By Arthur Tzianabos, CEO of Lifordi Immunotherapeutics, as part of the From The Trenches feature of LifeSciVC

It’s easy to jump on the ‘negative bandwagon’ these days when news in our world and industry is focused on doom & gloom. In biotech, headlines and daily conversations lean heavily toward company layoffs, shutdowns, pipeline pare-backs, regulatory setbacks, depressed valuations, and what feels like impossible situations. Whether it’s inside companies, boardrooms, research institutions, healthcare organizations, investment firms, banks, real estate offices, manufacturing hubs or conference panels and hallways, the beat down is palpable and contagious.

Today’s uncertainty, including economic policy shifts, financial challenges, and perceived regulatory hurdles, can be scary. It appears that many of us are allowing or perpetuating negativity. This is perfectly normal since we are human and are wary of job security or the inability to raise money to fund our companies. However, I fear that if we continue to embrace a pessimistic view, we risk creating a self-fulfilling prophecy. This will not serve us or our patients well.

Understandably, rapid, and recent changes in government policy and personnel create uncertainty, but this isn’t new. Anxiety in 2017 over NIH and FDA appointments preceded some of the strongest years of approvals, revenue, and funding. Moreover, we know and plan for development timelines that span multiple administrations, which means we must continue to focus on good science and prudent business operations.

Although the stakes seem higher today, the fundamentals of the biotech industry and the key ingredients for success have not changed. The biotech recipe still calls for a healthy mix of:

1) Credible science/promising drug candidate(s)

2) Experienced management

3) High unmet medical needs/commercial opportunity

4) Access to capital

We have experienced periods in the past when one or more of these essential ingredients have been difficult to procure and maintain. Even then, biotech companies launched new medicines, important scientific discoveries advanced to the clinic, treatments obtained regulatory approval and patients, investors and society benefited.

Today, we can still check these boxes…..

Scientific discoveries are flowing

New mechanisms of action (MOAs), new targets, modalities and approaches abound and are helping many more patients today

- Biologics and targeted therapies include new cytokine targets and bispecific antibodies. We welcome innovative CAR-Ts, GLP-1 receptor agonists, PD-1 inhibitors and others that have been approved, are in development or waiting to be discovered.

Good data is being rewarded

- Positive Phase 2 clinical data in head and neck cancer reported by Merus N.V. resulted in a rise in stock price from ~$40 to $62+ over the past several weeks

- Hot off the press is Kymera Therapeutics’ Phase 1 healthy volunteer data for its first-in-class oral STAT6 degrader which resulted in an impressive ~45+% jump in stock price on the news

- And this just in: Lyra Therapeutics’ positive Phase 3 results in the treatment of Chronic Rhinosinusitis (CRS), which drove the stock up ~400% on the announcement

Pipelines/programs founded on novel science that have had to be shelved for now doesn’t necessarily mean that they will no longer see the light of day. Opportunistic pharma and savvy investors may still seize the day and give some of these promising breakthroughs a new home when the time is right.

Management teams have gained valuable experience

Industry leaders have weathered a number of storms now, some of which have been more severe and lasted longer than others. Nimble, open-minded, and experienced management teams have taken important lessons forward. They’ve become more adept at building and contracting, keeping their options open, and pivoting when necessary. The best ones have also learned how and when to ask for help, leveraging the strong relationships that our biotech community is founded upon.

That is not to say that there aren’t opportunities to learn how to operate more efficiently. Assessing outsourcing strategies, particularly early on and in times of economic pressure, has become an art to successfully advancing the science. Knowing what key functions can be served from afar and those that must be integrated within is often company and time dependent. Experienced teams will lean toward staying lean while generating data as quickly as possible because cash is king.

Unmet medical needs remain high

One indicator of high unmet need is the number of clinical trials listed and currently underway. According to ClinicalTrials.gov, there are over 500,000 registered studies including interventional and observational studies. Not all of these studies are active or currently recruiting, but over the past five years, more than 35,000 studies have been registered annually. In 2024, BioSpace reported that the U.S. had 20,465 ongoing clinical trials, and worldwide there were 65,474 trials recruiting subjects. Unmet needs remain high and drugs that demonstrate clear benefits for patients will continue to attract pharma partners, strategic investments, and buyers.

