By Aimee Raleigh, Principal at Atlas Venture, as part of the From The Trenches feature of LifeSciVC

“It was the best of times, it was the worst of times…”

Another JPM is behind us, and while much of the small talk was centered on the beautiful weather, impressive sea of pink in support of the Biotech CEO Sisterhood, and Monday’s deals (congratulations to ITCI, Scorpion, and IDRx teams!), overall sentiment was bifurcated. While many early-stage private VCs (and especially those participating in recent M&A) are feeling good going into 2025, public investors lamented the poor performance of public portfolios and indices. Similarly on the company side, a few megaround darlings have captured a large share of the capital in the past year (nearly 100 raises >$100M). In contrast, the mood is more apprehensive for those companies with data or timing setbacks, especially on top of one of the highest rates of RIFs in 2024. The past year has been a mixed bag, especially when factoring in tenuous macro headwinds such as uncertainty regarding the new administration, debate on drug pricing, and persistently high interest rates. You’ll hear from other outlets that JPM sentiment ranged from poor to cautiously optimistic – while I won’t add more adjectives to the pile, below are some of my key takeaways as we start the new year.

Before we dive in, I would be remiss if I didn’t call out the fact that many of last year’s themes continue to be front and center, including M&A and investor dollars focused on “hot” areas. Without further ado – my key themes from this year’s JPM as we look forward to another productive year in biotech…

Brave New World: China Assets are Here to Stay

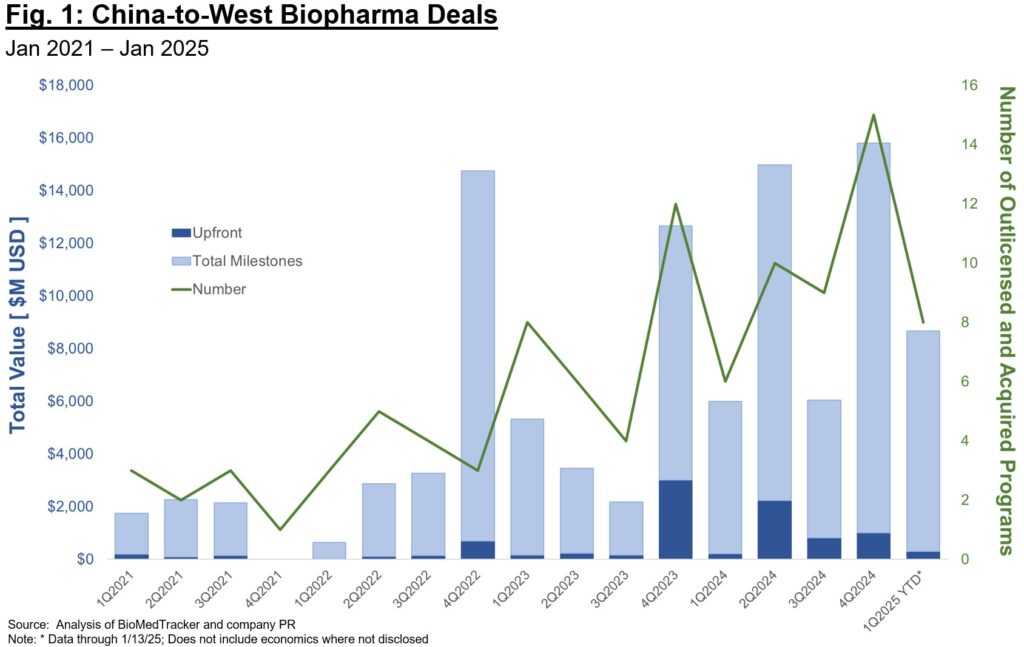

Despite grandstanding from Washington, China out-licenses to U.S. and EU-based biotech and Pharma have never been more abundant than in the past year (Fig. 1). While our industry will continue to debate whether the rapid timelines and abundant programs available in China are a boom or a bust for our biotech economy, there is no denying the landscape for therapeutic development is shifting (and especially for “validated” targets for “best-in-class” plays). Pharma in particular increased China-sourced deal volume substantially last year, a vote of confidence for the strong discovery and development talent there as well as more efficient timelines to clinical proof-of-concept. Stifel recently reported that ~1/3 of Pharma licensing deals in 2024 were sourced from China, an incredible statistic and one that points to the shifting landscape for asset-centric deals.

