Biotech has been one of the hottest sectors in the venture capital asset class over the past few years. Strong IPO and M&A markets have put wind in the sails of the space since 2012, and robust investment activity has enabled a wave of well-funded biotechs to mature with a lower cost of capital than a decade ago.

In addition to helping advance new medicines to patients, this accommodative environment has supported the welcome recycling of capital in the venture world – critical to continued interest of Limited Partners (LPs) in the space. A recent Silicon Valley Bank report from Jon Norris and his colleagues highlights a staggering level of potential venture capital distributions in the life sciences: they estimate returns of $79B since start of 2012 from both IPOs and M&A events. This far exceeds the capital deployed during that period (~$38B), and far more than the funds raised by life science venture firms.

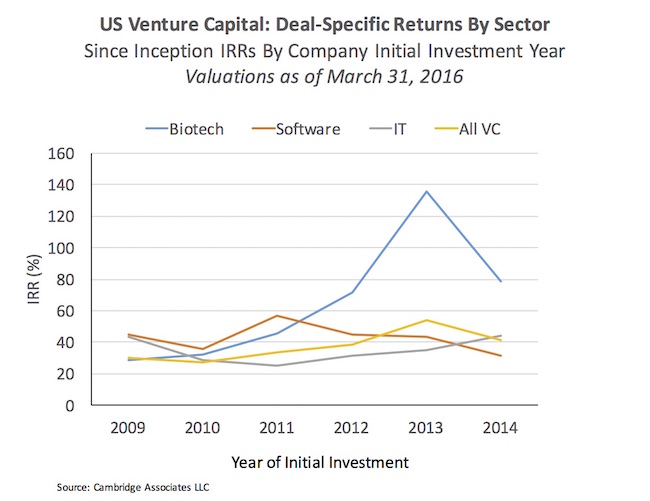

To further explore the specific returns in biotech versus other venture sectors, a recent commentary from industry-leading analysts at Cambridge Associates is a good place to start: it highlighted the outperformance of healthcare in 2015 even with the downdraft in the 2nd half (here). A deeper look at company-level return data, shared “as is” from their Venture Capital Index and Benchmark Statistics report for March 31, 2016, is worth presenting: the chart below reflects the IRRs by vintage year for company initial investments in different sectors and overall in venture. These data represent March 31, 2016 valuations, so are inclusive of the market correction from July 2015 through February 2016 that brought down the valuations of many VC-backed public biotechs. The acceleration of returns from investments made during 2012-2014 is striking.

In light of this, and the strength of the sector overall in the past five years, one would think that biotech and more generally life science investing would be increasing its “market share” within the venture asset class. Simple economics would predict that VCs would want to deploy more capital into the space, and that LPs would like to channel more fund-level capital towards managers in the sector.

But the opposite is in fact the case.

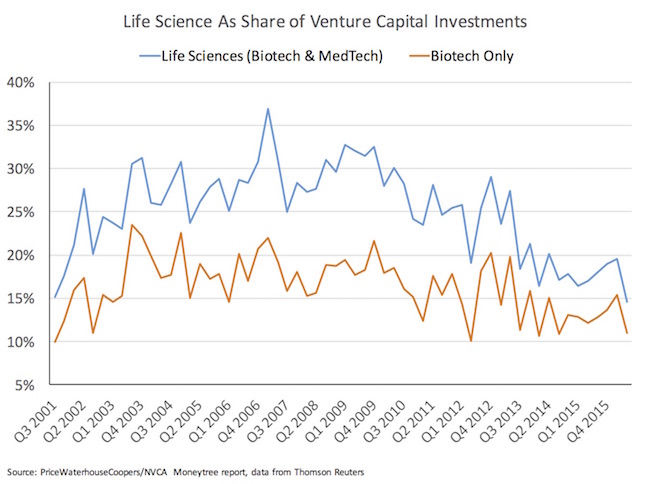

Life science investing, including biotech and medtech, as a share of venture capital hit a 15-year low in the second quarter of 2016, coming in below 15%. Biotech investing is hovering near its 15-year lows at just 11% of all the venture capital deployed in 2Q. The chart below captures the downward trends for the past 5-10 years.

I’ve written on this paradoxical trend before – that biotech is booming on an absolute basis, but shrinking within the venture asset class (here).

