Neuroscience has quietly become a hot space for startups. Across a range of neurologic conditions, contrarian investors have been fueling entrepreneurs to discover and develop novel therapeutic strategies.

Earlier this week, two Atlas-founded companies, Rodin Therapeutics and Disarm Therapeutics, both announced new financings aimed at advancing their programs in synaptic resilience and axonal protection, respectively. Another portfolio company, Lysosomal Therapeutics (LTI), did a transformative deal with Allergan earlier this year to bring its Parkinson’s through early clinical studies. And beyond our investment portfolio, there’s plenty of activity: CNS-focused Denali Therapeutics raised a monster round of financing rumored to have closed at an eye-popping $1.2B valuation. Many other venture-backed biotechs addressing neurologic diseases were able to raise significant rounds of venture funding, including Cortexyme, Cavion, Blackthorn, Axial Biotherapeutics, and many others. Its clear neuroscience is getting investors excited.

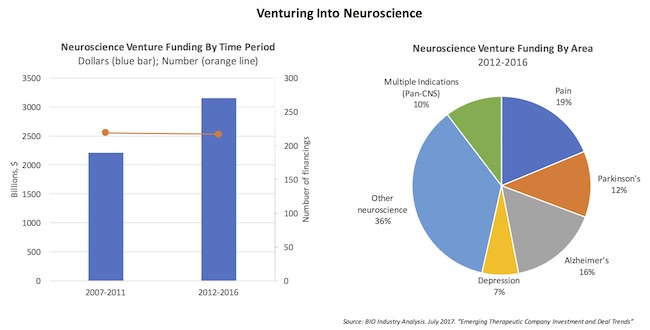

These anecdotes of heightened investment activity are borne out by the data. Neuroscience venture funding in the past five years is 40% higher than it was in the prior five years, with most of that increase coming in the last few years. Atlas’ portfolio includes a number of pure-play neuroscience companies (LTI, Cadent, Rodin, Disarm, Quartet) and a host of other platform companies with neuro-directed projects (like miRagen in ALS, Navitor in depression, and F-star’s technology partnership with Denali). Many VC portfolios presumably look similar.

As the charts above reveal, while financing the same number of companies in each five-year period (~220), the capital has gone up by nearly $1B, or 42%. This is about 33% faster than the overall rate of venture funding growth during these periods. And all this venture activity during a period when many in large Pharma were quietly reducing their internal efforts or backing out of the field altogether.

So why is there increased interest?

Patient unmet needs from neurologic disorders are staggering, and the cost to society is enormous. As most OECD countries see a “greying” of their populations, the burdens of many of these later-onset neurologic conditions will skyrocket. All of this creates an imperative to act – and to invest in new therapies. But this isn’t new news, and certainly isn’t a Eureka-style observation that has driven the uptick in financing.

I think the primary driver for this increase is simple: we’re slowly marching towards better understanding of the molecular mechanisms of neurologic diseases. This basic and applied research has created the robust scientific substrate that inspires entrepreneurs and investors to take the risk of tackling neuroscience projects.

A huge element of this expansion of basic neuroscience understanding has come from the explosion in NIH funding for neuroscience in the first decade of the 2000s. In the 1990s, the NIH channeled $954M into neurology research. In the 2000s, this number spiked to over $8B – a near order of magnitude increase in NIH funding for brain research (here). This was a larger increase than any other therapeutic area, and has created a wave of insights a decade later that we’re in the process of translating into new therapies.

In other disease areas, in particular oncology, the precision medicine mantra emphasizes “hitting the right target, in the right patient, at the right time” – and this is clearly the trend in neuroscience today. A few themes related to this are worth calling attention to.

Novel targets and pathways are being implicated across a wide range of neurologic disorders. Nature’s experiments revealed by human genetics have been critical in a number of settings. For example, Nav1.7 has gain and loss of function mutations implicating it in neuropathic pain. Similarly, SCA mutations in various cerebellar hereditary ataxias. In Parkinson’s Disease, there are numerous genetic risk factors (alpha synuclein, GBA, LRRK2, etc) that identify apparent pathways in disease. Further, the role of cell-types beyond neurons in neurologic disorders is increasingly appreciated, especially the immune lineage engaged in neuroinflammatory processes (e.g., TREM2 mutations in AD). Lastly, new processes, like axonal degeneration via SARMoptosis (Disarm’s approach), are being uncovered in various neurologic disorders, and these insights are identifying new targets for disease intervention.

Genetics is also enabling us to define neurologic conditions more precisely, helping convert archaic syndromic conditions that are clinically diagnosed through symptoms (and post-mortem brains) into definable patient populations. Take GBA-PD, as an example, where patients with loss-of-function mutations in glucocerebrosidase appear to present with a distinct form of Parkinson’s. Familial Alzheimer’s is widely appreciated with several gene families related to amyloid production. Progranulin mutations are found in a subset of Frontotemporal dementa (FTD), and tau mutations define a monogenic form of progressive supranuclear palsy (PSP). The “orphanization” of bigger heterogeneous neurologic clinical groupings into many smaller, more homogenous populations is a big part in getting to the “right patient” in precision neuroscience.

These subsets are also enabling more targeted translational strategies. In GBA-PD, these patients have been shown to decline faster, especially on cognitive measures; drugs that can address the drivers of disease and ameliorate this rapid decline should reveal themselves in smaller, shorter trials. We’re exploring this at LTI with Allergan. Similarly, BDNF mutations (Val66Met) have been shown to be more rapid decliners in cognition in Alzheimer’s and other pathologies, presumably by reducing the cognitive reserve through hypofunction of this important neurotrophic factor. Selecting these more targeted patient groups for clinic work can help power these trials.

Lastly, we’re identifying smarter ways of measuring disease progression. Imaging modalities like MRI, PET, SPECT, CT and others are making headway with a range of neurologic conditions. As an example, with synaptic loss being central to AD and other degenerative conditions, measuring synaptic density via SV2A PET imaging may help with both detection and progression. Further, tau and amyloid ligands are making progress after years of investment in imaging consortium and projects. Part of picking the right time to treat is knowing how far along the disease progression a patient may be, and these new imaging modalities can help; many prior Alzheimer’s studies were challenged because they either enrolled participants without bona fide Alzheimer’s (no amyloid at all) or where they were to late in the disease process. Beyond imaging, new cognitive batteries or wearables to quantify changes in movement disorders are advancing into the clinic.

All of these themes, and more, are driving the rise of neuroscience as an exciting investment area.

But its hard to mention excitement around neuro without mentioning Axovant’s pending Phase 3 results in Alzheimer’s, and the longer term data from Biogen’s enormously expensive amyloid program. Will failures in either of these dampen investor enthusiasm? I think that unlikely for two reasons. First, consensus on the former is low, so expect upside data to surprise and a failure to be status quo on a dead mechanism of action. Second, on the latter, amyloid hypothesis may be true but enough attempts have been made at it that if it fails it will only likely dampen stalwarts of that mechanism (though Biogen may have the right patients, at the right time, with the right drug…).

Exciting times for the field. The brain is the last frontier; we need entrepreneurial and scientific pioneers to conquer it with new therapies, and the venture community appears ready to fund these expeditions.