Another day, another “restructuring” – there’s been a flurry of press releases recently using phrases like “exploring strategic alternatives”, “extending the cash runway”, and “de-prioritizing” certain R&D programs.

These announcements are obviously responses to the tough market environment. In every downturn, belt-tightening happens as R&D-intensive, loss-making companies realize their balance sheets are too small and their cost of capital is too high to support their future aspirations.

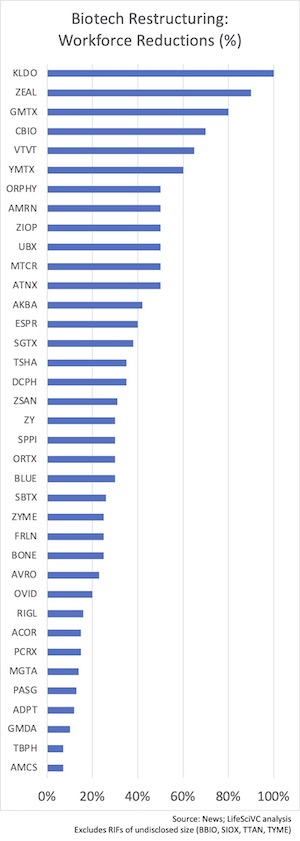

In the past few months these restructurings are being announced with an unusually rapid cadence, in large part because burn rates ballooned during the financing bonanza in 2019-2021. And we’ve got so many more public companies. Here’s a table with many of the restructurings, announced or executed since last fall.

What has caused this veritable flood of restructurings?

A good portion of them are due to bad data – especially with the higher-than-typical volume of negative clinical and regulatory news. In the face of diminished prospects for lead assets, costs need to be cut.

But some of these changes are also just good fiduciary governance and smart stewardship of capital in a time of risk-off sentiments in the equity markets: the realization that the prospects for any near-term financing will remain tough for SMid-cap players with beaten down stock prices. In these cases, extending runway by cost reductions to get through to key value inflection points with lead asset(s) is the goal – and hopefully prevents punitive dilution from near-term capital raises at painful valuations.

As is well appreciated, the cost structure of most emerging pre-revenue biotech companies is directly a function of R&D spending: how many projects is a company working on and how many people are doing the work. This means the key restructuring elements are reductions in force (people) and de-prioritizing earlier stage pipelines (programs). Leases are also commonly part of the cost structure; fortunately, in most regions today subleasing space remains a strong secondary market and these costs can be recouped. But people and programs are the typical cost-cutting focus.

Across the sector, these restructurings are therefore affecting a lot of employees. But these headcount reductions aren’t only the domain of smaller biopharma companies: big names are announcing changes too, and far larger ones in absolute number. Biogen has reduced its headcount by ~1000 in the wake of the Aduhelm challenges, Sanofi is shutting down the Principia site, Merck is letting go folks in the Cambridge area from their Acceleron deal, Gilead is laying off folks from their Immunomedics acquisition, and Novartis is restructuring with 1000s of job cuts worldwide, as examples.

Fortunately, overall, the biopharma job market remains a competitive one, and many of these new job seekers shouldn’t take long to find new roles. But it does feel like the incredibly “hot” talent market of 2019-2021, fueled by the availability of capital, is likely to cool down somewhat, in light of these recent big and small company workforce reductions.

Given the number and cadence of these announcements, the topic sadly warrants deeper consideration – especially around the different flavors of these restructurings and how to successfully navigate them.

At a high level, there are two primary situations for these biotech restructurings: (a) the “we must live another day” because we’ve got great pipeline assets; and (b) the more severe “we’re done” so let’s capture the residual value of our assets by exploring “strategic alternatives”.

The latter restructuring could be to liquidate the business (involving delisting, dissolution, and distribution of cash), as Kaleido just announced. Or, more commonly, the strategic alternative will be to run a reverse merger process to find a private company who can leverage the remaining net cash and “seasoned stock ticker” (with the public shareholders receiving value for their cash plus $5-10M for their established public company shell). There are plenty of these processes ongoing right now. We did this with Unum Therapeutics and Kiq Bio in 2020, which became Cogent, and it’s up 500%+ since the announcing the deal. In many ways, these “we’re done” restructurings are more straightforward in their path to extracting some residual value.

The trickier restructuring to get right is the “live another day” situation. Management teams and Boards still have conviction around the future of the programs and/or scientific platform and are restructuring to support a leaner version of the company – with the hope of making it thru to value-inflecting milestones without massively diluting the existing shareholders.

To get these restructurings right, there needs to be an honest and objective assessment of where the real value is (e.g., what programs, what technologies, etc). The goal is cutting “excess” or non-essential activities out of the operating plan, refocusing the attention of the team on getting thru key data readouts. Earlier projects, which may eventually be of real value in more accommodating capital environments, often can’t be funded when there’s a stage asymmetry of assets in the pipeline. These restructurings often, and rightfully, favor the assets that can hit value inflections in the near-term.

But you can’t cut into the substance of those lead assets, or the team that is truly required to deliver on these programs. Cannibalizing the primary value driver by over-cutting defeats the purpose of the restructuring. It’s a tricky balance to get right, and the degree of the cuts is often very situation dependent.

Once you’ve committed to doing a restructuring, doing it in the right way is critically important. Not only for a management team and Board’s long-term reputation, but also because it’s just the right thing to do.

On first principles, it’s about treating people with dignity and respect: explain the business challenges in a transparent manner, and reinforce the message that the RIF is not performance-related. Help the affected team members with their transition, and work with them to find new roles (like building and sharing a resume book with the HR community). Give these folks adequate notice and severance, where appropriate. Create a retention plan for the go-forward team. Try to do all this with the mindset of “measure twice, cut once” – as repeated or serial RIFs are utterly destructive to a company’s culture. Importantly, how you treat people in challenging times speaks volumes about what kind of Board and leadership team you are – in biotech, the world is small and memories are long.

In addition, monetizing paused or shelved assets can be worthwhile to consider: out-licensing them to existing companies can add much-needed capital, or working with entrepreneurs to spin them out into a NewCo. Both can be incrementally accretive. In addition, it has broader emotional value in that it helps convey that what the team was working on had purpose and merit, and isn’t just being thrown away.

Many restructurings of late are from struggling SMid-cap companies that have traded off 70-90% from their IPOs or all-time-highs. The obvious billion-dollar question is whether these restructurings to “fight another day” ever really succeed. Is it even possible? While challenging to do, the answer is definitively yes.

One of the best examples is Jazz Pharma, which traded down below $1/share, restructured in 2009 a few years after its IPO, and is now trading at ~$160/share. That’s quite a turnaround. Others that restructured successfully when near $1/share and have remained independent: Exelixis, Fate Therapeutics, Chemocentryx, and (although 15+ years ago) Illumina, just to name a few.

Many companies have restructured and then grown into very strong acquisition candidates by larger Pharma: Array, Arena, Dicerna, Trillium, Five Prime, and Pharmacyclics – all went from deep restructurings/reprioritizations during retrenchment periods (in or near penny-stock land) into large acquisitions years later.

As for reverse mergers, beyond Cogent, there are additional examples where they’ve been successful in extracting more than residual value for the public shell’s shareholders: Madrigal, Arcturus, and Rocket reversed merged in 2016-2017 and are up 1000%, 300%, and 250% since their reverses closed, as of April 2022 (even while coming down significantly from their all-time highs).

It’s hard to know which ones in the current crop of restructurings will be successful, but some of them most certainly will – especially as the group gets materially larger over the next few quarters. Being prescient about picking those winners will pay off handsomely for some.