Several questions are top of mind for investors when thinking about China-sourced assets:

- How long will these deals remain competitive, especially in the context of rapidly increasing economics (upfront, total milestones, royalties, equity)?

- How do we model evolution of this market – will we continue to see largely “me-too” or “me-better” plays? Or will the China ecosystem evolve to deliver first-in-class programs focused on riskier biology or challenging druggability?

- Related to the above, how many independent programs against the same target can the market reasonably support? At some point we will reach a saturation point in assets, beyond which there aren’t enough buyers to credibly carry a program through late-stage development and commercialization.

The future here isn’t all or none – it is highly unlikely China will completely replace Western countries in drug discovery and development, and it is also unlikely that future legislation will completely block collaboration. It is to our benefit as an industry to work towards a new paradigm that leverages cross-geography collaboration, while also ensuring the U.S. and Europe remain competitive in executing on development for first-in-class plays.

There and Back Again: Investors Tiring of “Me-Too” Plays

Relatedly, investor excitement for asset-centric plays has played a role in the rush to source (largely clinical-stage) assets from China. As my colleague Bruce wrote in a recent post (here), the sentiment in 2024 was overwhelmingly “assets-in, platforms-out.” Companies raising money for first-in-class biology or earlier platforms tended to have a more difficult fundraising journey last year, with few standout exceptions. However, the pendulum will inevitably shift, and the question is whether we as an industry can foresee that shift early and adjust or whether we have already oversaturated certain indications and targets. Given the movement towards big indications of the past 18 months (obesity, broader cardiovascular, high incidence oncology, and large I&I indications), it’s important to remember the enormous cost, expertise, and time commitment required to run multiple Phase 3 trials and commercialize in these competitive spaces. It is unlikely that many companies beyond Pharma and large-cap biotech can pull it off. Thus, when you are evaluating the 7th antibody program against Target X, consider whether the buyer pool is saturated and what incremental opportunity is offered by any differentiated features. I have no doubt many more of these programs will “work” clinically than can be feasibly commercialized.

