauntlet of building company(s), or even formal, retained leadership coaches. This CEO network can help be a sounding board for team, culture, board, or strategic issues. Further, they can help bring you up to speed on (and provide some stress-reducing context for) the important aspects of startup finance: out of cash dates, burn rates, liquidation preferences, dilution, investor management, etc…

Building this network early in your tenure as a first-time CEO will pay major dividends.

Articulate your story clearly and often – as you are always “on”

As CEO, when you are out in the ecosystem, you are always “on” with regard to corporate development. Every interaction with an investor sets the stage for a future potential fundraising. Every dialogue with Pharma opens up potential partnership opportunities. Every executive you talk to outside your company is either a potential future recruit, or a potential future supporter/enabler for your startup’s success. All of this highlights that it’s the CEO’s job to always be working to create optionality for the company across future financing paths and possible partnership structures, as well as talent expansion.

Lastly, the best CEOs are great storytellers. They paint a captivating vision around new therapies, and offer a “permission to believe” in their startup’s huge future potential. This narrative has to be fact-based and data-driven, but it needs color and delivery. These elements only happen by practicing it a lot – both by yourself, with your teams and boards, and of course externally. Get a speaking coach if you think it would help you. Don’t underinvest in becoming your startup’s best presenter and communicator. A crisp story articulating a compelling picture is hugely value creating.

—

So in conclusion – taking the leap into becoming a first-time biotech CEO is exhilarating, and can potentially pay off handsomely for both the executive and the Board/investors that back them. Focusing on the five behaviors above will help make the first-time CEO role easier, though it’s never easy: being a CEO is high intensity, 24-7. Lots of people are counting on you, and, importantly, investing in you.