By Cody Tranbarger, EIR at Atlas Venture, as part of the From The Trenches feature of LifeSciVC

It’s an interesting time to be thinking about space. Just a few months ago, SpaceX captivated and inspired the world by catching a reusable rocket booster with mechanical chopsticks for the first time. Meanwhile, humanity’s march toward a multi-planetary future continues, with Mars on the itinerary for the 2030s (unless you’re on Elon time). If that’s not compelling enough, space can at least offer a mental respite from our terrestrial woes – no gravity, no tariffs, no anti-science agenda.

Although it doesn’t get much attention, biopharma has been experimenting in space for over 30 years. Merck, Bristol-Myers Squibb, Amgen, Eli Lilly, and Gilead have all conducted microgravity research in orbit. In recent years, the renaissance in private space has rekindled interest in microgravity and spawned a more radical vision for the future: manufacturing drugs in space.

The statement conjures an image more apt for a sci-fi novel than industrial pursuit, but flying constellations of steel bioreactors may be closer than we think. Last year, Varda Space Industries took a long step toward that vision, raising a $90M Series B after successfully launching a bioprocessing capsule into Low-Earth Orbit, creating a unique crystal of the HIV drug ritonavir in microgravity, and returning the material to Earth intact. Varda’s mission is “expanding the economic bounds of humankind,” beginning with biomanufacturing in space.

Which begs the question, is space-based biomanufacturing science fiction or science fact?

Why Space, Why Drugs, and Why Now?

Gravity is one of four immutable forces of physics. Gravity’s influence on biology is so pervasive that many of its effects go unnoticed and unappreciated. At the molecular level, gravity underlies sedimentation and convection, the central principles that govern fluid dynamics. In microgravity, these “certainties” fail, freeing biological processes to unfold in novel ways. Fundamentally, microgravity turns a constant into a variable, enabling net-new biology and the tantalizing possibilities that come with it.

Microgravity has long been an object of curiosity for scientists. The earliest experiments, performed on NASA’s Skylab, date back to 1973. Research continued through the 90s on the Space Shuttle, but only after the 1998 launch of the International Space Station (ISS) did microgravity research achieve sufficient scale and consistency for substantial progress to made in unraveling gravity’s effects on molecular and cellular biology. In the subsequent 20 years, the number of “microgravity” patents grew more than 7-fold, highlighted by advances in protein crystallization and 3D tissue culture.1,2,3

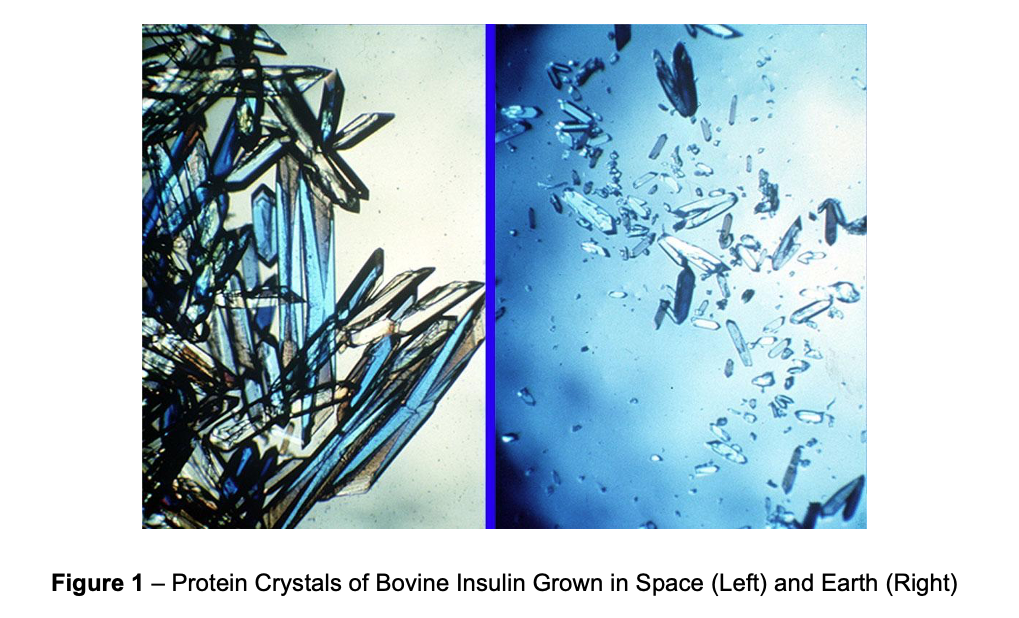

Among a long list of innovations, the “lowest” hanging fruit for commercialization is the use of microgravity-based crystallization to enhance high-value pharmaceuticals. Microgravity enables the growth of larger, more uniform protein crystals (Figure 1)4, which has unlocked both higher resolution structural data (valuable for drug discovery and design) and the production of protein isoforms with unique drug properties. With respect to the latter, Merck’s microgravity research on Keytruda is an informative case study.