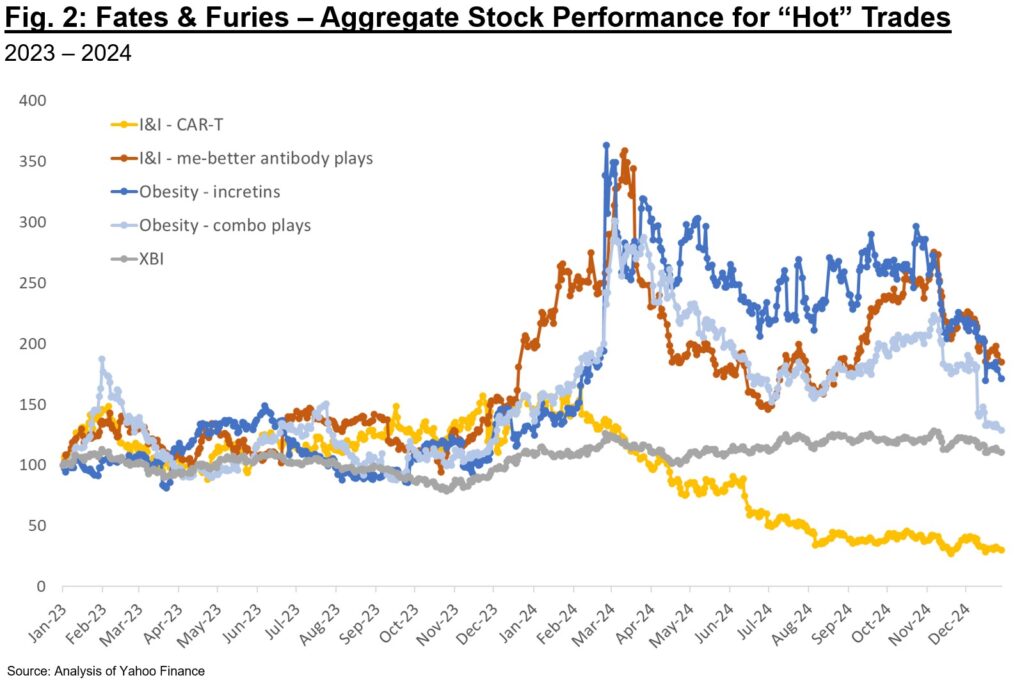

As an example, we can consider some of the “hot” areas in 2024 and the aggregate stock performance for representative public companies (Fig. 2). While both I&I and obesity plays are arguable strong performers, it is worthwhile to note that some categories clearly became overhyped last year and subsequently sold off. At times the sell-off was due to data that, while good, fell short of the perfection priced in. At other times, it was related to competitive plays emerging on the private side. In a market where there are zero-sum elements, an “obvious” play is only valued so long as it is perceived as best-in-class and competitive in late-stage development.

Perhaps in the near-future investors will again appreciate riskier but potentially higher-reward biology and deals – we may already be starting to see that in 2025 with some of the large follow-on financings for next-gen modalities. A common refrain this past JPM was that of public investors lamenting lack of “originality” in the private deals they were evaluating. There is an uncanny Catch-22 at play – platform or first-in-class asset plays require considerable investment and conviction, but company creation VCs can’t continue to invest in these areas if later-stage investors (crossover and publics) don’t participate in financings before these are de-risked in Phase 2. If we continue to concentrate bets in “validated” plays, I frankly worry about the novelty of our collective pipelines 5 years from now.

New Opportunities & Headwinds in Clinical Development

So where does an investor or entrepreneur look when some indications feel saturated? One area of focus might be indications where trial landscapes are evolving such that probability of success is higher today than previously. As an example, consider asthma – up until the early 2010s asthma trials did not use eosinophil levels as an inclusion criteria or stratifier, but rather some flavor of Th2 marker (e.g., periostin). Several mechanisms that many agree should work (e.g., anti-IL13 lebrikizumab) failed under this trial design – is that a read on the mechanistic relevance itself, or rather the setting in which it was trialed? Changing development paradigms offer a path forward for new or previously discarded mechanisms – a few of my favorites from the past ~year are below:

- COPD: a natural extension of the eos high vs. low paradigm in asthma is the application of this patient stratification approach in COPD. The Dupixent approval for patients with an eosinophilic phenotype last September points to the success of this approach. Will anti-IL33s have the same success stratifying by smoking status? We’ll soon find out, as a number of these readouts are anticipated this year.

- HFpEF: heart failure is an area where incretins are radically changing the paradigm, including the concept that weight loss can actually be beneficial in patients (compared to the “obesity paradox” notion, i.e., obesity correlates with better survival rates, implying losing weight could be detrimental to CV outcomes). Novo and LLY have trialed semaglutide and tirzepatide in both T2D and non-diabetic obese populations with heart failure and shown stunning efficacy on CV outcomes, quality of life, and function. Almost as important as the incretin mechanism, these trials established a new paradigm for obese HFpEF in terms of patient selection, approvable endpoints, and treatment duration. Hopefully this changing trial landscape for HFpEF, and potentially broader segments of HF, alleviates some of the risk for biotechs developing new treatments for these patients.

- Urticaria: the remarkable efficacy of KIT inhibitors in CSU has confirmed the role of mast cells in driving pathology, and has also ushered in the concept of Xolair naïve vs. refractory as a patient stratification approach. While Xolair is an okay early-line agent for patients, potent KIT inhibitors like CLDX’s barzolvolimab have shown to be equally efficacious across both Xolair-naïve and refractory patients, suggesting that best-in-class efficacy is possible across patient segments when disabling mast cells. Other programs targeting Th2 biology (e.g., dupilumab) have shown mediocre efficacy and only in the Xolair-naïve population, implying limited impact of the mechanism beyond current standard-of-care.

- Solid tumors: recent FDA guidance on use of ctDNA as an endpoint for treatments with curative intent for solid tumors may be an early biomarker for a shift in the surrogate endpoint landscape. While more work is needed to harmonize assays and interpretation across therapies and trial settings, it’s a promising development to expedite signal seeking in these trials.