Further, despite the strong returns, the relative flow of funds into biotech isn’t likely to change over the coming quarters. While venture firms in the life sciences have been successfully fundraising, with new funds from Longitude, Orbimed, Deerfield, Sofinnova, MPM, Foresite, 5AM, and Atlas, among others, in the past two years, non-LS technology sectors are also raising large amounts of venture capital (with recent $2B+ funds raised by Tiger, Lightspeed, and Accel, for instance).

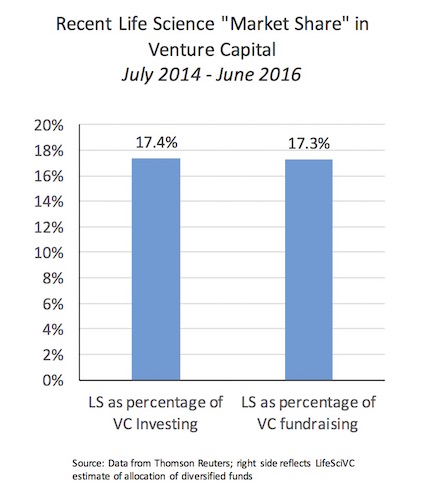

My estimation of the life science “allocation” of the venture capital industry’s recent funds is roughly 17%. This analysis included all VC funds closed over the last 8 quarters July 2014 through June 2016 according to Thomson Reuters. This allocation is identical to the share of disbursements that into the life science deals, implying the capital on today’s sidelines will be just enough to keep up with future deployments at this level.

So why the disconnect: strong relative returns for years, yet modest “relative” interest from LP’s? I’m sure part of this is that biotech’s reputation lags its performance and suffers from the “ugly stepchild” mythology among potential LPs that I’ve previously dispelled (here, here). Some of it is probably due to the esoteric nature of biotech investing as well. While understanding what a revenue growth rate means about a tech-enabled business is reasonably straightforward, the details of what a robust human PoC study in neuroscience should look like isn’t very simple to appreciate.

But this juxtaposition – outsized returns on one hand, and “minimized” market share in the venture asset class on the other – also raises a couple of other questions.

Is the deployment of capital into different venture sectors at the LP level efficient? Almost certainly not – it’s very hard to forecast where sectors will be in 3-5 years, let alone the 10-years-plus cycle of venture capital. Figuring out relative allocations into different asset classes and different sectors within those is always challenging. The current sector allocations, though, do seem out of line with relative returns. Further, the massive expansion of tech venture capital (driving the shrinking share of biotech) is likely going to lead to more inefficient deployment. As Benchmark’s Bill Gurley has opined multiple times (here), “Excessive amounts of capital lead to a lower average fitness.” In many ways, the silver lining for biotech is that the more modest deployment of LP dollars into the life sciences in recent years is a good thing for the sector’s current and future return profile.

Or does this constraint simply reflect a people and talent issue? There are plenty of novel, potentially breakthrough ideas to fund in biomedicine today, and more funding might move the needle on the constrained number of new startups in biotech (see first figure here). But relatively few diversified venture firms still have biotech teams, and relatively few experienced pure-play life science managers made it through the 2000s as functional teams to support. This lack of partner-level talent could be constraining the ability of LPs to deploy more into biotech. Fund sizes can’t really go up while maintain any shot at credible returns (the venture capital math problem), so the number of viable well-managed firms becomes a real constraint on the system. There are only a handful of firms that do early stage biotech, for instance. Maybe it’s time for some new first time funds to form, like top quartile players such Third Rock Ventures and Column Group did in the late 2000s.

Final thoughts – venture capital is a long cycle time and illiquid asset class. In principle, outsized returns are meant to compensate investors in venture capital funds (LPs) for the duration and illiquidity they are accepting. Much has been made about the skewed distribution of returns (like other asset classes); only the top quartile firms consistently generate returns that fairly compensate LP’s for those risks. This means that LPs in general have to make long-term forward looking bets as they select managers and sectors to support with their capital. Its hard to get right. For instance, few predicted the last few very bullish years of IPOs and M&As in biotech.

So the big question for both GPs and LPs going forward is whether the macro forces supporting biotech are likely to continue. I certainly believe many of the broader tailwinds driving the sector are likely to remain in place (as described here) – which should continue to support stellar absolute and relative returns, and attractive fund flows back into the sector.