Capital is available

There is significant capital that is yet to be invested. According to data from Cambridge Associates and Pitchbook, private equity and venture capital funds are sitting on around $1.7 trillion of committed, but not yet invested capital. This includes nearly $140 billion raised in 2019 or 2020 and an additional $200 million from 2021, some of which could also hit the end of its investment period this calendar year. Keeping in mind that most funds have five years to build their portfolios, critical allocation decisions will need to be made in the near term.

Investors have additional money to deploy

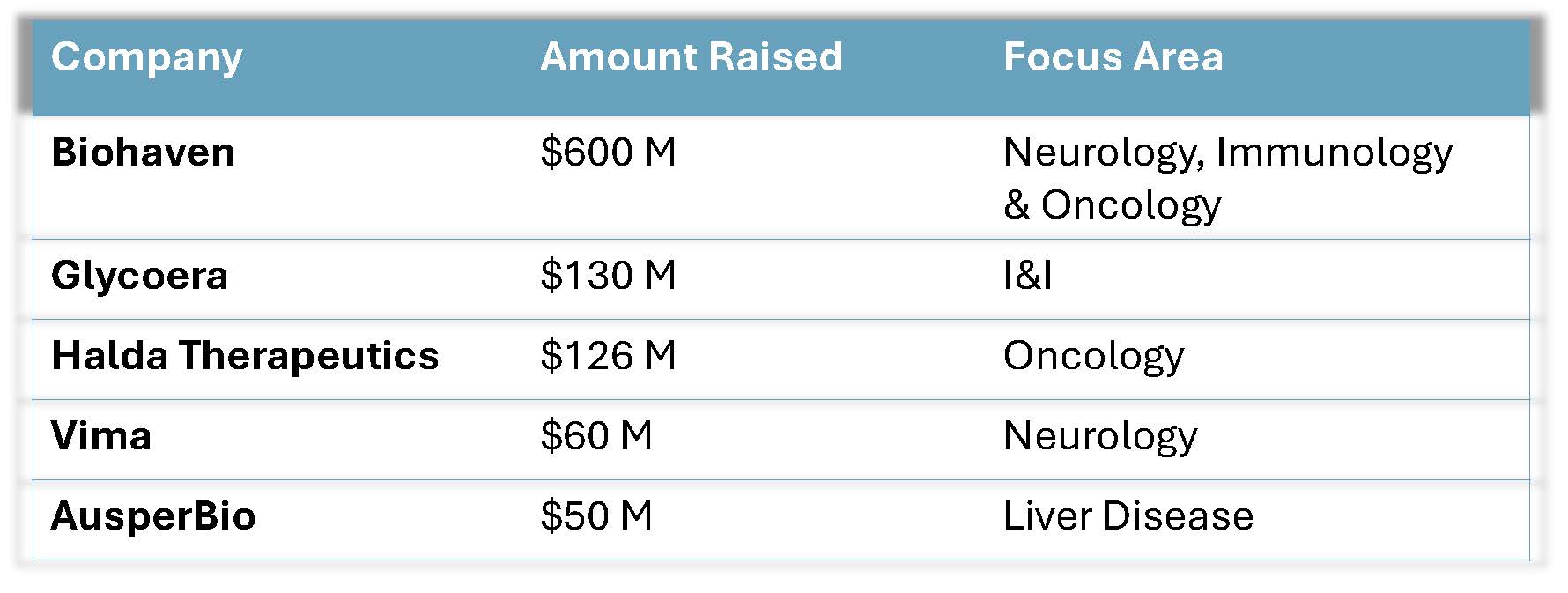

By mid-May, Life Sciences issuers raised approximately $8 billion in equity-based deals (including IPOs, CMPOs, Follow-Ons, Bought Deals, Convertible Note offerings, PIPEs and RDs and this does not include Preferred Offerings and ATMs). Private financings from 2025 also indicate that deals are getting done.