While these changing paradigms can help drive further development, there are also plenty of indications where the trial landscape is in dire need of new insights on patient stratification, endpoint selection, and treatment duration. Atopic Dermatitis in particular stands out – while the pipeline of active agents is increasing, so too is the collective uncertainty re: constraining placebo response. Likewise for ALS, we continue to see failed mechanisms across trials (the past year alone it was ATXN2, eIF2B, RIPK1, 15-Lipoxygenase, and others) and it’s unclear whether we are seeing trial design noise or true negative reads on the biology. At this point it’s unclear whether NfL as a surrogate will be relevant across multiple subtypes of ALS (genetic and otherwise) and what timeframe is reasonable to see disease modification. That said, with several high-conviction programs close to the clinic (including from Trace and others), hopefully 2025 brings additional clarity on how to best evaluate therapies for this devastating condition.

Herculean Clinical Impact: What Can’t Incretins Do?!

While some investors are growing exhausted with the sheer volume of obesity newcos, it is clear T2D and obesity are only the tip of the iceberg for indication relevance of this class. The “winners” have potential to command tremendous market share given the enduring metabolic benefit established in the past few years for this class. In 2024 we witnessed stellar readouts in HFpEF, MASH, Obstructive Sleep Apnea, Knee Osteoarthritis, Chronic Kidney Disease, and T2D prevention. While these datasets are being generated by LLY and NOVO, there is now a robust clinical-stage pipeline of incretins in fast pursuit.

There is tremendous opportunity for any Pharma with a current or future metabolic disease franchise to build rapidly here – the market is so large that no 2 players can feasibly corner all market share. Many indications exist where increasing level of weight loss (and corresponding improvements in lipid profiles, glucose control, etc.) is likely to drive greater clinical benefit. Tirzepatide (Zepbound / Mounjaro) is clearly market-leading for these benefits, but there is still substantial therapeutic potential for an agent that achieves higher weight loss (approaching ~25% bar set by bariatric surgery at 1 year). While some of these potential competitors (e.g., CagriSema, MariTide) have disappointed in terms of differentiation vs. tirzepatide, others in late-stage development (VKTX, Kailera, select others) may very well achieve the high bar required for differentiation.

In addition to the broad spectrum of metabolic diseases where incretins are now a relevant first line therapy, there are a few high-risk but high-reward readouts ahead in 2025. Topline readouts from Novo’s studies of semaglutide in early Alzheimer’s Disease (EVOKE and EVOKE PLUS) are anticipated by the end of this year. Another trial by Novo will read out on the efficacy of semaglutide and cagrilintide (amylin) in alcohol-related liver disease – importantly this trial has high potential to show benefit on alcohol consumption, potentially paving the way for broader development in substance use disorders. Finally, we are starting to see trials for incretins in combination with anti-inflammatory agents for I&I conditions with a comorbid obesity population (e.g., Lilly’s Phase 3 trial for tirzepatide in combination with anti-IL17A ixekizumab in psoriasis).

Ultimately there are emerging “tiers” of mechanistic rationale for incretins in indications beyond obesity and T2D:

- Group 1: most “obvious” expansion of mechanism and related to impact of weight loss on body mechanics. Examples include Knee Osteoarthritis and Obstructive Sleep Apnea.

- Group 2: less obvious but likely related to both reduction in fat mass & inflammation. HFpEF and MASH fall into this category, and while not 100% correlated, improved weight loss benefit (a surrogate for therapeutic potency) tends to improve outcomes for these indications.

- Group 3: indications where incretin potency is likely to impact efficacy but where data is still emerging. These indications include addiction / cravings, cognition / dementia, and long-term CV outcomes.

While the appetite for new incretin-based companies is waning, it’s largely a result of the compelling late-stage programs (e.g., from VKTX, Kailera, and others) already in line to compete with LLY and NOVO. It’s also clear that incretins as a class have more to prove in terms of mechanistic relevance and impact on human health – this could very well be the biggest therapeutic breakthrough of our lifetimes.

