Euphoria in the markets seems like a common theme these days. In fact, this week the NASDAQ Biotech Index (NBI) hit its all time high, even higher than in the 2000 genomics bubble. It’s up 49% since Jan 2012. Add to this the recent DowJones report that late stage venture rounds (across all sectors), have risen to post-2000 bubble records.

With all this optimism sending valuations skyward, one would hope that it is translating upstream into better deal terms for startups to raise venture financings. The Cooley Venture Financing Report released last month captures the recent 5-year trends for all the venture rounds they’ve been involved with, and there’s definitely some optimism in the industry. However, the majority of the financings the Cooley report tracks (80%+) are not in biotech, so the trends in there aren’t easy to dissect for our sector.

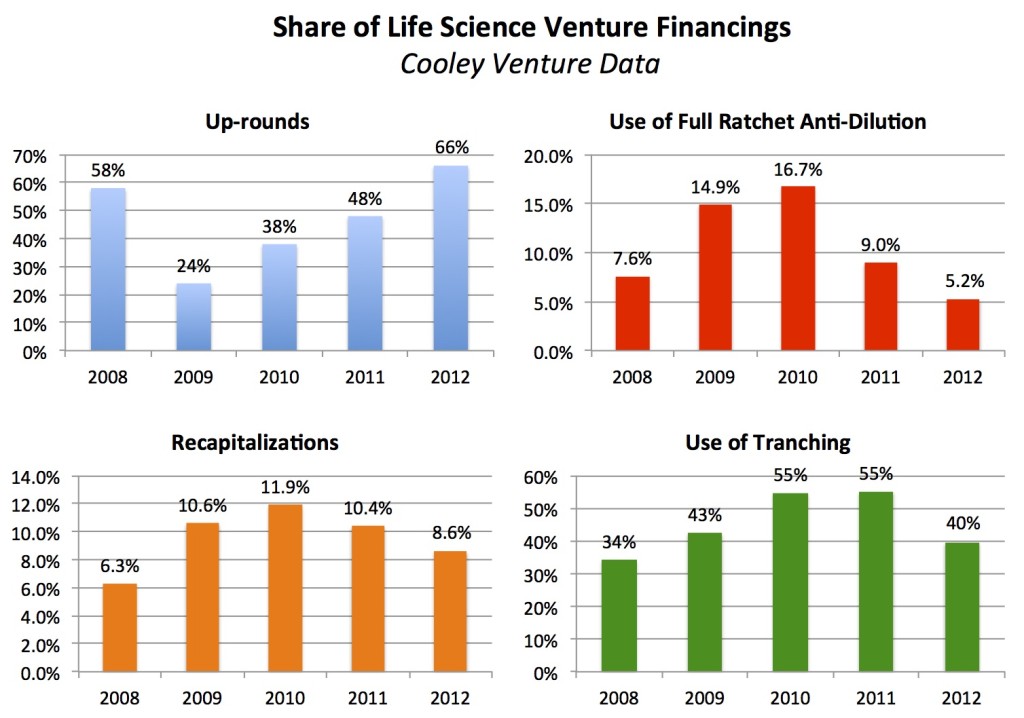

Fortunately, they were willing to share a life science-only analysis with me, and it’s a fairly large dataset – they have participated as counsel in over 380 life science rounds in the past five years, including nearly 60 in 2012. Here’s a summary of a few of the interesting deal terms, with a chart below to capture them.

The good news is that on most dimensions the deal terms are improving for startups and reverting to pre-2009 financial crisis levels.

Two-thirds of all life science financings were “up-rounds” last year: This is a healthy, high percentage of rounds with step-ups in valuation, and is the highest level in five years, way above the meager 24% in 2009. Further, it’s only slightly lower than the rate across all of venture, including frothier Tech, which was 75% in 2012.

Recapitalizations as a share of financings are down: Recaps are obviously signs that companies (and the sector) are struggling, so its good to see the rate of recaps is down by 30% or so, with only 8.6% of rounds in 2012. This is down from a 10-12% share of financings in the past three years.

Punitive “full ratchet” anti-dilution provisions are less common: Last year only 1 out of 20 financings had full-ratchet ownership protections for new investors; in 2010 it was as high as 1 out of 6 financings. This term may seem esoteric, but its presence is a real sign that new investors have more leverage and are raising the effective cost-of-capital. It essentially preserves the ownership percentage of a new investor in a future downround by extracting ownership from others in the cap table – it can lead to particularly painful outcomes if future rounds are challenging to price. The term really only existed in a few life science financings last year and was absent from deals in other sectors.

Tranching of rounds is less frequent: The share of financings that include the tranching of capital around specific milestones hit a high in 2011 of 55%, and in 2012 that dropped to 39% or near its 2008 level. While its fairly common in life sciences, tranching remains out of fashion in most other venture sectors – less than 15% of venture financings in other sectors were tranched.

So while those deal terms trended well in 2012, at least two deal term components haven’t improved in 2012, or at the very least haven’t reverted back to their 2008 levels: pre-money valuations and the use of fully “double dip” preferred securities.

So while those deal terms trended well in 2012, at least two deal term components haven’t improved in 2012, or at the very least haven’t reverted back to their 2008 levels: pre-money valuations and the use of fully “double dip” preferred securities.

Median pre-money valuations are flat or down across most of the financing series that Cooley has tracked for LS. Series A pre-money valuations are off from 2008 by 20-30%, around $5-6M in 2012, the lowest level in the past five years. Later Series are flat or down in overall valuation. Its hard to square these data with the up-round statistic mentioned earlier, but it might suggest that the companies that have been raising new money had previously priced lower rounds in the past, giving them headroom on valuations to support the higher frequency of step-up rounds of 2012 that Cooley witnessed.

Fully participating preferred stock issuance has been on a steady climb since 2008 in Life Sciences. This term peaked last year at 47% of all financings in our sector, compared to 30% in 2008. This full “double-dip” preferred (vs straight preferred, or capped participation) is clearly investor-friendly: in essence, it enables investors to be paid as both a debt-holder first, and an equity-holder second – and clearly raises the cost-of-capital for startups. The trend runs counter to the more entrepreneur-friendly changes cited above. It also is counter to the trend in other non-LS sectors of venture, as I’ve mentioned on this blog before, where full participation feature is now present is less than 1 our 4 financings, about half the rate in Life Science deals.

All in all, the general trends captured in the Cooley dataset are positive, and bode well for venture and for startups trying to raise money at a reasonable cost-of-capital. As an early stage investor focused on company creation, I’m obviously quite pleased about the frequency of up-rounds, a lower recap rate, less full ratchet anti-dilution clauses, and attractive pre-money valuation ranges. That said, the lack of tranching in the majority of deals isn’t something that I’m excited about, nor something that I’m actually seeing in practice. I’d guess that close to 100% of the deals we see and do are tranched, but that may be because we only occupy the earliest end of the venture spectrum. As I’ve mentioned before on this blog, tranching is a great tool for derisking while limiting capital exposure and has an important place in early stage biotech financings.

Looking forward to the continued positive trajectory of these deal term trends in 2013.