By Aimee Raleigh, Principal at Atlas Venture, as part of the From The Trenches feature of LifeSciVC

If you are a first-time founder who has heard the phrase “This isn’t a good time to be raising for X,” where X is a platform, a preclinical play, a non-consensus story, I empathize! After you’ve spent years contemplating an idea, potentially investing some of your own money to generate early data, and carefully thinking through the pitch, it’s difficult to hear that an entire scope of companies is out of style for a more cautious investment environment. Raising money for early-stage companies is difficult, regardless of macro factors, but is particularly challenging today.

Now more than ever, an effective first pitch is essential for biotech companies looking to raise capital. While there is no certain path to success (many more companies seek to raise funding than are ultimately successful in doing so), there are some practices that may increase your odds. My colleague Bruce wrote a post on pitching nearly 15 years ago (!), and the advice is as salient as ever (though make sure to inflation-adjust for some of the financing figures cited 😊). I figured it was worth revisiting this topic, within the lens of the unique challenges of 2025.

Let’s level-set: This is one of the more difficult times to fundraise for a biotech company in the last decade

Despite the broader U.S. market’s recovery from the April “liberation day” meltdown, biotech has not fared so well. 2025 has introduced real threats to our business model, ranging from early-stage research funding to regulatory interactions to drug pricing to potential upheavals to the global supply chain. Most investors dislike uncertainty more than almost anything else, and unluckily for us 2025 has that in spades.

There is still an abundance of capital for private biotech financings, as many VCs raised sizeable funds in the past 1-2 years. Based on an analysis of recent Pitchbook data, I estimate >$55B in dry powder (largely for private deals) across >200 life sciences VCs in the U.S. and EU. That is extremely healthy by historical standards, and on its own could support tens of thousands of seed raises or hundreds of larger private financings of $100M – $300M each. We are likely to continue to see capital skew towards the latter type of deal, with concentration in clinical-stage, asset-centric plays. And that’s not necessarily a bad thing – private biotech companies are increasingly taking programs later in clinical development, and that inherently requires larger raises to fund through important milestones. That said, if fewer total companies are accessing capital in the private markets, it does beg the question of how to effectively pitch so that you have the best shot at funding your breakthrough programs.

With that in mind, let’s take a deeper dive into funding basics, mechanics, and best practices to increase odds of success. These pointers are geared towards first-time founders, but some are applicable even for well-seasoned teams preparing to raise. Of course, each entrepreneur and company are different, as are the venture firms and individual investors on the receiving end of a pitch. Shared here are my perspectives, but they are one of many so take them with a grain of salt!

Venture financing realities: very few deals make it from first pitch all the way to syndicated deal