Select private financings from 2025

In this environment, investors will continue to be conservative and disciplined regarding the companies they invest in. Management teams will need to be even more results-driven and efficient with their dollars. This is a good thing. Companies with the right ingredients that also take a conservative and disciplined approach can succeed. Low valuations won’t last forever and while here, they offer opportunities for smart, discerning, and patient investors to reap potentially greater ROI.

In this environment, investors will continue to be conservative and disciplined regarding the companies they invest in. Management teams will need to be even more results-driven and efficient with their dollars. This is a good thing. Companies with the right ingredients that also take a conservative and disciplined approach can succeed. Low valuations won’t last forever and while here, they offer opportunities for smart, discerning, and patient investors to reap potentially greater ROI.

“As the biotech sector rebounds from the funding downturn, capital is now being more selectively allocated to high-quality, data-driven programs.” – 3rd Annual BioConnect Conference, H.C. Wainwright & Co., Investor Panel

Pharma has money to spend

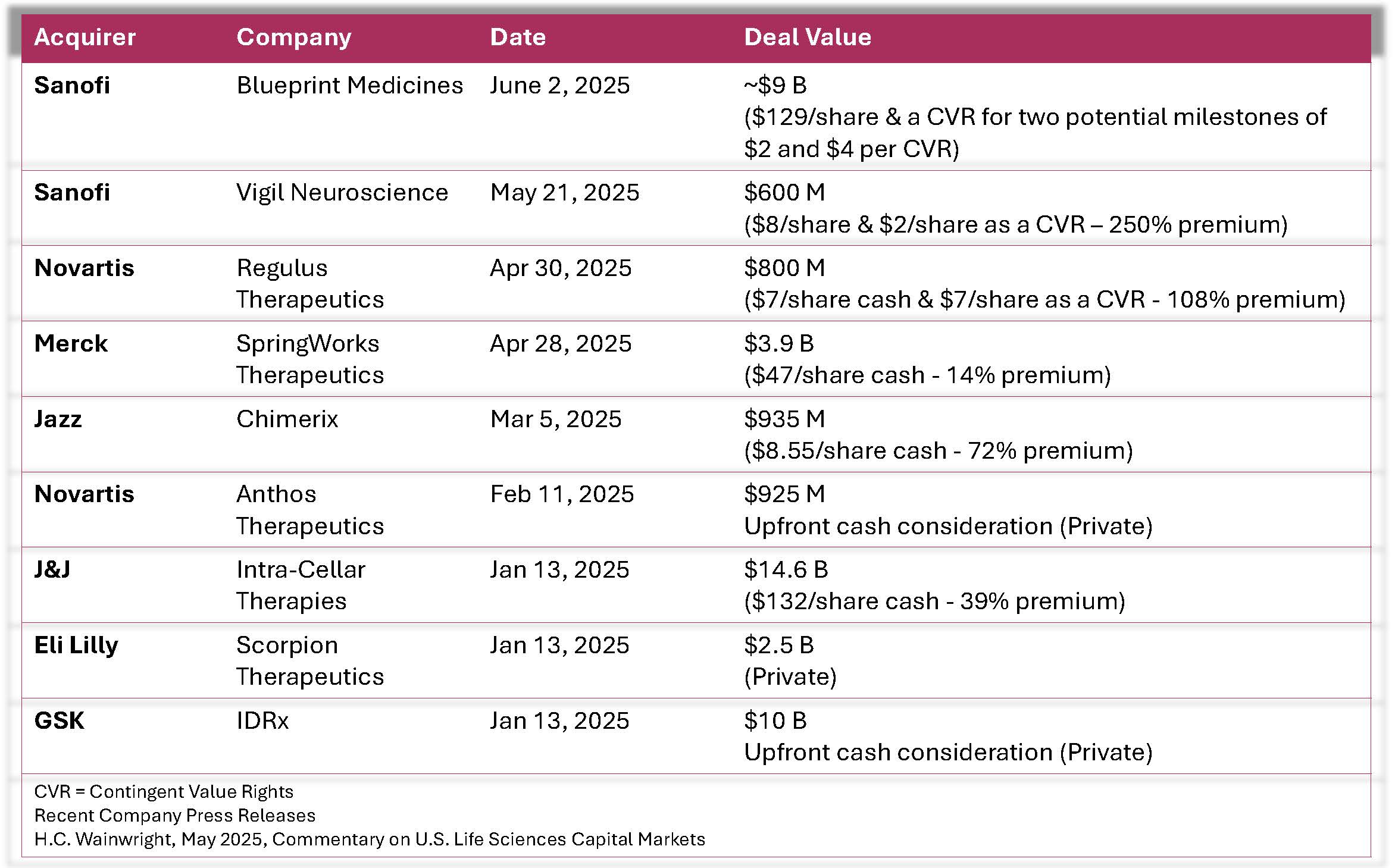

The advent of COVID vaccines contributed to record global drug revenues, and the new obesity drugs appear to be following suit. With trillions of dollars in revenues, R&D reductions, pipelines in need of expansion, and a bevy of patent expirations that are drawing even closer, Pharma needs to be active. As of mid-May 2025, Life Sciences M&A transactions represented ~$30 billion of announced value. SMID-cap M&A activity is expected to accelerate in 2025 presuming a favorable regulatory environment as the pharmaceutical sector hunts for new pipeline assets. Four public and three private M&A deals with consideration greater than $500 million were announced.

With trillions of dollars in revenues, R&D reductions, pipelines in need of expansion, and a bevy of patent expirations that are drawing even closer, Pharma needs to be active. As of mid-May 2025, Life Sciences M&A transactions represented ~$30 billion of announced value. SMID-cap M&A activity is expected to accelerate in 2025 presuming a favorable regulatory environment as the pharmaceutical sector hunts for new pipeline assets. Four public and three private M&A deals with consideration greater than $500 million were announced.

Biotech clearly has assets that provide value to pharma’s pipelines, and one could expect to see a bolus of M&A deals over the next 3-6+ months. As competition for the most promising assets and companies intensifies, biotechs who have demonstrated meaningful progress and generated compelling data should command better economics.

