Biotech venture investors often prefer to back executives and entrepreneurs with a bit of grey hair. Seasoned industry veterans that possess leadership charisma along with years of experience, and the oft-accompanying learned judgement, are highly sought-after in biopharma’s seemingly endless war for talent.

Earlier this month, I tweeted about how talent was the biggest constraint in biotech. I highlighted that the number of VC-backed startups in biotech remained constrained (relatively flat for years) despite huge increases in aggregate funding flows, and that this was caused by talent bottlenecks rather than limits on ideas or capital. The pool of executives/entrepreneurs with both demonstrated leadership skills and bona fide R&D/BD expertise is very limited.

This observation unleashed a storm on Twitter: I was apparently exhibiting rampant age-ism and ignoring the return-generating exuberance of youth; it was evidence that a biotech VC cartel actively keeps young people out; hedge funds apparently try to destroy young CEOs, etc… I did myself no favors by continuing to throw fuel on the “we like experienced veterans” fire by engaging in a thread on the subject (here). It was (kind of) fun. But the whole discussion lacked any real data.

Unfortunately, there aren’t great data sources to explore the fullness of this topic from an investment perspective (e.g., success/failure rates of biotech companies with 20-something CEOs vs more experienced CEOs over the past four decades of the industry). Survivor bias abounds in most anecdotal retrospective looks (e.g., Bob Swanson was only 29 when he co-founded Genentech in 1976 – see, youth matters! Ah, but George Rathmann was 53 when he co-founded Amgen, age matters!).

To my knowledge, no unbiased dataset exists to look at the topic. But since CEO age is reported in S1 filings before an IPO, that provides one dataset to examine. It’s clearly a success-biased dataset (only companies worthy of having an IPO) – but at the very least can provide some context for the discussion.

Working with the great team at Pitchbook, I analyzed some of these data, and compared biopharma to software CEOs. This is an extension of a prior analysis that Katrine Bosley did in an early From The Trenches post on the subject of Rookie CEOs (very much worth reading). As background on this dataset: in biopharma, 220 companies went public from 2012-2017, and Pitchbook provided the CEO ages at IPO for 184 of those companies (via their analysis of S1 filings). In software, 148 companies went public during that period and 110 had relevant age data.

Here are six key observations of these data.

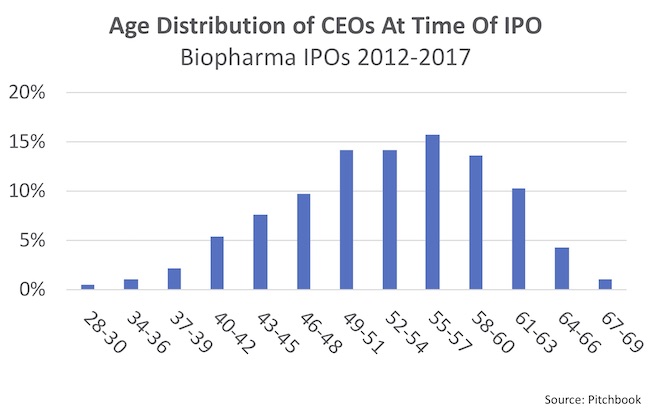

The vast majority of IPO-stage CEOs in biopharma are older than their mid-40s. The median age of a biopharma CEO at IPO is 54 years old, and 75% were 48 or older. The histogram below captures the spread. The youngest and oldest biopharma CEOs to IPO were 29 and 68 years old, respectively.