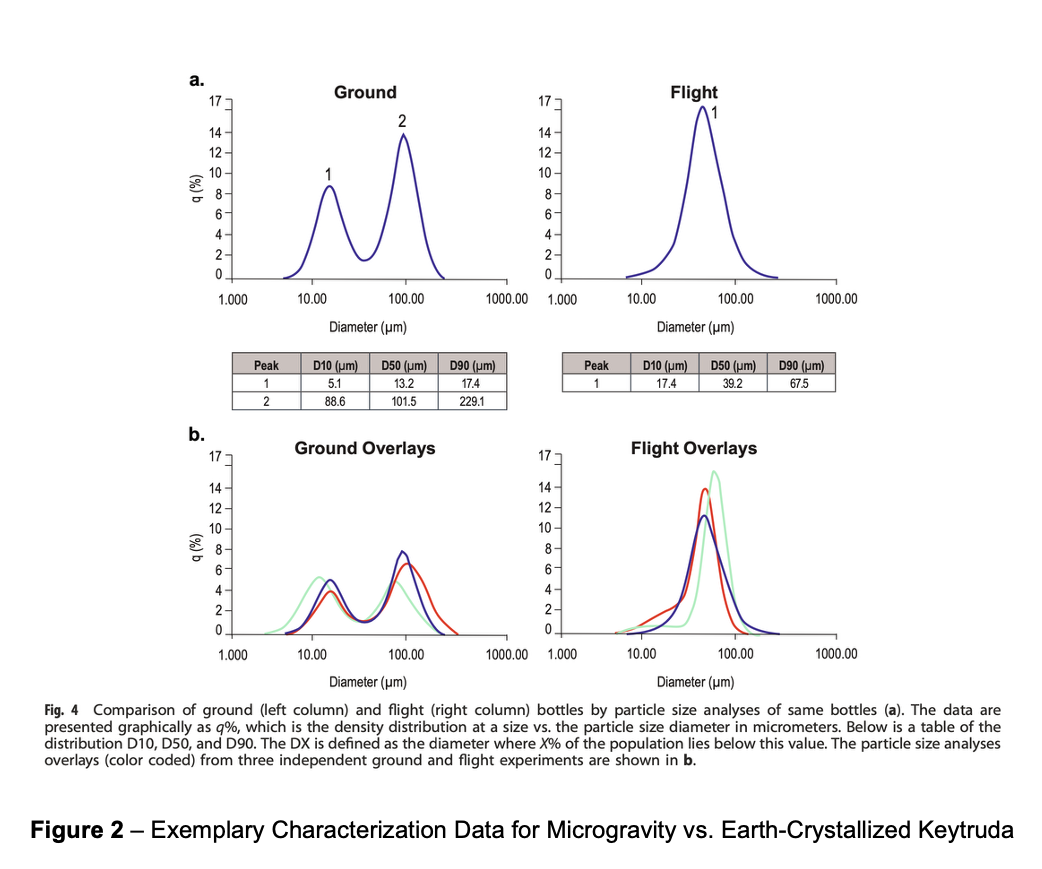

Keytruda, which generates >$25B in annual sales, is among the most important and impactful oncology drugs of all time. In a pioneering study on the ISS, Merck successfully generated a crystalline suspension of Keytruda with significantly higher particle homogeneity and lower viscosity relative to terrestrial controls (Figure 2). Relative to benchmarks, the space-grown crystalline suspension of Keytruda exhibited substantially lower viscosity at therapeutic concentrations (>100mg/mL), suggesting superior compatibility with subcutaneous delivery.5

Insights from this work were subsequently applied on Earth to advance subcutaneous formulations of Keytruda. In the future, however, the drug product itself could be the space-grown crystalline suspension. Convenience is an increasingly common competitive lever in the biopharma industry, particularly for crowded targets. Microgravity crystallization, in combination with modern innovations in antibody engineering (e.g., half-life extension) and formulation / delivery (e.g., large volume auto-injectors), could unlock hard-to-copy drug presentations that provide meaningful commercial differentiation.

Despite the progress made, microgravity research projects to date have been exploratory, small-scale one-offs. Access to and reliance on the ISS is a bottleneck. Demand exceeds supply, and there is little hope in clearing the queue – many ongoing studies won’t even finish prior to the ISS’s 2030 retirement.6 That opportunity hasn’t gone unnoticed by a burgeoning private space industry. Fueled by outlier successes like SpaceX, the past 10 years have seen nearly $80B of investment in companies building the future of space.7 Among them are startups like Varda Space, Yuri Gravity, and SpacePharma, all of which have emerged with a mission to translate biological microgravity into commercial value. Despite this sub-sector’s infancy, there are reasons to believe in its potential.

