The private biotech sector is awash in capital today: funding over the last few quarters has been record-breaking, up over 250% since 2013, as biotech CEOs have worked hard to strengthen their companies’ balance sheets. But in the process of filling up their corporate coffers, have they also filled up their own wallets?

To examine this question, I worked with Jody K. Thelander and her team at J. Thelander Consulting, a compensation data and consulting firm, and explored their recently completed 2018 Private Company Compensation survey dataset. Several interesting findings worth noting.

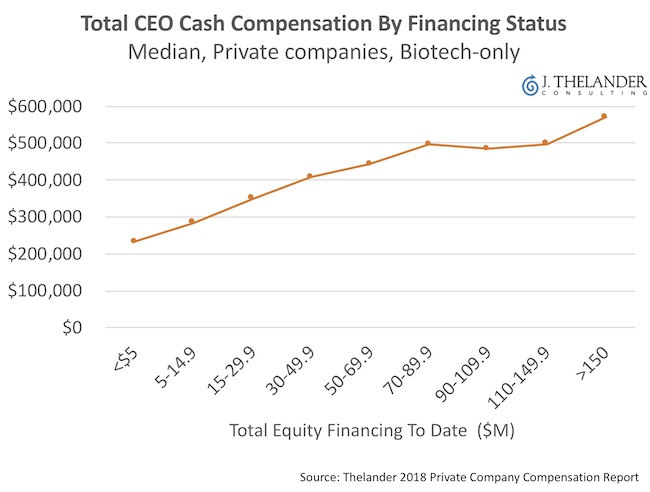

First, as you might expect during the journey of a startup, the total cash compensation (base salary plus target bonus) for biotech CEOs goes up in a remarkably linear fashion as companies raise more capital – up until they approach public company CEO compensation. Here’s the latest 2018 data:

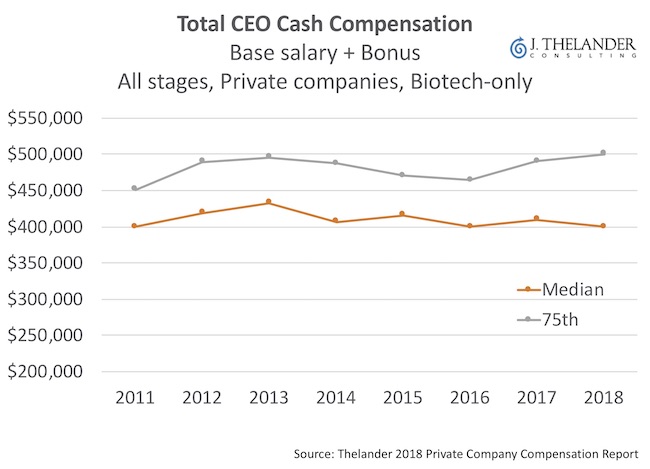

Second, over the past 6-8 years, the median CEO compensation across the biotech sector has been remarkably flat in the Thelander survey dataset (shown below at the median and top quartile of total cash compensation). This is in part because it includes companies of all financings stages (integrating the curve above). Other datasets, like Radford, which surveys a later-stage biased set of companies, suggest a modest change in the 2-3% per annum range, not far from the typical annual increase done across the board in many companies.

This very modest change (if any, according to Thelander) in total cash compensation, at the median or top quartile, obviously does not mirror the massive increase in aggregate funding into the sector over the past few years. This is somewhat surprising, especially since we’ve observed more capital going into roughly the same number of companies – creating somewhat of a disconnect with between that fact and these two charts (i.e., if companies are moving up the curve on the first chart faster, one would expect the second chart to show aggregate increases).

This disconnect likely reflects the steady graduation into the public markets of companies who have raised significant capital (thus taking higher paid CEOs out of the private pool) – which over the past five years includes more than 200 IPOs, as well as M&A exits.

In short, it also means that CEOs have largely remained disciplined and good stewards of their capital; they haven’t used the recent 250%+ increases in aggregate biotech funding to demand significantly higher cash compensation packages. The focus, rightly, has been on equity compensation and the adequate “reload” of equity for the team after financings.

An additional observation from doing this analysis is just how different various compensation surveys are. Radford/Aon Life Science survey captures the upper end of the spectrum, systematically higher in their base and bonus data, suggesting (as noted above) a bias towards later stage and more mature companies; Park Square’s CompStudy survey appears to capture a much lower end of the compensation spectrum, likely reflecting smaller or earlier stage startups; and, Thelander appears to be somewhere in the middle, with a mix of both early and later stage startups.

Further, the surveys also have different geographic biases, which are important to consider: the market for CEO talent in Boston is different than in Boseman, for instance, and cash compensation differences should reflect that.

To highlight the difference between surveys, as an example, the median total CEO cash compensation for Radford in 2018 is above the 75th percentile in Thelander’s 2018 survey. The absolute dollar value variation between them is also large: they can differ by more than 25-35%, or upwards of $100-125K, on their respective “median” total compensation packages.

The implications of this are that Boards and their compensation committees should make sure they are using the right sets of companies as comparables for their benchmarking exercise, rather than just plugging in one survey. While chasing the Radford data up the compensation curve may be great for executives in the short term, it may not be the right approach from a corporate governance and fiscal discipline perspective. It also may not represent truly relevant comparables. Instead, a “best practice” approach is to assemble either a custom cut of data tailored to the best set of comparables, or a composite compensation benchmark that integrates across multiple datasets from different surveys (e.g., CompStudy, Thelander, Radford, and others) to provide the best and most comprehensive view possible. This type of bespoke compensation metric allows for tailored flexibility by comp committees. This flexibility is especially important when comparing roles across different geographies, sub-sectors, and scale of companies. Unfortunately, most compensation committees just default to the cookie-cutter (and easy) approach of using single broad surveys. Leveraging external and “independent” compensation consultants is often very helpful in creating a more bespoke answer (for other reflections on comp committees, see this blog post).

Lastly, the recent run-up in biotech fundraising is just that – very recent – since compensation committees work on annual time scales. Perhaps these CEO compensation trends will move dramatically upwards soon as the effects of the ongoing “war for talent” at the senior level collide with private balance sheets ballooned with money to burn. This could be a recipe for significant executive compensation inflation. Hopefully, good corporate governance, and an expanding talent pool, will prevail – keeping everyone aligned around equity as the real wealth-creating incentive.

Big thank you to Jody Thelander for both sharing her firm’s survey data and providing me with helpful input into this blogpost. Thanks as well to compensation consultant Nancy Arnosti for her input.