Similar to this time last year, when IPOs were capturing everyone’s attention, M&A in biotech has been delivering real value. This morning HBM Partners released their outstanding report on BioPharma M&A in 2014 (here), and the conclusions are in line with the positive cadence and tenor of today’s excitement in the biotech market.

Last year in early February, I posted on the “fourth straight year of impressive results” in M&A in the biotech space; with this post, lets make that five straight years.

In fact, according to HBM, “2014 was the best ‘exit year’ for VC-backed biopharma companies over the past decade”.

As I’ve done in past years (here in 2011, and here in 2014), here’s a look a few of nuggets of their 2014 M&A report, with a focus on the VC-backed biotech returns (as their report covers all BioPharma M&A, public and private equity backed returns included); I’ll call out a few conclusions, echoing what the messages they state very nicely in their report:

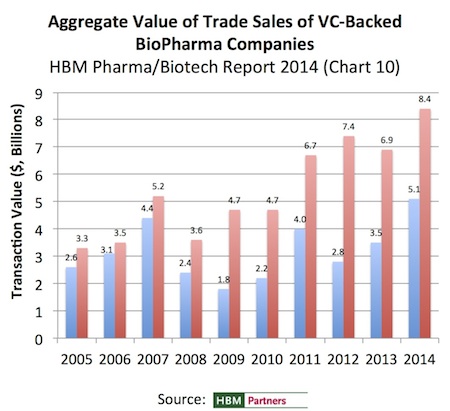

First, while the number of VC-backed M&A xits is in line with prior years (~25 per year), the value both in terms of upfronts and full “biobuck” potential have reached new highs, topping over $5 and $8 billion, respectively. The percentage of deal value in the upfront has steadily been between 40-50% for most of the past five years.

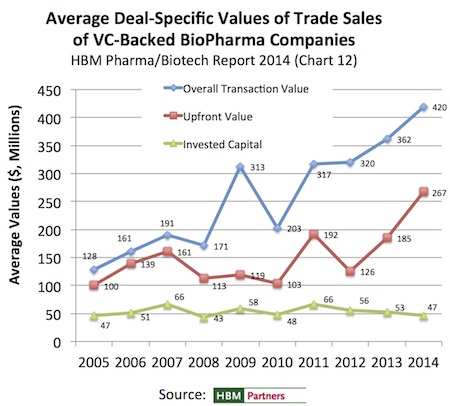

Second, the average values per deal are steadily escalating – even though the average invested capital required to get there has remained steady. This chart below shows overall, upfront-only, and invested capital average values in the VC-backed cohort of annual M&A deals. Nice to values tracking in this direction, and that the average capital intensity in biotech (at least for these exits) has not been increasing.

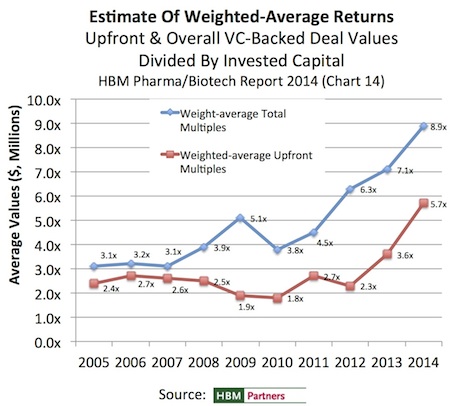

Lastly, these trends have led to a very robust and positive return trend. HBM uses, appropriately, the proxy of total deal values divided by total invested capital to come up with the weighted average return multiples on an annual basis. This is the key chart. Return multiples have almost tripled since 2005-2007 on overall deal multiples, and have more than doubled on the upfront multiples.

HBM further calls out two spectacular wins – Seragon’s purchase by Roche/Genentech for $725M upfront and $1B in earnouts; and, Alios’ acquisition by J&J for $1.75B. Both exits should have returned over 20x returns on a handsome amount of capital

As I noted in last week’s post on the state of VC-backed biotech today (here), the exit environment has been very positive – and I fully expect the M&A component of this environment to continue to be attractive as the fundamentals of more collaboration between Big BioPharma and biotech startups remain stronger than ever.