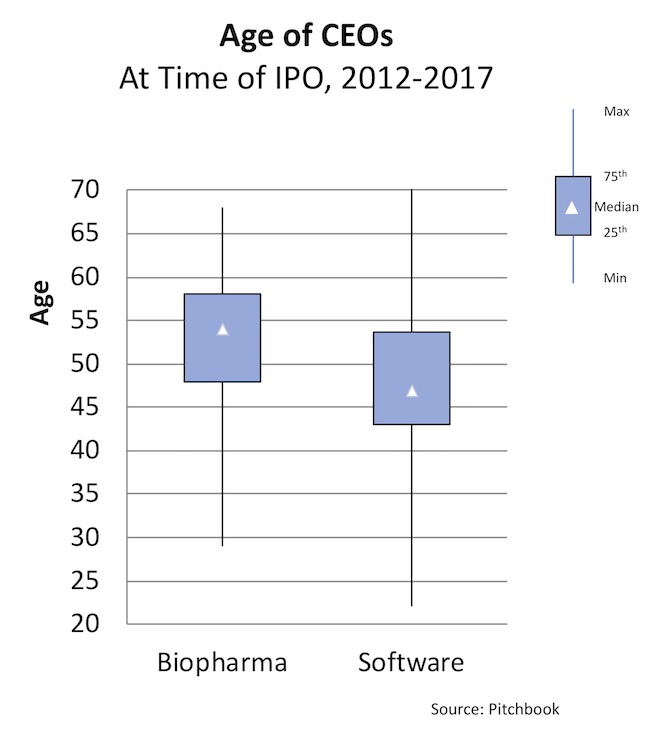

The vast majority of software CEOs were also older than their mid-40s at IPO. The chart below compares the distributions for biopharma (same as the histogram above, just plotted differently) versus software. The median software CEO was 47 years old at IPO. The youngest and oldest CEOs to IPO were 22 and 72 years old, respectively. While the software distribution is slightly younger than the biopharma distribution, it doesn’t reveal a huge differential in CEO ages.

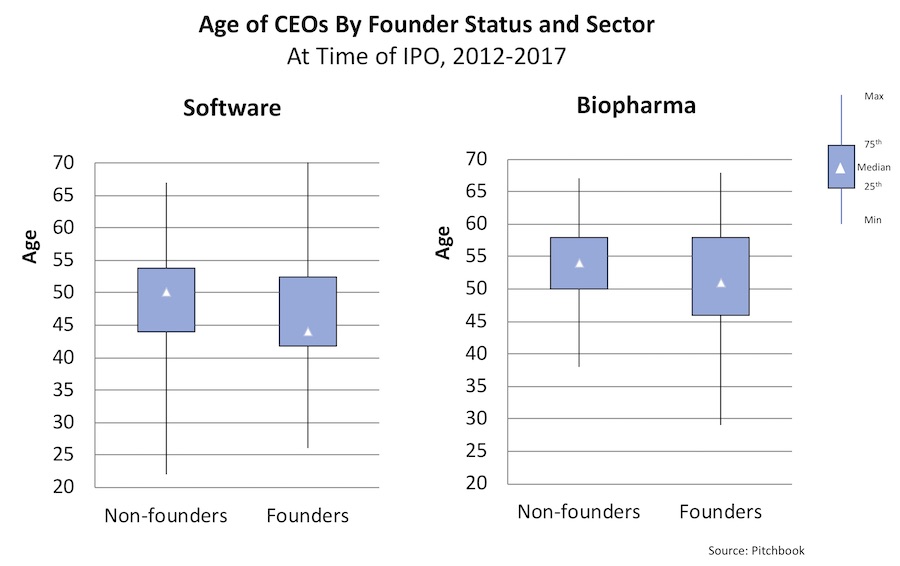

Founder vs Non-founder CEO status slightly shifts both sectors younger, as expected. But this shift isn’t as large as I anticipated, and implies that founding a company as a CEO isn’t always a youthful pursuit in either sector (e.g., Rathmann at 53). The non-founder CEOs in biopharma do tend to have more years under their belts than other cohorts: while the youngest was 38 years old, 75% of these non-founder biopharma CEOs were at least 50 years old.