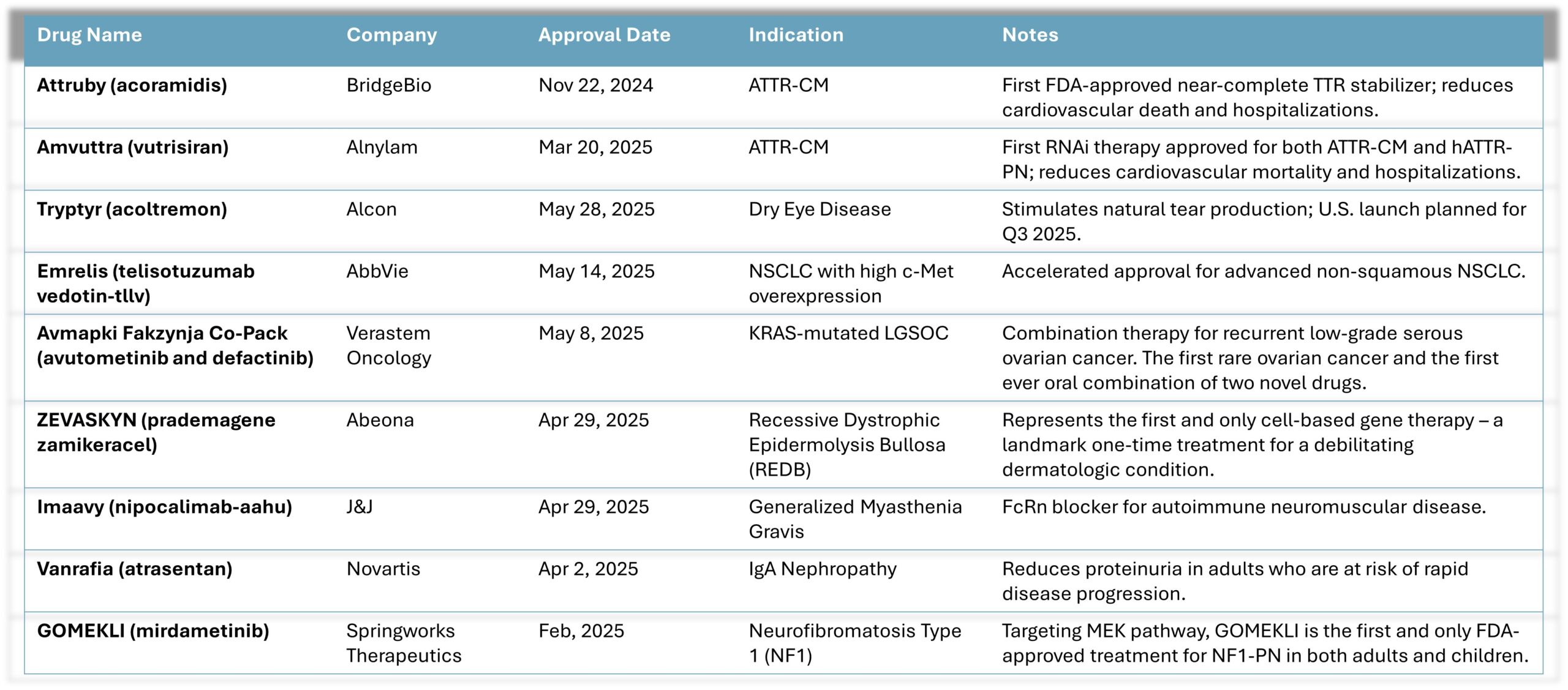

FDA continues to approve therapies, and the industry is experiencing success in commercial launches with more to come. Recent drug approvals include:

It is worth noting that Verastem’s approval is the first for a rare ovarian cancer and the first-ever oral combination of two novel drugs in oncology. Abeona’s approval represents the first and only cell-based gene therapy for a debilitating derm condition –and with a single treatment. These are significant milestones for both patients and for the biotech industry.

