Getting high quality analyst coverage of your company as a recently minted IPO is important for communicating the rationale and excitement around your story. Thoughtful analysts can evangelize (or punish) companies they believe in (or not). But understanding the relationship between a forecasted “price target” of a stock and its current share price has always puzzled me.

Before reviewing some recent data, here’s some background: most analysts build their valuation models to reflect the disease area’s market size, share of patients addressable, price per therapy etc, and then discount these back in various ways to incorporate pipeline attrition expectations and such: NPVs with high discount rates, forward P/E ratios, etc… These models vary in their sophistication, and there is wide heterogeneity in analyst quality. In general, the early analysts that cover a stock are related to the investment banks that helped underwrite and manage the offering, though the linkage is now more tightly regulated post-Sarbanes-Oxley.

Analysts have to adjust their price targets upon any “new” news: a positive clinical readout or other good event (and a risk-related discount on the value of a stock has been removed), they typically go up, and vice versa. Since there aren’t real revenues and earnings to go off of, a lot of “future value” and sentiment is baked into these price targets.

To try and understand the relationship of price targets and current prices in biotech today, I examined data from ~60 or so therapeutic VC-backed biotechs that went public since January 2013, and have at least three analysts covering them with price targets.

The striking, although not surprising, summary data conclusion is that the differential between the average analyst 12-month price target and the current stock price is often quite considerable: for all the IPOs since January 2013, its 90%. So the mean target price is nearly double the current price.

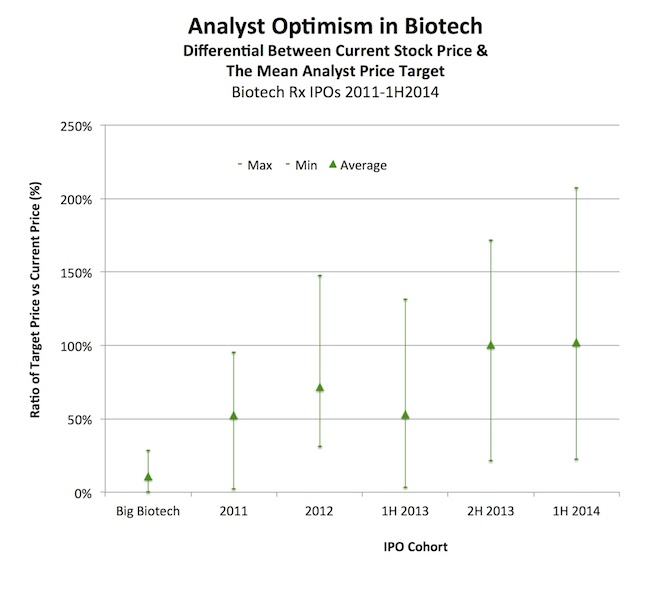

Below is the breakdown of various IPO cohorts plotted against the ratio of mean analyst target price versus current stock price (TP/P ratio as of 8/27/2014) , compared to a basket of larger Biotechs (Gilead, Celgene, Biogen, Alexion, Vertex, Biomarin, Pharmacyclics, and Amgen).

A few observations:

- Most of the biotech offerings since June 2013 have a 12-month price target that is 2x higher than the current price, with a few companies (Max) having mean targets as high as 3x higher than the current price.

- As you might expect, the ratio for more seasoned larger cap biotech companies is small – on average just 11% above the current stock price. More coverage, deeper understanding, less price target differential – a rather obvious point, but nice to see in the data.

- Interestingly, even over rather short time periods of 2011-2014, a meaningful trend exists that the longer a stock “seasons” as a public company the closer the target price to current price ratio becomes.

Why is this last point the case?

Could be a few things. Either analysts get smarter on these stocks over time (and adjust their forecasts appropriately up or down), or companies’ stocks perform and approach their price targets, the latter being a function of the market valuing the company “more in line” with the analyst’s forecast. I don’t have the longitudinal data to understand how analyst price targets have changed over time, but given the outperformance of biotech in general over the past three years, I suspect that, while analysts undoubtedly get smarter every day watching these stories progress, it is probably a reflection of both.

How does all this compare to the past?

A 2006 paper by Mark Bradshaw of Harvard and Lawrence Brown of Georgia State reviewing analyst price target performance is of interest (here). They reviewed 100,000 12-month price targets by analysts across all industries from 1997-2002. I realize this is an old sample set and not specific to biotech, but their findings were interesting. The aggregate dataset across the period showed that the ratio of target price to current price was rather tight around 135% (i.e., targets were 35% higher than current price). Further, 24% of stocks hit their target at the end of the forecast horizon, and 45% hit the price target at some point during the 12-month period. Analysts were, therefore, more optimistic on average than they otherwise should be, and most were unable to persistently perform well in forecasting.

Reflecting back then on the Biotech IPO dataset, one thing is very clear: analyst price targets are much higher than for more seasoned stocks. A ~100% premium on average is well above the large Bradshaw dataset (which was during the first bubble, btw), and well above larger cap Biotech stories. This premium presumably reflects several things:

- Analysts are overly optimistic about “shiny new toys” (as we all are, especially VCs), and adjust their forecasts over time as management teams and their drug candidates perform. It is fair to say, however, that a good analyst who has done their homework knows a company and its drug portfolio far better than many public investors (especially retail investors lacking institutional support).

- Given the short trading histories, the overall market has had less time to find an equilibrium price point accounting for expectations of performance, a more fulsome understanding of the drug candidates, and a “permission to believe” that what a management team is saying is truly likely to happen. All these things affect market sentiment

- Lastly, these stocks are very illiquid and presumably trade below their fair value because of it – the concept of the illiquidity discount – which keeps lots of potential investors out of the market for their shares. The average trading volumes, even after the lock-up expires, remain very thin until “big event” days when huge amounts of shares can move. This makes price targets and market equilibrium concepts challenging.

I’ll close with a thought experiment as an optimist: if, in line with historic data, 45% of the current IPO class hits their price targets at some point over the next 12-months, which implies a doubling of many recent biotech IPO’s stock prices, that would certainly be quite the year ahead for the biotech market. There are, of course, other possible futures, but that one is particularly intriguing.