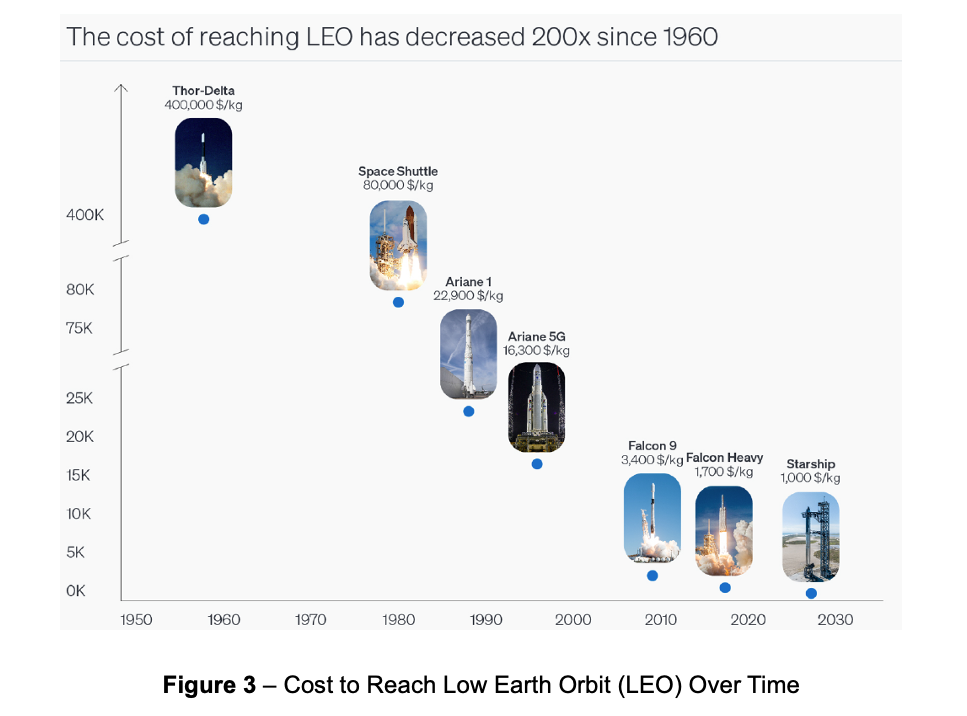

Bolstered by declining launch costs and rising drug prices, the economic paradigm has evolved; and the trajectory toward unit economic viability is increasingly clear. First, the cost to reach Low Earth Orbit (LEO) has dropped 200-fold – from ~$400,000/kg during the first era of commercial space to ~$1,500/kg today – and is expected to reach <$1,000/kg by 2030 (Figure 3).8 Second, high-value biologics may be the economically optimal starting point for space-based manufacturing. Pharmaceuticals are among the world’s most valuable materials by weight – leading branded drugs, particularly biologics, carry list prices that often exceed $1M per kg.9 Keytruda, for example, sports a list price of $47M per kg. These converging trends are representative of the current inflection point: the transition from exploratory research toward industrialized development to unlock economic value from space-based life science.

Sprinkling Star Dust on Biopharma Business Models

Industry structure in the nascent and dynamic space-based life science sector is still evolving. Broadly, the three business models being employed all mimic those of terrestrial incumbents:

- Contract Development & Manufacturing (CDMO) – providers of space-based manufacturing of and innovation on high-value biopharmaceuticals, such as Varda

- Contract Research (CRO) – providers of microgravity research-as-a-service, such as Yuri Gravity, Redwire, and SpacePharma

- Real Estate / Infrastructure (“REIT”) – developers of commercial space stations and satellites that will host life science R&D among other activities, such as Axiom Space

On Earth, outstanding businesses have been built in each vertical. Space, though, is subject to distinct constraints. One key difference is volume – the cadence and cycle time of space-based experimentation is much longer than the terrestrial alternative. For a fee-for-service CRO business, this is a fundamental limitation that will likely relegate microgravity “research-as-a-service” to premium, non-recurring projects for the foreseeable future.

In contrast, the CDMO model has historically offered greater optionality. “IP-Enhanced” CDMOs that provide unique value-add, such as cell lines (e.g., Lonza), formulation enhancement (e.g., Halozyme), or delivery devices (e.g., Ypsomed), often escape the fee-for-service paradigm, capturing economics through milestones and royalties. While these cash flows are exposed to duration and scientific risk, they are larger in aggregate, stickier, and command a premium valuation. This model – lower volume, greater value capture per unit – is more compatible with the characteristics of space-based biomanufacturing and is the highest probability path to economic viability and venture-scale returns in the near-to-mid-term. Varda, which is employing an IP-Enhanced CDMO model, has emerged as an early “winner” in the space, but it’s early. Varda hasn’t yet shown commercial traction with biopharma, nor has it elucidated a core, differentiated use case that will allow it to do so.