Within Neuro, Epilepsy Continues to be a Darling for Investors

2024 saw many gains in the neuro space, including repurposing anti-amyloid antibodies with TfR1 shuttles for improved brain penetration, the first approval in Schizophrenia in over 30 years in Cobenfy, and positive mHTT and NfL readouts in Huntington’s. Last year was also marked by numerous compelling datasets for epilepsy. In particular, data in pediatric developmental and epileptic encephalopathies (DEE) and adult focal epilepsy suggests a paradigm shift to best-in-class activity with safer profiles. Some of the compelling readouts in the past year, and those on tap for 2025, are below:

- Novel therapies for DEEs may achieve disease modification and thus have a profound effect on infants and children with refractory epilepsy.

- STOK recently received Phase 3 design alignment from the FDA, EMA, and PMDA (Japan) for the EMPEROR trial of zorevunersen, an innovative oligonucleotide to increase SCN1A transcript levels and thus directly address the haploinsufficiency driving disease. Compelling seizure reduction (>85%) is annotated for these patients on top of standard-of-care (albeit in an open-label setting). In addition, Phase 2 data showing benefit on cognitive and developmental scales as well as inclusion of the Vineland-3 endpoint in Phase 3 suggests potential for real disease modification in these refractory patients

- Last year Lundbeck acquired Longboard Pharmaceuticals largely for its 5-HT2c superagonist small molecule therapy Bexicaserin after reading out compelling Phase 1/2 earlier in the year in DEEs. Given >30% seizure reduction (placebo-corrected) across DEE patients, 2025 will be an important execution year for the Phase 3 trial for the mechanism

- Praxis also read out a compelling Phase 2 dataset for DEEs last year – relutrigine is a sodium channel inhibitor being trialed in SCN2A and SCN8A DEE patients. Topline data showed nearly 50% seizure reduction (placebo-corrected) at 16 weeks in a very severe population and 1/3 of patients achieved seizure freedom

- While early, Xenon recently published preclinical data for its Nav1.1 sodium channel openers, which have blockbuster potential for Dravet Syndrome.

- The past year has also seen tremendous advances in therapies for adults with focal epilepsy.

- 2/7.3 potassium channel openers have rapidly emerged as one of the highest-potential treatments for focal epilepsy, especially those with selectivity (and thus safety) to enable chronic treatment. XENE leads the pack with azetukalner, achieving ~35% seizure reduction (placebo-corrected) in a recent Phase 2b readout. BHVN’s Kv7 activator BHVN-7000 isn’t too far behind, and these programs may usher in a flood of competitors

- RAPP’s RAP-219, while earlier-stage, has potential in focal epilepsy as a more selective AMPA receptor NAM – Phase 2a readouts are expected this year, and interestingly will provide a read on long episodes (via implanted intracranial EEG) as a potential PD marker

The mechanisms governing hyperexcitability in seizure generation may also play a role in other neuro conditions, and it is no surprise some of these programs are also being developed for psych, movement disorders, and related conditions. Even with all the success of this field, it is worth noting that 2024 wasn’t uniformly positive in epilepsy – Ovid and Takeda saw the Phase 3 failure of small molecule inhibitor of cholesterol 24-hydroxylase (CH24H) soticlestat in refractory Dravet syndrome and Lennox-Gastaut syndrome. While not all data has been rosy, the future has never looked so bright for epilepsy treatments and 2025 may usher in a real paradigm shift for new (and potentially disease-modifying) medicines.

Closing Thoughts – Exits Will Continue to Dictate Sentiment

Ultimately investors are judged on their exits, so M&A and public portfolio performance will continue to play an oversized role in sentiment for 2025. On the former, Pharma patent cliffs continue to loom large and thus will likely drive sustained acquisitions for clinical or near-clinical plays. On the latter, we are still seeing strong data being rewarded (e.g., BMPC, DNLI, others last week). Even if stocks aren’t at their all-time highs, there is opportunity to pick winners and do well in this market, especially considering some of the undervalued names.

There is a bimodal distribution in investor and company sentiment and it’s unlikely to change in the very near-term. Instead of focusing on what is out of our control (geopolitical agita, pricing pressure, stubborn inflation), let’s put energy into what we can control: doing everything in our collective power to bring medicines to patients. Cheers to a productive 2025 for our industry.

P.S. For those of you following along, yes the callbacks to literature were intentional and there are 5 in total!