SPACs are all the rage today. With the IPO market booming and public investors seeking better returns, blank check companies called “Special Purpose Acquisition Companies” (SPACs) have been fueling up their tanks and chasing down their merger targets. New ones are getting announced every day, including in biotech: so much so that serial entrepreneur Mike Gilman tweeted that “it’s raining SPACs” – a sentiment that captures the frenzied downpour of activity.

Atlas Venture has been dipping its toes into these SPAC waters. Today Gemini Therapeutics announced their intention to be acquired by FS Development, a blank check company formed by Foresite Capital.

Gemini is the first Atlas biotech company to be the target of a SPAC merger. Earlier this year, two legacy Atlas fund portfolio companies backed by our former technology partners, DraftKings and Skillz, were both targets of large and successful SPACs. It’s hard to ignore the increasingly loud SPAC drumbeat in the capital markets today.

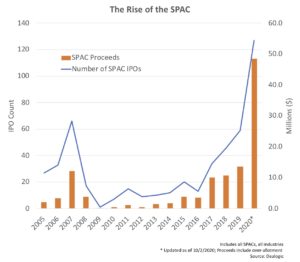

Venture-backed private companies are increasingly considering the SPAC route as an attractive path to go public. Across all sectors, SPACs used to be only a few percentage points of the IPO market, but now they are more than a third of all IPOs, according to NASDAQ.  I won’t get into the details of the SPAC process or structure, but I will refer readers to a few primers on the deal structure (here, here, here, here).

I won’t get into the details of the SPAC process or structure, but I will refer readers to a few primers on the deal structure (here, here, here, here).

This new SPAC momentum largely started outside of healthcare, in particular in the tech world. Some tech investors obviously think SPACs are a great alternative to traditional IPOs – but that’s a view not without controversy. A great set of blogs/counter-blogs here: Benchmark’s Bill Gurley hails the virtues of the SPAC as a way to address the “structurally broken IPO process” followed by a defense of traditional IPOs from Andreessen Horowitz and a specific counterpoint by others.

While emerging as a wave in tech and other sectors, the phenomenon has definitely hit the biotech sector in recent quarters. We’ve seen new SPACs announced by top-tier biotech investors like Casdin, Cormorant, Deerfield, EcoR1, Foresite, MPM, Perceptive, RA Capital, RTW, and 5AM. Plus others like LifeSci Advisors, Vesper, Chardan, and others.

One might rightfully wonder if we’re seeing over-saturation of the healthcare SPAC marketplace, with all of these looking for merger targets at the same time. By my count, nearly two dozen SPACs have been raised or announced in 2020 through mid-October, targeting more than $3.5B in proceeds; for context, in 2019 traditional biotech IPOs raised ~$4B in new offerings over the course of the entire year. Given the magnitude of anticipated activity, this is no longer some fringe financing approach.

In many ways, it’s a surprising trend given the incredibly robust and prolific biotech IPO market in 2020, begging the question of why not just go public via a traditional IPO?

The reality is SPACs do offer some interesting benefits to both a target and a sponsor that may explain some of the “why” around the excitement for SPACs today.

Attractive Sponsor Economics

Let’s start with the sponsor, since that’s easiest: sponsors of a SPAC get to market their expertise in picking great investments and quickly convert that into a handsome initial return (a), as well as guarantee they get a significant allocation of capital to invest over time (b). This latter point addresses one of the main criticisms of ‘hot’ IPOs, which is that crossovers/buysiders get too small of an allocation in an over-subscribed IPO.