Achieving Stage Separation

Despite early proof-of-concept, an improving cost structure, and availability of capital, the path to sustained commercial success is highly uncertain. Space-based biomanufacturing faces a formidable set of hurdles – among them:

Cost: the fully loaded cost of space-based biomanufacturing is largely unknowable today. Operation of bioreactors, maintenance of sterility, management of thermal and mechanical stress, and payload recovery will all carry costs that are hard to predict, but may far exceed the cost of launch alone.

Scale: in any biomanufacturing process, scaling introduces new variables and complexities – this transition is often difficult even on Earth. To date, space-based biology experience has been decidedly subscale – current space-based processes are producing milligrams to grams of material at best. Keytruda, meanwhile, is manufactured terrestrially in bioreactors of more than 10,000 L. To reach commercial viability, output will need to be scaled-out (running many missions in parallel, which is expensive) or scaled-up (deploying larger reactors, which is hard). Regardless, dedicated bioproduction facilities will be essential infrastructure, but the development, validation, production, and deployment of such systems is not guaranteed.

Regulatory: there is no regulatory framework for products made in space. Regulators may reasonably ask – is a drug crystallized in orbit the same as if made on Earth? Resolving even basic questions like this for a space-produced drug will be challenging, given the barriers to inspection and the challenge of executing parallel validation runs. Initial discussions between FDA, NASA, and industry have begun, but a solidified regulatory framework is years away. Until then, regulatory risk is likely to remain an overhang for commercial efforts.

Adoption: the value density of biologics is a double-edged sword. Biopharma companies are strongly incentivized to minimize manufacturing risk, even at the expense of margins. This introduces a unique chicken-and-egg dynamic – reliability and reproducibility must be proven at scale to facilitate adoption, yet adoption is required to prove reliability and reproducibility.

How and when is that stalemate broken? When space-based biomanufacturing finds its “killer app” – a differentiated, value-add use case that is both uniquely possible because of microgravity and unable to be recreated on Earth. The search continues, and the prize is substantial. Biopharma CDMOs generated ~$180B of revenue in 2024 – capturing just single-digit share would place biomanufacturing among the largest sectors in space.

Science Fiction or Science Fact?

The convergence of declining launch costs, expanding commercial infrastructure, and rising biopharma demand positions the life sciences among the potential defining industries of the new space economy. Whether the time is “right” or not, space, in some form, is an inevitability for our industry. The underlying variables – scientific novelty, value-to-cost per unit weight, and monetization capacity – align. While it may sound like science fiction, space-based biomanufacturing is a rational and realistic pursuit.

However, this is a 10+ year story. An enormous amount of risk and uncertainty must be discharged along the way. The path will almost certainly be iterative, and its origin lies at that first “killer app” – differentiated use cases at small scales drive further investment, which unlocks new use cases at larger scales, and so on. Beyond that, the sector needs a champion – a visionary that can evangelize, inspire, and influence while withstanding the volatility. Hope is as important a variable as the economics.

After all, science fiction vs. science fact is often a product of perception.

Thank you to my friend and colleague Matt Sears for his contributions to this article.

References

- DeLucas, L J et al. “Protein crystal growth in microgravity.” Science vol. 246,4930 (1989): 651-4.

- Ma, Chiyuan et al. “3D cell culture model: From ground experiment to microgravity study.” Frontiers in bioengineering and biotechnology vol. 11 1136583. 24 Mar. 2023.

- Hirschberg, Carsten, et al. “The Potential of Microgravity: How Companies across Sectors Can Venture into Space.” McKinsey & Company, 13 June 2022.

- Choi, Charles Q. “Space May Be the Best Place to Grow Bone Formation Protein Crystals.” Space.com, 17 Aug. 2016.

- Reichert, Paul et al. “Pembrolizumab microgravity crystallization experimentation.” NPJ microgravity vol. 5 28. 2 Dec. 2019.

- NASA. NASA’s Management of the International Space Station and Efforts to Commercialize Low Earth Orbit (No. Report No. IG-22-005). 2021.

- Space Capital. Space Investment Quarterly: Q1 2025. Space Capital, 9 Apr. 2025.

- Lee-Brown, Donald. “Is Space Investable?” Colossus Review, Nov. 2024.

- McCormick, Packy, and Elliot Hershberg. “Varda: The Space Drug Factory.” Not Boring, 12 June 2023.