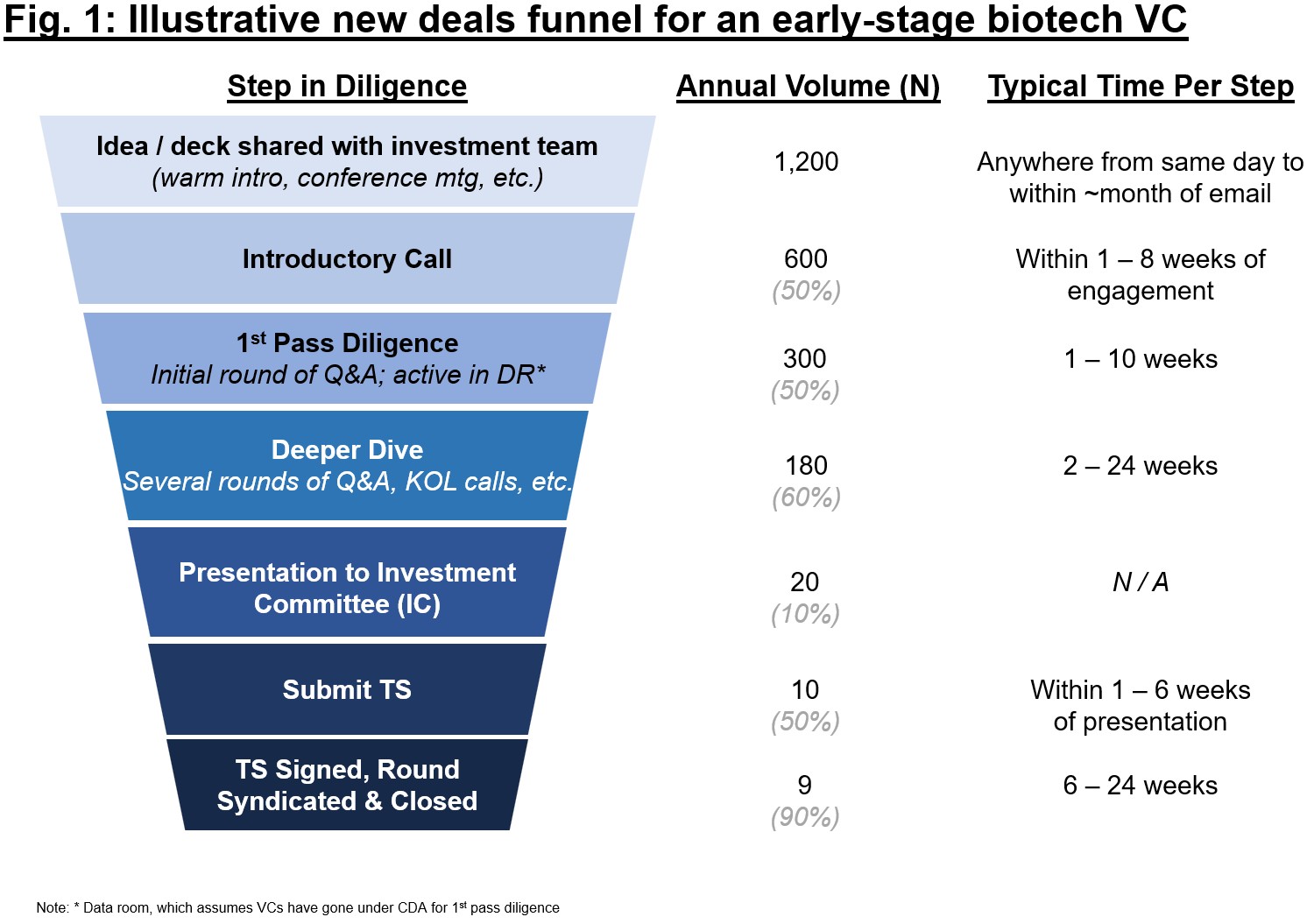

How many inbound pitches does a “typical” VC receive annually? Fig. 1, while highly illustrative, captures what an average annual deal flow may look like for an early-stage biotech VC. If you are an entrepreneur, consider that your deck is probably one of 10-30 to come through the funnel in a given week. It’s in your best interest to set it up for success in the best way possible – we’ll dig in on best practices below. Given timelines can vary widely and are likely to take longer today than a few years ago, prepare yourself for a marathon and not a sprint when it comes to financing.

Advice to entrepreneurs who are pitching to VCs

Below are some recommendations especially to improve odds of success in the earlier steps of the funnel, where attrition rates are high and planning ahead can go a long way. While I am sure some of these pieces of advice are shared by others, keep in mind every VC is different in terms of style and preferences.

Before you begin:

- As illustrated in 1 above, be realistic with yourself about probability of success and timing for a successful financing. It is not atypical to see some investments (regardless of whether they are Seed or Series C) take 9-12 months to close, and these days it may take even longer.

- Map out expectations for the financing. Prospectively define when you anticipate having a read on momentum – what does success look like? If you get to that point in time and haven’t achieved desired momentum, level set. Are aspects of your pitch not landing and could they be reworked? It’s helpful to pay close attention to feedback (both explicit and implicit) and try to address early.

- Given pitching is ultimately a numbers game, many entrepreneurs will need to pitch to a large number of VCs to convert the few who will ultimately come into a deal. If you are pitching a seed concept, maybe that total number is 50. That’s a lot of pitches to sit through – before going after them all at once, think carefully about “tiering” investors based on fit (including stage, check size, types of companies in which they have previously invested, geography, etc.). From there, you can reach out to investors in groupings, such as the below:

- First, schedule a few lower-stakes calls to practice the pitch and solicit honest feedback. Great if these are friendly faces, but make sure they are able to provide candid and rigorous feedback.

- Next, consider the ~10 or so investors who are likely highest priority – great overlap in interest, stage, write big enough checks to lead a round, etc. The goal is to try to build momentum with groups of highest likelihood to convert

- Then come the next set of ~10 – perhaps these are firms for which your company’s thesis seems to fit squarely in strategy, but they write slightly smaller checks, or infrequently lead, etc. If there is momentum in the first group of investors, that can help drive this second wave to be expedient with diligence

- Batch out firms in sets of ~10 or so and set up “rules” for reaching out (e.g., if you get a certain threshold of investors passing). Try to maintain a consistent number of investors hearing the pitch, in the data room, etc. so that you maintain momentum.

- If this is your first time pitching, remember that VC firms can be more different than they are similar! Check out this prior post for a basic primer on early-stage biotech VC.

- The pitch deck should not be thrown together overnight

- Give yourself at least a month (and ideally more) to iterate. I can’t stress enough how important it is to solicit (and listen to / act on!) early feedback.

- The “aha” of the pitch should be obvious to a new reader of the deck, without requiring a voiceover. Nearly every deck is reviewed quickly for relevance and initial interest – if the narrative is so complicated it cannot be succinctly pitched entirely in deck format, rethink how you are communicating the story.

- Recently I have seen more and more groups share both a quick 1 or 2-page “executive summary” of a deal in addition to, or in place of, a deck. My personal preference is always for a deck, as oftentimes the summaries are so high-level that it’s impossible to ascertain true differentiation of a technology or program. But to each their own! Some investors may prefer the written executive summary, so consider having one ready to go in case it is requested (or if you are trying to A/B test your pitch email, which can also be an insightful practice).

