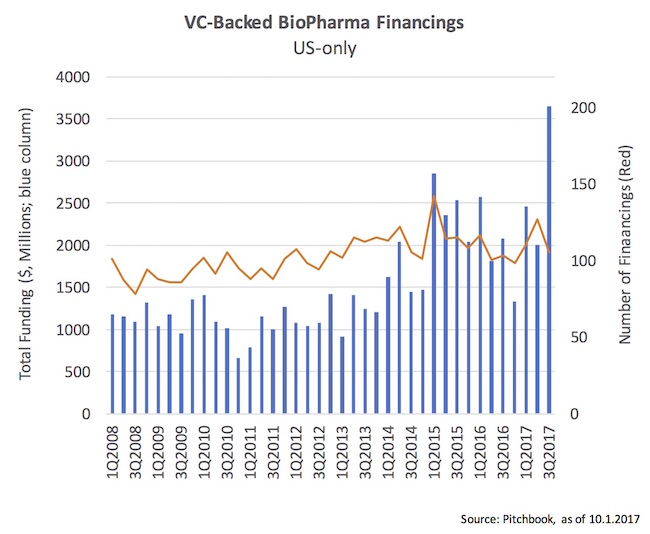

Private biotech funding numbers are in for the third quarter and on an absolute capital basis they are huge: $3.6B flowed into private biotechs, the largest quarter of VC-funding into biopharma ever in the history of our industry, according to a preliminary view of Pitchbook data.

The news has been full of financing announcements of late. Just this morning, KSQ announced a $76M financing. In September, Intarcia topped up its Series EE financing, reaching $650M, which should help it navigate its regulatory situation. Many other firms also came in with strong financings, e.g., SpringWorks raising $103M, Gritstone $93M, Homology $84M, etc. Our portfolio at Atlas Venture was busy too, with Replimune raising $55M, Disarm at $30M, Rodin at $27M, and few stealth ones to be announced soon.

Here’s the aggregate quarterly data where you can see the massive jump in financings in the third quarter:

While many of these financings have traditional VCs in them, a significant portion of the capital is coming from non-traditional investors, like Baillie Gifford, as well as crossover firms keen to get in before IPOs in 2018.

Of note, the financings aren’t about sprinkling around capital to more players. In fact, the number of financings was in line with the 10-year average: slightly more than 100 VC-backed biotech financings in the US each quarter as you can see on the line above.

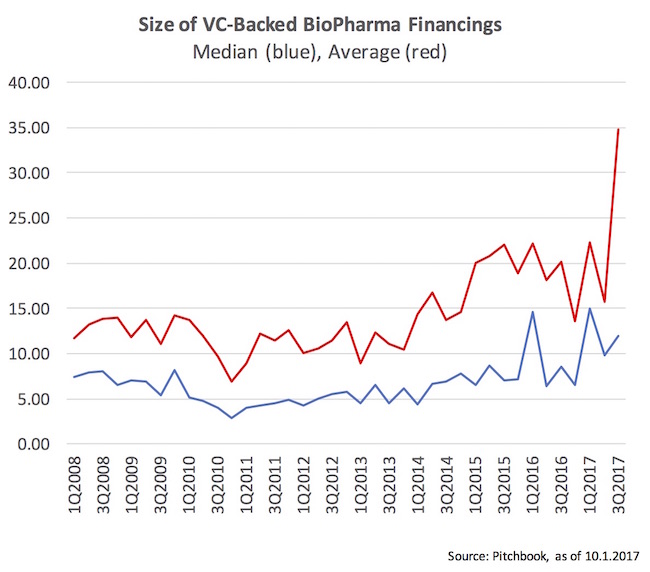

To state the obvious for the math-savvy, this implies one thing: the size of financings have gone up. This is indeed the case. Below are the median and average financing sizes by quarter. It appears like more funding to finite number of startups.

Biotech venture financing is booming, but is it a bubble? Who knows, as most bubbles are only truly diagnosed in the rear-view mirror.

Given the innovative pipelines in biotech today, and the need to finance them, this could reflect the optimism of investors and management teams about advancing their portfolios deeper into the clinic. It also suggests that 2018 will be a gangbuster year for IPOs – many of these crossover-heavy financings will want to get access to the public markets, and more funding, in the near-term.

One downside is that as more capital flows into biotech companies, valuations will almost certainly be moving up with similar buoyancy – which means the risk of future downrounds and valuation compression goes up. The hope is of course each round of financing sees upticks in price over the last, but that’s not always the way it works, especially if/when tighter capital market environments show up.

Thankfully, we haven’t seen a huge spike in the proliferation of companies – many more small (and undercapitalized) players competing around the same areas of science would be a negative for the ecosystem.