The flood of capital continues to pour into the private biotech ecosystem, marking the current climate as the most prolific period of investing into the sector of all time.

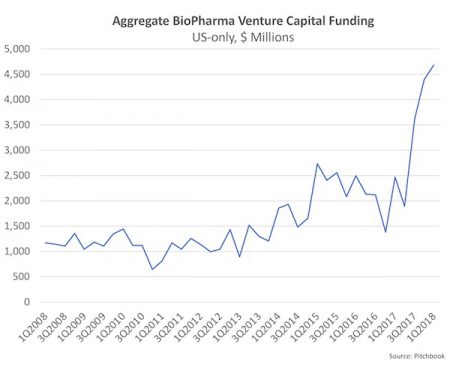

The first three months of 2018 secured yet another “biggest quarter ever” trophy for the sector, hitting nearly $4.7B in funding. This is the third such quarter in a row, which prompted a similar post on the “Boom or Bubble” last fall. Here’s the last 40 quarters of private biotech funding, according to Pitchbook.

The staggering funding comparison is that in 2012 and 2013, during the opening of the IPO markets, the entire US-based biotech venture sector over those full years invested roughly the what we did in just the current quarter (1Q 2018), around $4.5B. That’s a 3-4x increase in capital.

As I’ve noted in the past, the source of this new wellspring is a diverse set of players that go well beyond traditional US-based venture capital firms: public crossover investors, Asian venture funds, sovereign wealth funds, and ultra-high net worth family offices. One long-term question is whether these players are merely tourists to the space, backing momentum stories and taking advantage of the abundance of opportunities today, or if are they developing deep conviction and long-term expertise in the space to withstand the future ebbs and flows of the investing cycle. I hope the latter (and can make the case for it), but fear the former is likely.

While seed financings remain stable (and the number of first-financings into new startups relatively flat), the average and median size of Series A and Series B financings have gone up considerably in recent quarters. In particular, the Series A average, skewed upwards from the median by a number of big financings, have skyrocketed in the past quarter or so. Early stage startups are being fueled with far more funding than they ever have in our sector.

With capital flows of this scale, emerging biotechs have seen their cost-of-capital drop considerably. Another way of saying it: increased demand from these capital providers has increased the private stock prices of the sector. As a supplier of equity (i.e., a venture firm focused on creating new startups), we’re of course pleased to see the downstream demand for innovative startup equity

The changing dynamic over the past few years is striking. In 2011, I wrote a blogpost on the reduction in capital flows into biotech venture (here), trying to paint a positive, glass-half-full view of a very constrained moment for the sector. Times were much tighter, and indeed a “seller’s market” did develop in 2013-2015 as speculated. But it was a challenging time to raise capital for early stage startups.

To illustrate the difference, here’s how a prototypical Series B has changed. Today, as it was a decade ago, a Series B for a novel drug discovery startup often helps power up the lead programs and advance them into the clinic. For context, the seed/Series A was and continues to be spent reproducing the founding science, establishing the biotech’s platform, identifying the initial lead programs, perhaps securing a validating partnership.

In 2010, a Series B financing often looked like this: raising $25-30 from top tier VCs and selling 50% of the company to these new B-round investors, usually at a flat price to the Series A (which raised $25M or so). The post-money would be $60-70M, and the company would hope to be bought for $300M in order to make a 4-5x. IPO pre-money valuations were in the low-100M’s, so typically not a great return until the stock seasoned with data in the after-market. The “no-step-up” game in terms of price-per-share (or minimal step-up) from the A-round to B-round (and often later) financings was commonplace in 2006-2012. Getting in early was more about ball-control than it was about benefiting from big Series B step-ups. Often the A-round syndicate was a pre-baked version of the Series B syndicate.

But as the IPO and M&A markets took off, the biotech sector saw increased demand (more capital inflows), which led to a real uptick in follow-on round valuations. This reduced cost-of-capital manifested itself in bigger step-ups in the price-per-share, especially after the IPO window opened as public crossover investors came into later rounds to set up near-term public offerings.

Today, a Series B is far more attractive to teams, founders, and early stage VCs: for a strong blue-chip story, startups are routinely raising $40-80M and selling less than 33% of the company – a much lower cost of capital – increasing both the size of the raise and the pre-money valuation. Accessing the public markets shortly thereafter helps further power up these stories at robust valuations, and we’re seeing continued IPO appetite despite the volatility. Successful post-IPO M&A stories like Ablynx, Bioverativ, Kite, and Juno, as well as pre-IPO acquisitions like Ignyta and Impact Biosciences, continue to drive interest in not missing out on big upside newly public positions.

Lots of implications to the changing dynamic in funding today, as I ranted in a recent tweetstorm. The upside is that today’s Series B stage biotech startups have far more resources than their 2010 comparable peers. This should enable better clinical programs, more expansive pipelines, and the preservation of more product rights (rather than giving programs away to Pharma).

The downside is that company’s may lose their fiscal discipline, increase their burn rates too quickly before the science is ready, and fail to keep a rainy-day-fund on their balance sheet for when the market cycle turns negative. Or when science turns out to be harder and the lead program(s) blow-up after lots of invested capital. Bigger raises can leave a bigger dent on the capital-adjusted loss ratios of the investors in a blow-up. Further, few things are more damaging to a management team and board’s collective psyche than a punishing down-round on valuation. Getting out too far in front of one’s ski’s can be a problem.

In the face of this changing dynamic, I’m reminded of the age-old investing axiom: companies rarely die of starvation, they die of indigestion.

In 2011, that phrase was sometimes hard to comprehend: the sector was rather anorexic and borderline starving. But today, in the face of the massive increase in capital, it’s hard not to see indigestion hitting some of these well-fed (over-fed?) startups. Doing more things better requires lots more than capital, like talent. A great team’s bandwidth is one critical ingredient, and that doesn’t scale quickly if the quality bar is maintained at a high enough level.

The really good news in all of this, at least in the near term, is for patients: innovative new medicines are being robustly being funded today and some of these are likely to be true breakthroughs. We can all handle some indigestion in light of that likely outcome.