- Refine what you are asking for and why

- Be realistic about the differentiated profile for the program(s) you are pitching. VC investors have their own set of investors (Limited Partners, LPs) that they report to, so make sure there is a clear path to programs that will generate value if they are successful. VCs are not altruists who are tasked with pushing biology forward – they need to have a sense of what return profile may look like for them when they invest.

- When thinking about the amount of capital you are asking for, consider what you will be de-risking in the financing window, and don’t shy away from asking (and answering) the “killer” questions early on.

- Ask for enough capital. Often I see pitches funding just barely through an inflection point (e.g., preclinical PoC in a relevant model for seed deals, Ph1b or Ph2a data in a Series A). Budgets and timelines expand 95%+ of the time – do yourself a favor and pitch for a financing to cover the base case budget plus 6 months of operations.

- Seek advice from multiple (reasonable) advisors. For first-time founders, try to solicit balanced views from multiple sources when planning out your financing strategy. The fundraising dynamics are very different in tech compared to biotech, so bias your selection of advisors for input towards the types of firms you will be pitching.

- Getting the intro: warm is best. When you are ready to share your story with prioritized investors (and you have refined your pitch with feedback, per above), aim for personal connections vs. cold emails. While we certainly do take pitches that originate from cold outreach, it often goes much further if a mutual connection can share a blurb about the story and you as a founder – think of it as a high ROI way to increase your odds of progressing to step #2 in the funnel in 1. Take the time to map out mutual connections before deciding how best to engage with a given firm or investor.

While pitching:

- Understand your audience. If you are an entrepreneur pitching a novel biology story for seed financing to us at Atlas, we are going to deeply diligence the mechanism and / or technology. I often see pitches that are too high-level, which makes it challenging to dig into details and assess differentiation. Other firms may not want to spend >50% of the time on the science. It’s all about knowing your audience and adapting in real-time to feedback during the meeting.

- Relatedly, try not to give the same rote pitch to every VC firm. Dynamically refine the story based on questions, engagement, any live feedback, etc. Is something not resonating? Consider pausing to explain it in a different way. Ultimately each pitch is a trial-run of a potential partnership – each side should be intellectually flexible and respectful, so this is a good dry run of the dynamic.

- Consider the lift you are asking of investors. Obviously, an investor should be engaged in the story, do their homework, and ask questions respectfully. But be honest with yourself when pitching a complicated story when you are asking investors to “get it” too quickly without the appropriate level of explanation. As a founder, you are embedded in your thesis and pitch, while an investor hearing it for the first time is likely evaluating your story plus perhaps 10 others (see 1) in a given week. Carefully craft the story (both verbal and written) to try to reduce friction in getting to the “aha” moment.

- Advice for when an investor passes: in most cases, try to resist the urge to “correct” the investor and instead use the pass as an opportunity to solicit meaningful feedback that will help you hone the story for the next round of discussions. It is extremely rare that upon passing, an investor would be convinced to reconsider (unless there is new data or market conditions, like an exit in the same space), so there is relatively little to gain from trying to school an investor, and often leaves them feeling belittled and turned off by the interaction.

It goes both ways – advice to early investors

Having also pitched deals myself, a few quick words of advice to fellow investors, especially those starting out in their careers:

- Aim to get to some critical go/no-gos in a first call (valuation, stage, indication focus). It’s tough for a small team to receive a pass after multiple rounds of time-consuming Q&A for an “obvious” reason that is knowable from the non-con deck.

- Sometimes we think we are being kind by digging in on a deal that is clearly off-strategy, but the kinder approach may be to let the team know it’s not in-scope and offer to instead provide transparent and genuine feedback without asking the team for a huge lift.

- Remember teams are often pitching on top of their “day jobs” (i.e., keeping all experiments, discovery campaigns, clinical trials, etc. running) – focus on the critical questions in Q&A vs. aiming to boil the ocean.

- To the extent possible, share feedback when passing on a deal. Depth and extent of feedback should roughly scale with time spent (from both you and team). If you suggest datasets you would have liked to see or other action items, try to make sure these are in fact actions that, if team comes back to you after successful completion, would change your mind. A laundry list is usually not as helpful if it wouldn’t move the needle for you, and may end up distracting the team from true value generation in the long run.

Parting advice to first-time founders

Ultimately, it’s a two-way street: investors and entrepreneurs are each diligencing the other for potential fit during the pitch. And that fit is important – an investment might represent the start of a 5- or 10-year relationship that will face immense enthusiasm, heartburn, and everything in between. The good news is nearly everyone in this industry is incredibly motivated to bring medicines to patients, so when the path forward is unclear or the going gets tough in an uncertain market, keep that end goal in mind. I hope these tactics may help provide some clarity to those taking the leap into entrepreneurship. As Bruce mentioned in his post 15 years ago, “we look forward to hearing about your startup.”