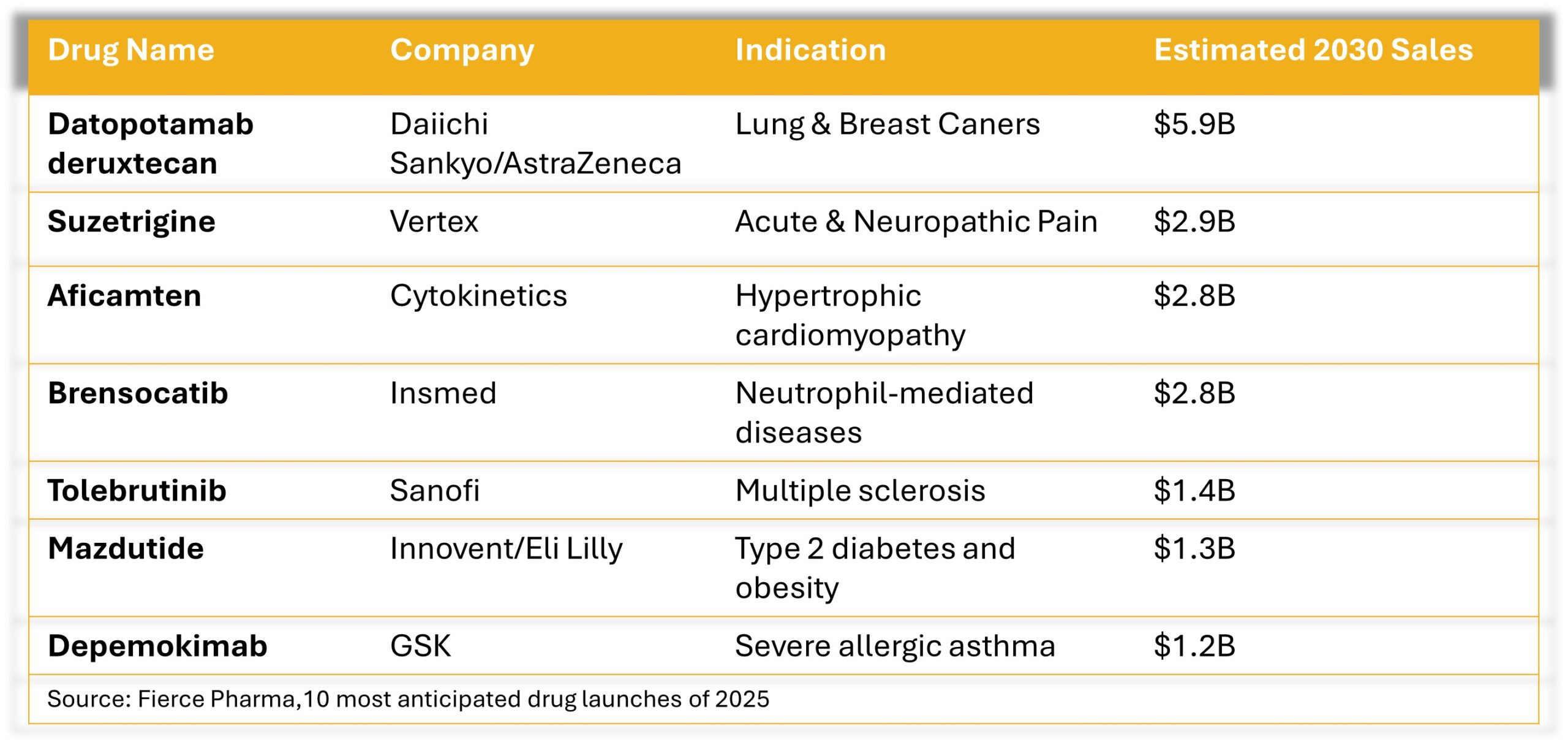

Eli Lilly’s Zepbound, a drug approved for chronic weight management in adults, generated over $2 billion in revenue for 1Q 2025, which represented an increase of $517.4 million over the same period last year. Drugs still anticipated to launch in 2025 include:

So, with all this good news, why do biotech surveys, analyst and industry reports, and general, trade and social media keep harping on the negative?

Perhaps they have forgotten that over the past 5-10 years an unprecedented number of biotech companies have launched, and a considerable number of these also completed initial public offerings (IPOs) at much earlier stages in their development (preclinical stages). These biotechs must report their progress, as well as any setbacks, on a frequent basis. As a result, they are unveiling initial data and having it play out in the public markets vs. in a private company setting. How often does a small, early clinical data set knock it out of the park in safety and efficacy? Very rarely. Depending on the PK/PD of a drug and the indication, early data readouts can be meaningful. More often than not, the data are mixed, open to interpretation and needing more patients to demonstrate clinical proof of concept and an attractive safety and efficacy profile.

It’s no wonder that patience is wearing thin. During the pandemic, COVID vaccines were approved in record time and with Emergency Use Authorizations (EUAs) came the idea that future treatments might also reach patients sooner than ever before. Breakthrough Designations, Fast Tracks, RMATs and Accelerated Approvals have been major advancements, but developing new drugs and obtaining approval is still a long, winding, and expensive road.