Here’s how (a) and (b) work for a SPAC sponsor: typically a sponsor will invest ~3% of the value of the IPO proceeds to fund the initial launch of the SPAC and support the operating costs during the potentially 2-year “hunt phase” of the entity. At the time of the IPO, this at-risk capital converts into equity in the SPAC, plus the sponsor gets common stock or potentially warrants that convert into ~20% of the ownership of the funded SPAC, which is the so-called “promote” for sponsoring the SPAC. In other words, the sponsor gets to “bank” a quick ~6x or so on paper via this blank check company “promote” concept. Its not realized or liquid, and requires the successful completion of an acquisition of a target company, but at least on paper it’s a great return. As examples, according to their SEC filings, RA Capital invested ~$4.4M into Therapeutics Acquisition Corp which raised $118M, and they now own north of 20%. Similarly, Casdin helped create CM Life Sciences by investing ~$10M and owning 20% after raising $385M in proceeds. Both of these translate into >6x paper returns, prior to acquiring a target company. This is also prior to any “renegotiation” that happens into the merger itself, a process that often incrementally shaves some of the sponsor’s initial returns.

Further, many sponsors have committed side letters or other agreements with the SPAC allowing them to buy a certain percentage of an additional concomitant PIPE investment that happens alongside the closing of the SPAC acquisition, helping ensure that the sponsor can put larger amounts of capital to work. Putting adequate capital to work is the only way to make a deal “meaningful” for a large investment fund. This subsequent investment changes the average cost basis for the sponsor, of course, but they still benefit greatly from the aforementioned “promote” aspect of the pre-acquisition ownership.

For some of biotech’s blue-chip crossover or later stage investors, being a SPAC sponsor seems like a no-brainer in light of both the “juice” on the returns and the guaranteed capital allocation. Plus it doesn’t require doing something dramatically different than what they have already proven they can do: many of these crossover investors are incredibly skilled at doing diligence and picking great stories to help build and scale into the public markets.

So the benefits to a SPAC sponsor are very real. Let’s turn to the merger targets.

Alternative Path to Going Public

Today’s IPO market for biotech companies is obviously very strong, but it’s not perfect – as I mentioned in the latter section of my recent blog post on the structural changes to the IPO process.

While we’ve come a long way since the pain of the 2000s, the IPO process today is really a two-step dilutive process with lots of exposure to risky market volatility. It’s a two-step process because of how dominant the role of the crossover round has become in recent years. Without crossover-insiders capable of buying significant coverage of your IPO book, it’s hard to drive the euphoric demand and over-subscribed sentiment common to hot IPO stories today. And it’s very dilutive: sell 25-33% in the crossover round and then sell another 20-30% in the IPO. Don’t forget to add the greenshoe dilution, too. That’s 50%+ dilution in a matter of a few months or quarters. And with the 25-40% first day price “pop” that is customary in 2020 for many IPOs, the “money left on the table” from both dilution and the price appreciation is not insignificant.

Further, the extended timeline of a typical IPO process, from the closing of the crossover to the pricing of the offering, which means there’s significant risk associated with both intrinsic (like pipeline news) and extrinsic (like macro issues) events. This create risk around both the raise and the valuation.

At least in theory, a SPAC merger transaction to “go public” can address both of these concerns.

Because it replaces the two-step of crossover and IPO, at valuations that approach that of the IPO itself, there is often slightly less total dilution (10-15% less), according to bankers familiar with IPOs and SPACs. For context, even avoiding just 10% extra dilution would have been $3-4B of value for existing private shareholders in IPOs this year – that’s not an insignificant figure.

And once a SPAC sponsor has done its deep diligence, and mutually agreed on a merger with a target company, there’s a valuation discussion. SPAC price discovery is largely a direct negotiation between the SPAC sponsor and the target, which is why sophisticated later stage biotech investors make smart SPAC sponsors – they know how biotech pricing in the market is occurring. Further, the concurrent PIPE acts as an important source of price validation, supporting the valuation negotiated by the sponsor. In contrast, while in theory a biotech IPO is priced by a multi-day book-building process with scores of investors putting in their orders, the reality is that IPO pricing is largely driven by the pricing appetite of a few large accounts (which is not so different than the SPAC after all). Plus IPO valuations can often be anchored by the crossovers, who don’t want higher valuations as the IPO is where more of their capital gets put to work versus the crossover round (as discussed in the last section of this recent blog).

With a specific valuation mutually agreed for the merger, there’s a clear albeit complicated timetable for closing the deal and trading as a public company (aka the “de-SPACing” process). For a merger target, both the timeline to being public, as well as the pre-specified scale of the valuation and capital raise, are better “controlled” in a SPAC process.