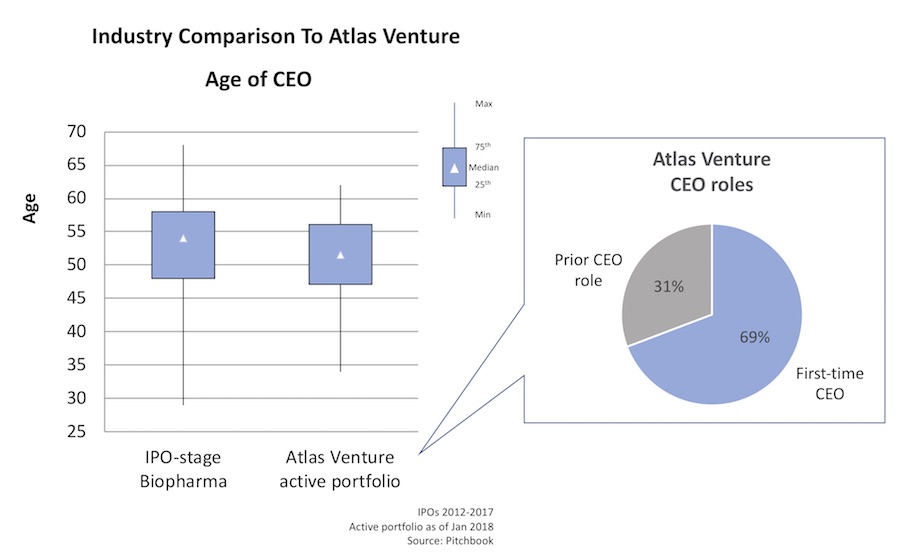

Atlas’ current active portfolio has a CEO age distribution just slightly younger than the IPO-stage industry cohort. This makes sense and reflects an age range similar to the overall “market” – most of our portfolio companies are private and a few years away from an IPO. These data include 26 companies with CEOs in place; another 8-10 startups do not yet have their first CEO (often an interim role held by an Atlas partner). Of note, nearly 70% of our CEOs are first-timers in the role. While often experienced leaders before we back or hire them as CEO, more than two out of three of them were “bets” on an “unproven” CEO candidate.

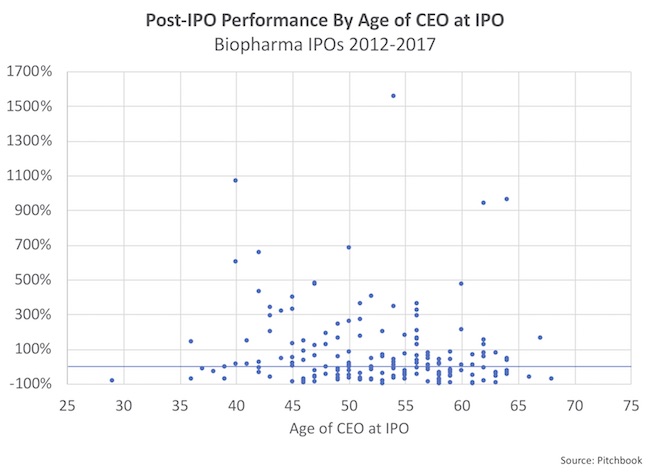

Post-IPO stock performance has no correlation with CEO age at IPO in biopharma. The scatterplot below demonstrates clearly that there is no correlation across the dataset (stock data as of early Feb 2018), e.g., 40-something CEOs don’t’ see their stock perform any better/worse than 60-something CEOs. Of top five largest positive winners, two were in their 60s at IPO (Kite’s Arie Belldegrun, Sage’s Jeff Jonas), two in their 50s (Receptos’ Faheem Hasnain, Supernus’ Jack Khattar), and one in his 40s (Bluebird’s Nick Leschly). This dataset is unfortunately biased towards experience (e.g., only five individuals out of 184 were less than 40 years old at IPO). Of note, performance also didn’t change relative to founding status of the CEO: the average post-IPO returns of founder and non-founder CEOs were 65 and 66%, respectively.

Female CEOs in biopharma are roughly the same age as male CEOs. Unsurprising in light of the widely appreciated gender gap, only 13% of the CEOs in this sample were women. But their average age was 52 years old (vs 53 in the overall cohort) – essentially the same age as the men in this sample.

So what does this all mean? Here are some thoughts to spur the discussion.

IPO-stage CEOs in biopharma commonly span over three decades (40s, 50s, and 60s), with rare exceptions (<5%) younger than that. Since the median time to IPO is 6-7 years in this cohort of companies (as described here), the typical founding CEO must have been in their mid-40s when they started the company. The typical non-founding CEO must have been slightly older when they took the helm. Given the robust CEO numbers in their early-to-mid 40s at IPO (see first chart above), many of these must have become CEOs in their mid-to-late 30s, presumably after 10+ years of industry experience. These data imply that, unsurprisingly, investors want to back biotech CEOs who have spent some time at the coalface of R&D/BD in the industry. And often an advanced degree of some sort. So pulling all that together early in one’s post-college career is often very difficult.

The relative lack of CEOs who are 20- or 30-something-at-IPO in this dataset suggests one of two things: either they rarely get funded in CEO roles, or, if funded, they rarely make it successfully to an IPO. I think the former is clearly the primary driver in today’s market, but suspect that’s a learned response from past investors witnessing the latter in prior decades (without the data to prove it).