Instead of fueling the fire, this is an opportunity for us to reassess what we are doing, how we are doing it, and why we are doing it.

We are developing innovative therapies as quickly and efficiently as possible to help patients who need new treatment options.

It’s time to get off the negative bandwagon and keep our focus on what we do well, what we could do better and what we believe is possible. With the BIO International Convention just around the corner, let’s regroup, reset, and hop on board a positive bandwagon. To inspire this view, I share some recent quotes from investors and industry veterans that I believe deserve more of the spotlight:

“…now we should focus on rebuilding, not dwelling on things we cannot control but learning from them.” –Paul Hastings from the Endpoints 100 Biotech Survey

“If we give into the negative sentiment, it’s like giving up… and that’s not what we do, it’s not how we are built, and it’s why we survive.” –Longtime CEO and VC

And I thought this one summed it up nicely:

“This is possibly the greatest moment in biotech if you can see through the current headwinds. Valuations are attractive for efficient biotechs with good drug candidates, smart management teams, and supportive investors. Focus on areas of unmet need…and develop it cheaply and quickly. It CAN be done. Dare.” –Investor at BioConnect Conference, H.C. Wainwright

Hopefully, I have made a case for why we need to shift our collective mindset to a positive mode. We have a lot of great science being discovered every day and the knowledge and experience to translate it into impactful drugs for diseases where patients have few, if any, treatments available.

WE GOT THIS……LFG!