Importantly, another feature of some SPAC negotiations that is favorable for merger targets is the concept of earn-outs. To bridge the bid-ask spread on valuation, a merger target might accept some of future equity milestones if the pipeline delivers more than the SPAC sponsor expected, or if certain price targets are met. These types of future value concepts aren’t available in a traditional IPO process.

There are a lot of other wrinkles with a SPAC, including the redemption possibility during the de-SPACing process (i.e., IPO investors can get their money back before the acquisition closes if they don’t like the deal), so they aren’t for everyone. And these complexities need to be understood before embarking on a SPAC path. We actually had a SPAC biotech deal fall apart back in 2008, the last time SPAC’s got frothy, when Dynogen Pharmaceuticals wasn’t able to get shareholder support for it’s merger with Apex BioVentures.

It is worth noting that times have changed a lot since the SPAC bubble of 2007-2008. Until recent years, SPACs were largely considered a “dirty” financing with oddball investors. Today, the quality SPACs are full of some of best biotech investors in the business, so any negative stigma that was around is certainly no longer in place. The strength and breadth of the investor base is critical to the success of any IPO route, including SPACs.

Importantly for management teams and biotech Boards, SPACs simply provide more options: it’s great to have another strategic path for accessing public market capital beyond the traditional IPO process. What was once commonly called a dual-track process (S1/IPO and M&A) might now become a “three-track process” that includes exploring SPAC options for many aspiring biotechs.

What kind of biotech should look for a SPAC acquisition?

Let’s start with a good example: Cerevel Therapeutics. Founded by Bain Capital and Pfizer, Cerevel went public in July 2020 via a merger with Arya Sciences Acquisition Corp III, a SPAC sponsored by Perceptive Advisors, a blue-chip crossover/public biotech investor. The deal included $150M in the Arya IPO’s trust account, and $320M from a common stock PIPE, which closed at the same time, led by Perceptive and a who’s who list of public biotech investors. Despite raising a whopping $445M in net proceeds, the Cerevel shareholders effectively sold only a third of the company in the process. While larger than most biotech SPAC deals, it’s a good illustration of how catalytic a SPAC process can be.

The optimal biotech merger target profile, in my opinion, is the “pre-crossover” private company that has an emerging product pipeline with an expectation of meaningful clinical news flow over the next 1-3 years. It obviously needs to be a story that will appeal to biotech public market investors. This likely means the company has raised $25-100M in preferred stock financings, but hasn’t yet built a roster of customary crossover investors yet. In lieu of the crossover/IPO two-step dilution of a traditional path, and the risk of market volatility, accessing the public markets via a defined SPAC timetable may be smarter.

Gemini Therapeutics fits this profile: it just initiated a Phase 2 study for it’s lead program, had raised $42M in prior financings, and was evaluating strategic options for going public.

As part of their IPO process, SPAC sponsors have to articulate the attributes of a preferred target, but by and large they all sound similar: strong science, seasoned teams, lead programs with solid Target Product Profiles and near-term inflection points, and “attractive” valuations. It’s no coincidence that these are the same attributes that describe biotechs that are successfully seeking crossover or IPO financing.

Some folks are referring to this period as the SPAC 3.0 wave, reflecting the evolution of the structure and it’s move towards mainstream. And in other sectors that might be true. But in biotech, we’re in the earliest innings of the first real wave. Most SPACs are still searching for merger partners. In reality, the number of SPAC acquisitions that have successfully closed in biotech remains incredibly small – and can be counted on one hand. Examples include the Immatics merger with Perceptive’s Arya II SPAC in June 2020 and two biotech SPACs closed in 2019, including Chardan/BiomX and RTW/Immunovant.

With 15-20 biotech-focused SPACs recently launched, and seemingly a new one every day, we’re going to see a lot more mergers happen over the next year.

If these deals work, and both generate adequate returns and raise sufficient capital, we’ll likely continue to see the SPAC path become one of many possible choices for aspiring biotechs.