To state from an investor perspective, generating stellar returns in early stage biotech investing is already difficult, before adding youthful inexperience and lack of R&D leadership expertise to the biotech C-suite. Reducing management “risk” often helps generate better returns. Because of this, and the complexity of our regulated and long-cycle-time business, getting a top tier VC to back a mid-20s recent PhD graduate to be CEO of a $30M+ Series A stage therapeutics startup is a challenge. C-suite executives with more experience are likely to be better at R&D risk identification/mitigation strategies and appropriate resource allocation; further, they will typically bring value-added broader networks, built over their careers, into Pharma decision-makers and the capital markets to leverage for downstream liquidity.

The “desired” CEO experience profile often requires perspective from different roles, and the emergence of learning-derived scar tissue and upregulated pattern recognition receptors. These are hard to measure, but time in relevant industry roles is often a reasonable proxy for those.

Fundamentally, the hallmarks of a successful CEO in early stage biotech are clear: attracting and retaining a great and experienced team, having a nose to discern good science and avoid the pitfalls of past failures, leading the execution of a high quality translational plan to demonstrate value to patients, and having the good fortune (luck, yes… luck) of R&D/BD falling in one’s favor more often than not over time. These attributes aren’t age-delimited, obviously, but frequently associate with folks who know a thing or two about the industry from having worked in it for 10, 20, or 30+ years (rather than being straight out of school).

One of my tweets that triggered the biggest reaction was this one: “Market forces are powerful. If backing inexperienced youth to run drug R&D-stage startups produced better returns, biotech VCs would be doing it all the time.” Restated, if firms backing a plethora of young 20-something entrepreneurs to run their biotech startups were generating outsized returns, we’d all be clamoring to back that CEO phenotype. Investors are frequently like lemmings regarding “hot” areas and strategies. Look at early stage biotech investing in general: in 2010-2012, early stage venture creation was contrarian (we and a few others were doing it); today, everyone wants to do it because the strategy has delivered attractive returns. I stand by the point about backing young, inexperienced CEOs: if it was truly a “smarter” and “better” strategy for generating returns in therapeutic biotech investing, over the long term we’d see more investors doing it.

That said, rightfully, I got solid criticism that this statement was too broad and (wrongly) implies something about the return potential of women CEOs in VC-backed biotech – since there aren’t very many of them. A very fair point, indeed, and I accept and acknowledge the criticism. Lots of other historic forces are at work relative to gender diversity and we’re working on them as an industry. It’s interesting to note that these data don’t suggest CEO gender covaries with age (e.g., the same general age ranges exist for women CEOs in our biopharma cohort).

Lastly, when it comes to backing youth, tech VCs somehow have created a mystique around their willingness to back dynamic yet inexperienced founder CEOs – promulgating the myth that software/tech VCs back dramatically younger CEOs and this youth leads to more successful exits. But this appears to be is just that – a myth. IPOs in the tech world frequently require building high growth businesses before going public, so using an IPO as a marker for “success” in software seems reasonable. These survivor-biased data suggest that the vast majority of “successful” software CEOs (that take their startups public) are also in their mid-40s or older, whether founders or not. While they may back lots of 20-somethings to lead startups, when filtered for IPO “success” there aren’t a lot of those 20-something CEOs on the roster (just over 5%). Youth, by itself, isn’t some magic elixir for better returns in any sector.

Parting thoughts.

Experience isn’t everything, though – it’s often just a surrogate for other traits (like judgement). Further, there are many other aspects of leadership that are critically important and aren’t associated with age, like vision, courage, charisma, humility, empathy, and integrity. Over-valuing a resume (aka experience in and of itself) and ignoring other leadership traits is clearly not smart, and no intelligent investor would advocate for that. But the combination of both is highly valuable.

I’d also like to emphasize that infusing young blood into leadership roles in our sector is a good thing and should be fostered. Talent is our #1 constraint and anything we can do to expand the talent pool is likely a good thing. And on the positive side, less “experience” also means less reliance on engrained ways of thinking and a willingness to challenge to status quo.

Investors and management teams should all aspire to draft more unproven “best athletes” rather than just hiring only “experienced” veterans into key roles in our startups. Bringing younger talent onto leadership teams, and even into the C-suite, provides them a great opportunity to grow and learn. Providing better mentorship for younger CEOs is also helpful; the use of an “Executive Chair” role can provide this guidance and has been a common approach in venture-backed startups. Facilitating peer-to-peer CxO mentoring is also valuable, and this is something we actively foster within the Atlas portfolio.

Lastly, and coming back to what prompted this blog, it’s clear that Twitter isn’t the right medium for a balanced discussion about an important topic like talent. But thanks to all who engaged in the dialogue earlier in February and sparked my interest in posting this piece.